In a landmark revision of the US trade policy, former President Donald Trump imposed differentiated tariffs on Vietnamese exports in early April 2025. The new structure includes:

- 20 per cent US tariff on Vietnam-origin goods

- 40 per cent tariff on transhipped goods via Vietnam—especially those with Chinese input

- 46 per cent reciprocal tariff was initially announced but later adjusted into the two-tiered structure during trade negotiations

These tariffs, although broadly applied, have specific implications for Vietnam’s chemical and material industries, which rely on both domestic manufacturing and regional integration for their supply chains.

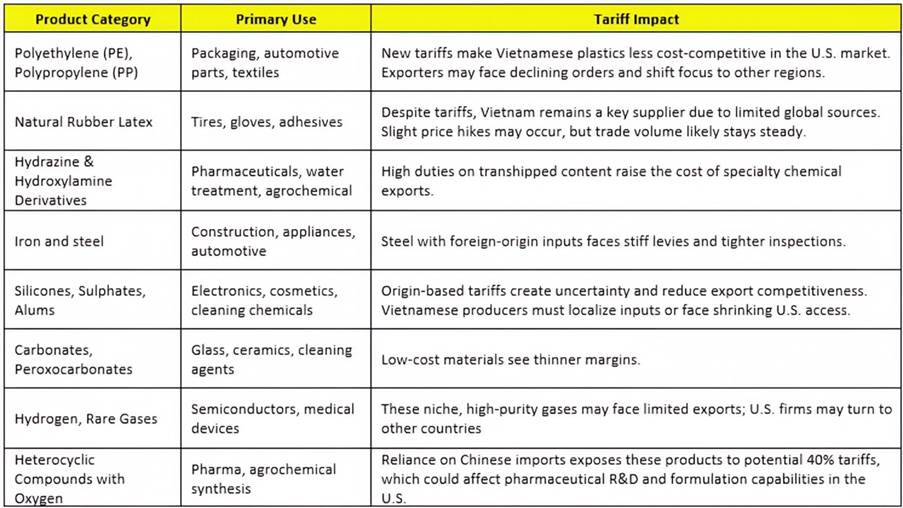

Key Chemical and Material Exports Affected

The following table highlights Vietnam’s major chemical exports to the US:

Impacts on Vietnam's Chemical Sector

Pros

- Push for Localisation: The tariffs may encourage Vietnamese producers to reduce dependence on Chinese inputs and invest in upstream capabilities.

- Supply Chain Upgrade: Firms are likely to explore R&D and value-added production to stay competitive and tariff compliant.

- Diversification Incentives: Exporters are expected to pivot more towards ASEAN, EU, and South Korea to hedge against US trade exposure.

Cons

- Cost Pressures: Higher tariffs reduce competitiveness in the US market, Vietnam’s key chemical export destination.

- Transshipment Scrutiny: Chemicals with Chinese origins routed through Vietnam face steep 40 per cent tariffs, increasing documentation and compliance burden.

- Market Disruption: Producers and logistics operators must urgently adapt to new demand patterns.

-b_Big.jpg)