India Soda Ash Market Overview – FY 25

The domestic soda ash market continued to experience pricing pressure, with rates in the Mumbai region settling at around ₹29.5/kg as of June 21, 2025. This marks a sharp reduction of nearly 45 per cent from the peak observed in May 2022. Weak price realisations, combined with increased discounts offered by producers, were primarily driven by oversupply conditions and subdued export demand.

The Chinese soda ash market suffered a continuing slide in pricing, going from roughly $203/ton in late March to $178/ton by June 25, 2025, or a 14.6 per cent drop. This was mainly due to high production capacity utilisation, rising stockpiles, and sluggish demand.

Soda Ash Pricing Estimation for Q2 FY 2025–2026

Considering the present market fundamentals:

- Rising levels of inventory in the domestic market

- Gentle export amounts from India and China

- The domestic demand outlook is mixed, with detergent demand flat and glass demand steady.

Lack of supply-side interruptions: The average price of soda ash in India is predicted to be between ₹25 and ₹34/kg (Mumbai base), and it is likely to continue to be squeezed for the upcoming quarter. Glass makers' seasonal demand and possible slowdown in import shipments should lead to some minor price stabilisation by the end of Q3 FY26. Any notable increase, meanwhile, is unlikely in the absence of more robust demand recovery or supply changes.

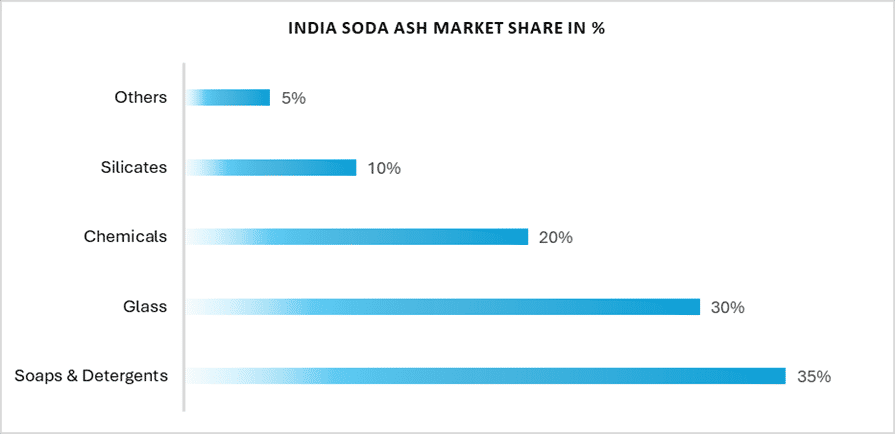

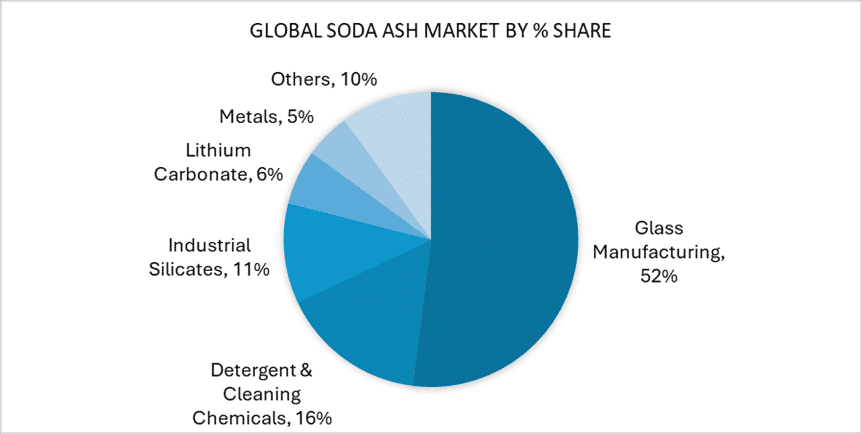

The Indian soda ash market growth was primarily led by the glass manufacturing sector, supported by the commissioning of new production lines in flat glass and solar glass applications. Additionally, emerging demand from the lithium carbonate sector contributed to the overall consumption increase.

The detergent and cleaning products segment remained largely flat, impacted by extended monsoon conditions and raw material price volatility. On the global front, soda ash demand witnessed robust expansion during the fiscal year, largely driven by strong consumption trends in China. While most other regions experienced relatively muted growth, China’s demand momentum remained strong, especially through the first quarter, resulting in a noticeable decline in China’s export volumes as more product was absorbed domestically.

Global Soda Ash Demand Outlook 2025–2035

The Global demand is projected to reach around 74 million metric tons approximately by CY2025 which is increased by 13.85 per cent compare to CY2023, the total global demand for soda ash was estimated at approximately 65 million metric tons, reflecting continued consumption across established and emerging markets, supported by expansion in the construction and automotive sectors, where soda ash is a key raw material in flat glass and container glass production. Additionally, growing usage in industrial chemicals and detergents is contributing to this upward trend.

Long-term forecasts suggest a sustained growth trajectory, with global demand expected to surpass 86 million metric tons by CY2035. Factors driving this increase include rapid urbanisation, infrastructure development, and rising demand for cleaner energy sources where soda ash plays a role in flue gas treatment and solar glass manufacturing.

- WE Soda

- Tata Chemicals

- Gujarat Heavy Chemicals Ltd. (GHCL)

- Sisecam

- DCW Ltd

- Solvay

- CIECH SA

- Shandong Haihua Group