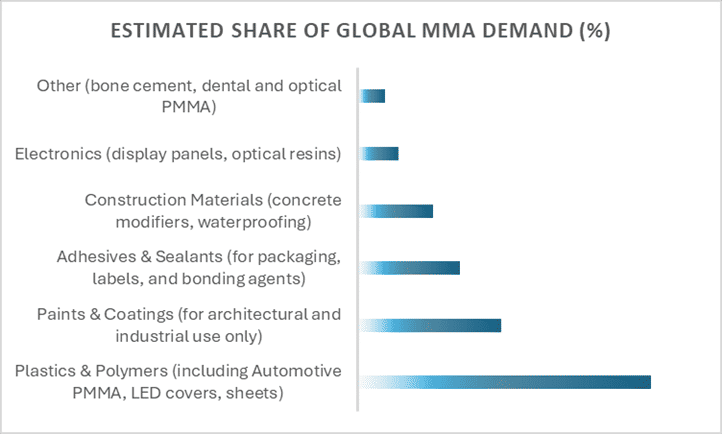

Methyl Methacrylate (MMA), a vital acrylic monomer used in the production of polymethyl methacrylate (PMMA) and various coatings, adhesives, and resins, continues to play a significant role across diverse downstream industries. In 2024, global demand for MMA has surpassed 3.4 million metric tons, and the market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5 per cent. By 2030, global consumption is anticipated to exceed 4.7 million metric tons, driven by steady demand recovery in key sectors such as construction, automotive, and electronics and others.

Methyl Methacrylate (MMA) Price Trends and Market Sentiment

Over the past year, as per ALCHEMPro, MMA prices have experienced significant downward pressure, particularly in Asia. In mid-2024, prices were recorded at around $2.159 per kg, but as of July 2025, prices have declined by nearly 44 per cent, falling to approximately $1.200 per kg in Asian import (CFR/CIF) market. This sharp correction is largely attributed to:

- Weak downstream demand, particularly from the construction, automotive, paints and coatings, and plastic polymer sectors.

- Persistent inventory overhang, which has further pressured producers to cut prices in order to clear stocks.

- In India, producer margins have tightened and are now closely aligned with import prices, primarily due to weakened demand across key downstream sectors, resulting in declining interest from international buyers.

The subdued industrial activity across several Asian economies has curtailed MMA consumption, leading to slower spot market transactions and heightened competition among suppliers.

MMA Price Performance – US vs Asia & Europe

In contrast to the steeper declines observed in Asian and European markets, US MMA prices have remained relatively more stable. FOB US Gulf prices moved from $1.970 per kg in April 2025 to around $1.860 per kg by July 2025, reflecting a month-on-month drop of approximately 5.6 per cent. Although this decline also reflects weaker domestic demand, particularly from adhesives, construction and coatings, the US market has outperformed Asia and Europe in terms of pricing stability, supported by relatively stronger offtake and balanced inventory levels. Tariffs help protect local prices from low-cost imports but can reduce US export competitiveness in tariff-imposing countries.

This relative stability can be attributed to:

- Balanced inventory positions among major US producers.

- Import tariffs and trade measures that have provided partial insulation from Asian oversupply pressures.

- Reduced exposure to lower-priced Asian imports, owing to both freight cost considerations and existing antidumping duties or tariff barriers on MMA.

In comparison, Asian markets have been more vulnerable to aggressive price undercutting and elevated inventories, while European demand remains constrained by slower economic activity and limited downstream consumption.