Urea (chemical formula: CO(NH₂)₂) is a widely used nitrogen-based fertiliser and an essential input in global agriculture. It contains approximately 46 per cent nitrogen, making it one of the most concentrated solid nitrogen fertilisers available. Its high nutrient content, ease of handling, and relatively low production cost contribute to its widespread use.

Urea is synthesised industrially through the reaction of ammonia (NH₃) and carbon dioxide (CO₂) under high pressure and temperature. This process typically takes place in large-scale fertiliser plants, often integrated with ammonia production units. Major producers include China, India, Canada, Europe and countries in the Middle East.

Agriculture: The primary use of urea is as a fertiliser to promote plant growth and increase crop yields. It is applied directly to soil or used in fertiliser blends.

Industrial Use: Urea is also used in the production of urea-formaldehyde resins, diesel exhaust fluid (DEF/AdBlue) for emissions reduction, pharmaceuticals, and animal feed.

Urea prices are influenced by several factors:

Natural gas prices, as ammonia (a key feedstock) is derived from natural gas.

Seasonal agricultural demand, particularly during planting periods.

Geopolitical conditions affecting production or trade flows.

Freight and logistics costs, especially in regions relying heavily on imports.

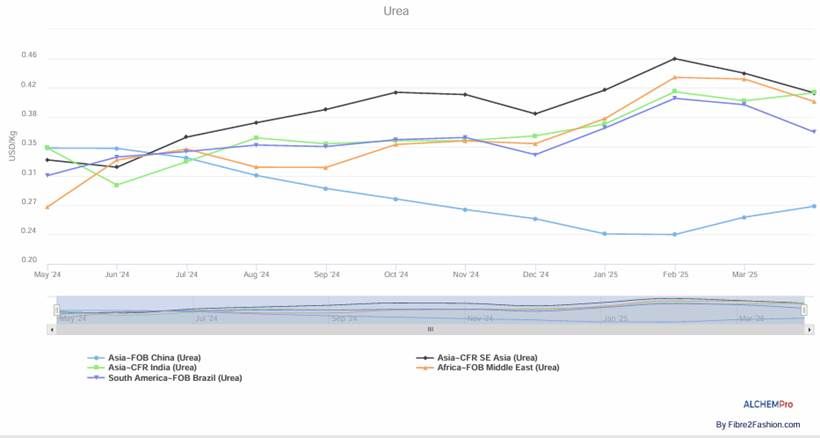

Global price trend of urea:

Asia – FOB China: -12.58 per cent

China, the largest urea producer, experienced a 12.58 per cent drop in FOB urea prices in 2025 so far. This downward movement can be attributed to:

Domestic oversupply resulting from high production volumes and stable natural gas/coal input costs.

Government-imposed export restrictions aimed at securing local fertiliser supply and curbing inflation in the agricultural sector.

Reduced foreign demand due to increased self-sufficiency in neighbouring countries and a shift in sourcing toward the Middle East.

Stronger Yuan and higher shipping costs, reducing the global competitiveness of Chinese exports.

Asia – CFR Southeast Asia & India: +9.21 per cent

Urea prices delivered to Southeast Asia and India have risen by 9.21 per cent YTD in 2025, largely driven by:

Strong agricultural demand linked to rice, maize, and sugarcane sowing across India, Vietnam, and Thailand.

Inconsistent domestic production, particularly in India, where gas-based plants faced reduced operating rates.

Tight regional supply chains during peak planting months, coupled with spot vessel shortages.

Rising global freight rates, which impacted CFR prices more than FOB markets.

Africa – FOB Middle East: +30.32 per cent

Middle Eastern FOB urea prices surged by 30.32 per cent in 2025, making it the most pronounced regional increase, driven by:

Disruptions in production in the Gulf region due to regional geopolitical tensions.

High regional and international demand, particularly from East Africa and South Asia, shifting volumes away from long-haul exports.

Increased spot buying as many buyers avoided long-term contracts due to market volatility.

South America – FOB Brazil: +4.29 per cent

Brazil’s FOB urea prices recorded a 4.29 per cent increase in 2025, supported by:

Seasonal demand increase aligned with the country's first major planting season.

Heavy reliance on imports, as Brazil produces less than 10 per cent of its total urea requirement domestically.

Stable crop margins encouraging larger planting areas, particularly for soybeans and corn.

|

Licensor |

Headquarters |

Key Technologies |

Distinctive Features |

|

Stamicarbon |

Netherlands |

Ultra Low Energy, Safurex and Fluid Bed Granulation |

- Market leader in urea plant licensing |

|

- Pioneer in corrosion-resistant materials |

|||

|

- Focus on energy efficiency and safety |

|||

|

Saipem (Snamprogetti) |

Italy |

SuperCup High Efficiency Trays |

- Over 140 certified plants worldwide |

|

- Strong retrofit & greenfield project presence |

|||

|

- Focus on CO₂ reduction and operational efficiency |

|||

|

Toyo Engineering |

Japan |

ACES21 and Spout-Fluid Bed Urea Granulation |

- Licensed over 100 plants globally |

|

- Designed world’s largest single-train urea plant (4000 MTPD) |

|||

|

- Focus on energy recovery and plant scale |

|||

|

Casale SA |

Switzerland |

Spil Flow Loop, Hyper-U and Green Granulation |

- Integrates modern synthesis loop designs |

|

- Emphasis on sustainability |

|||

|

- Offers complete revamp and green technology solutions |

_Big.jpg)