Benzene is a key aromatic hydrocarbon extensively used as a foundational raw material in the petrochemical sector. Primarily derived from refinery reformate streams and as a co-product of steam cracking of naphtha, benzene serves as a critical feedstock to produce various high-demand intermediates used across multiple industrial value chains.

Production & Supply Landscape

Benzene is predominantly produced via catalytic reforming in petroleum refineries and through steam cracking processes associated with ethylene production. Given its role as both a by-product and a primary target in these operations, benzene availability is closely tied to the broader dynamics of gasoline blending and ethylene markets. Regional production capacities vary, with Asia-Pacific leading in terms of both supply and consumption, followed by North America and Western Europe.

Benzene Market Overview (Jan–Jul 2025): Navigating Through Crude Oil and Downstream Fluctuations

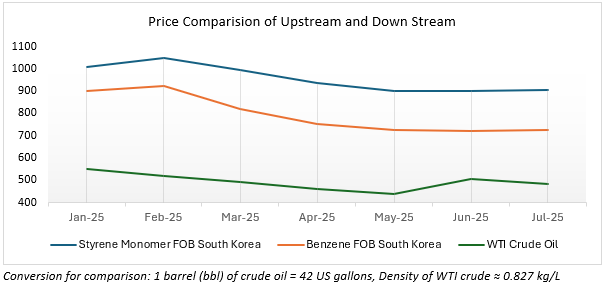

Between January and July 2025, the benzene market in Asia, particularly FOB South Korea benchmarks, witnessed a gradual yet firm downward price adjustment, shaped by upstream volatility and downstream restraint. Benzene prices began at approximately $900/ton in January 2025, tracking moderately below Styrene Monomer FOB South Korea, which hovered above the $1,000/ton mark. WTI crude oil, the key upstream cost driver, stood around $75/bbl. at the start of the year. However, over the next several months, a persistent dip in oil futures notably sliding to $66/bbl. by March and holding similar levels through July signalled a softening cost base.

Despite this easing in crude prices, benzene's response was more gradual, dropping to about $728/ton by July 2025. This relative firmness can be attributed to supply-side caution and the market’s watchful stance on operating rates and downstream demand, especially in the context of styrene production and aromatics integration. While styrene itself followed a parallel downward trend, the gap between benzene and styrene remained structurally intact, pointing to a maintained, if tempered, value chain margin.

Throughout the period, international market activity remained a key influence. For instance, in late January, FOB Korea benzene was steady at $902/ton, these aligned closely with brief consolidations in crude oil, suggesting that benzene pricing remained sensitive to upstream corrections, even as broader market fundamentals held it within a steady operating range.

By July, as crude oil dipped again, benzene resisted further sharp declines a sign of supply-side adjustments and cautiously optimistic sentiment on downstream recovery. The overall market outlook for benzene remains steady in the short term, with participants closely monitoring crude oil volatility, external price movements, and the operational dynamics of benzene consuming units across Asia and the US Gulf.

Benzene Derivative Market share and Key Applications

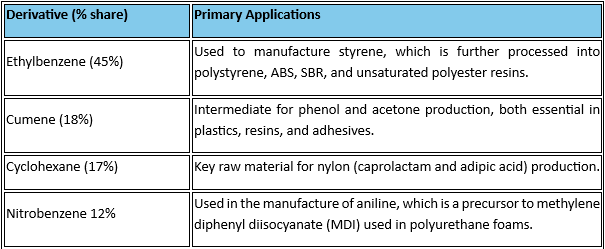

Benzene’s primary value lies in its conversion to several downstream petrochemical intermediates. The major derivatives include:

Benzene End-Use Industries

The Benzene end-use industries of benzene derivatives span a wide industrial spectrum. Key sectors include:

- Packaging and Consumer Goods (via polystyrene, ABS, and other styrenics)

- Automotive and Transportation (through synthetic rubbers and nylon)

- Construction (via insulation foams and phenolic resins)

- Electronics and Appliances (using styrenics and engineering plastics)

- Pharmaceuticals and Agrochemicals (intermediate compounds and solvent applications)

- Household and Industrial Cleaning (through surfactant chemicals)

Benzene global Market Dynamics and Growth Outlook

As of 2024, global benzene demand was estimated at approximately 52.6 million metric tons, with styrene production via ethylbenzene accounting for nearly 48 per cent of total consumption. Cumene, mainly utilised in the production of phenol and acetone, accounts for approximately 20 per cent of global demand, making it the second-largest application. Collectively, ethylbenzene and cumene account for over two-thirds of total benzene use, reinforcing benzene’s critical role in the styrenics and phenolics value chains.

The global benzene market is expected to grow at an CAGR of 3 per cent by 2030, driven by expanding demand in Asia, particularly China and India, and ongoing developments in plastics, synthetic fibres, and urethane-based materials.

- BASF SE (Germany)

- Chevron Phillips Chemical Company LLC (US)

- ExxonMobil Corporation (US)

- Shell PLC (UK/Netherlands)

- INEOS Group Holding S.A.

- LG Chem (South Korea)

- SABIC (Saudi Arabia)

- Reliance Industries Limited (India)

For more information on benzene producing companies and report, please contact ALCHEMPro team.