The global maleic anhydride market is projected to grow at a compound annual growth rate (CAGR) of 4.2 per cent from 2024 to 2030. This growth trajectory is largely fuelled by rising demand from key downstream applications, particularly in the production of unsaturated polyester resins (UPR) and other derivatives.

The global maleic anhydride market is poised for steady growth, driven primarily by increasing demand from downstream industries such as UPR, construction materials, and industrial chemicals. Its broad application portfolio ranging from infrastructure and manufacturing to fuels, lubricants, and specialty chemicals highlights its strategic importance across multiple sectors.

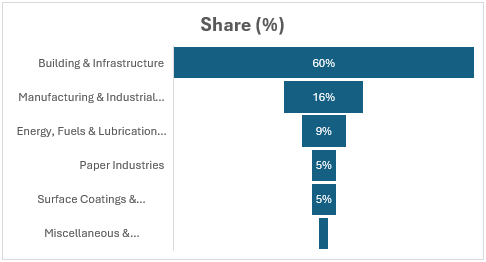

Maleic Anhydride – End Market Share Analysis

In terms of the end-use distribution of maleic anhydride, the building and infrastructure sector accounts for the largest share at 60 per cent, primarily due to its use in UPR. Manufacturing and industrial applications follow at 16 per cent, while energy, fuels and lubricants contribute 9 per cent. Smaller shares are seen in paper industries and coatings and adhesives (5 per cent each), with miscellaneous applications making up the remaining 1 per cent. This reflects maleic anhydride’s dominant role in construction and its versatility across various industrial uses.

In April 2025, the price of maleic anhydride in China (Asia-FOB) was $0.929 USD/kg, while in India (Ex Kandla), it was $1.028 USD/kg.

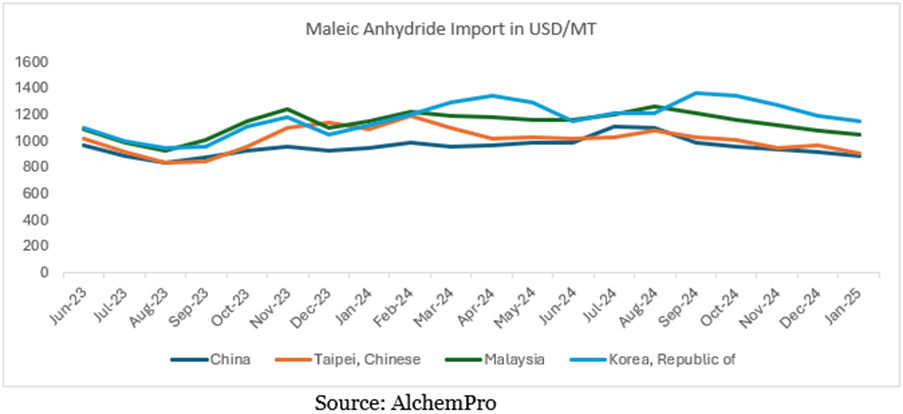

Indian maleic anhydride imports trends from June 2023 to January 2025 show fluctuations in USD/MT across key importing regions: China, Taiwan, Malaysia, and the South Korea. Taiwan showed relative stability, ranging between $850 and $1150 USD/MT. Malaysia peaked around September 2024 before declining to approximately $1050 USD/MT in the beginning of 2025. South Korea experienced volatility, settling at approximately $1150 USD/MT.

Drivers of Growth in the Maleic Anhydride Market (2024–2030)

The anticipated growth of the maleic anhydride market over the forecast period is attributed to several interrelated factors that reflect evolving industrial demands and global economic trends:

- Rising Demand for UPR: A significant portion of maleic anhydride consumption is linked to the production of UPR, which are widely used in construction, marine, and automotive applications. As infrastructure development accelerates, particularly in emerging economies, the demand for UPR—and by extension, maleic anhydride—is expected to rise substantially.

- Expansion of 1,4-Butanediol (BDO) Applications: Maleic anhydride serves as a key feedstock in the synthesis of 1,4-butanediol, a compound essential to the production of engineering plastics, elastic fibres, and solvents. The steady growth of industries such as automotive, packaging, and electronics is fuelling increased demand for BDO derivatives.

- Growth in Construction and Infrastructure Projects: Global investment in infrastructure, including residential and commercial buildings, roads, and bridges, continues to drive demand for composite materials that rely on maleic anhydride-based resins. This trend is particularly strong in Asia-Pacific and the Middle East, where urbanisation is progressing rapidly.

- Diversified End-Use Industries: Beyond UPR and BDO, maleic anhydride is used in the formulation of additives, coatings, adhesives, agrochemicals, and pharmaceutical intermediates. Its broad utility across these sectors supports stable, long-term demand.

- Global Shift Towards Lightweight and High-Performance Materials: As industries seek materials that offer strength, corrosion resistance, and lower environmental impact, maleic anhydride-derived resins are increasingly favoured. This shift supports ongoing demand across sectors such as transportation, consumer goods, and renewable energy.