The ethylene glycol (EG) market in China has exhibited notable volatility over the course of 2025, largely influenced by global macroeconomic trends, upstream feedstock dynamics, and trade policy shifts. In the first quarter, the market remained relatively firm, with prices ranging between $638 to 626 per metric ton, supported by seasonal demand from downstream polyester and antifreeze segments with slight surge February 2025.

Ethylene glycol prices dropped sharply between late March and early May, reaching a low of around $593 per metric ton. This fall was driven by weak upstream pricing, rising inventory levels, and bearish sentiment following geopolitical disruptions, particularly the reimposition of US tariffs. Post-mid-May, the market showed signs of recovery, stabilising in the $627/MT plus range, as production cuts and restocking activity helped tighten domestic supply.

Ethylene Glycol Price Analysis (Jan–Jul 2025)

- January–March

Prices ranged between $635–657/MT

Market supported by polyester demand and stable feedstock prices

- April–Early May

Sharp drop to ~$590/MT

Ethylene prices supported the decline

- Mid-May–July

Gradual recovery to $610–625/MT

Due to production adjustments and slight feedstock rebound

Downstream Industry Impact- Ethylene Glycol Demand

- Textile Industry

Production activity remained subdued, with reduced operational intensity at weaving facilities.

- Polyester Industry

Sluggish demand and high inventory levels led to lower production rates and cautious raw material procurement.

- Overall Impact

Weak downstream performance continued to limit ethylene glycol consumption, contributing to a demand-side drag despite low inventory in the upstream market.

Upstream Correlation: Ethylene Market Analysis

Ethylene, the primary feedstock for ethylene glycol production, followed a relatively stable trend in early 2025 but underwent corrections that directly impacted ethylene glycol pricing.

- Jan–Feb 2025

Ethylene prices remained stable at $870/MT

Supported by steady cracker operations and limited supply disruptions

- March–April

Prices slipped to $790 per metric ton, pressured by an oversupplied market and softer demand.

- July 2025

After surging to $820 per metric ton, prices have stabilised amid steady downstream demand.

This close price alignment suggests a strong positive correlation between ethylene and ethylene glycol, with downstream market sentiment closely tracking feedstock costs.

Impact of Trump Tariffs on China’s Ethylene Glycol Market

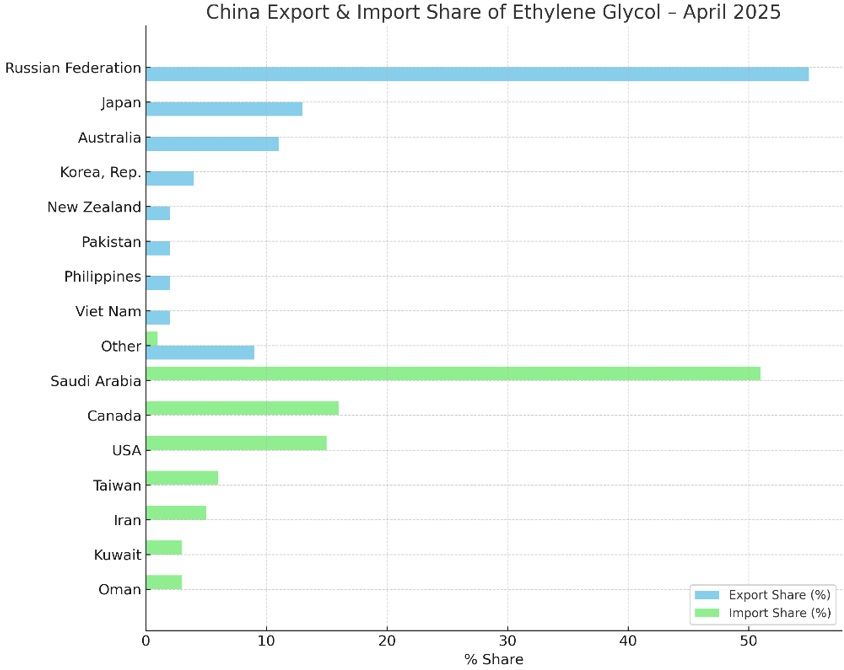

The United States remained one of the notable suppliers of ethylene glycol to China, contributing a meaningful share to total imports alongside major exporters like Saudi Arabia, Canada, Taiwan.

The reintroduction of tariffs on Chinese petrochemicals by the US administration in Q2 2025 did not directly affect China’s ethylene glycol exports (which are minimal), but it did spark heightened trade tensions and retaliatory policy risks, which indirectly influenced China's petrochemical import landscape, including ethylene glycol.

Ethylene Glycol market Key Impacts

- Import Market Sensitivity

Although not an immediate disruption, China’s reliance on US imports of ethylene glycol meant that any potential retaliatory trade measures or tariff extensions raised concerns over supply continuity and procurement costs from American suppliers.

- Diversification Push

Uncertainty prompted some Chinese buyers to seek alternative sourcing from countries like Saudi Arabia, Canada, Kuwait, and others, which already held a significant portion of China’s ethylene glycol import share.

- Sentiment Weakness Across Asia

The broader geopolitical backdrop led to cautious buying behaviour and contributed to suppressed demand sentiment across Asia coinciding with soft polyester activity and weak operating rates in downstream industries.

- Upstream and Feedstock Implications

As ethylene glycol demand weakened and downstream production slowed, ethylene consumption also declined temporarily, leading to downward pressure on upstream feedstock pricing.

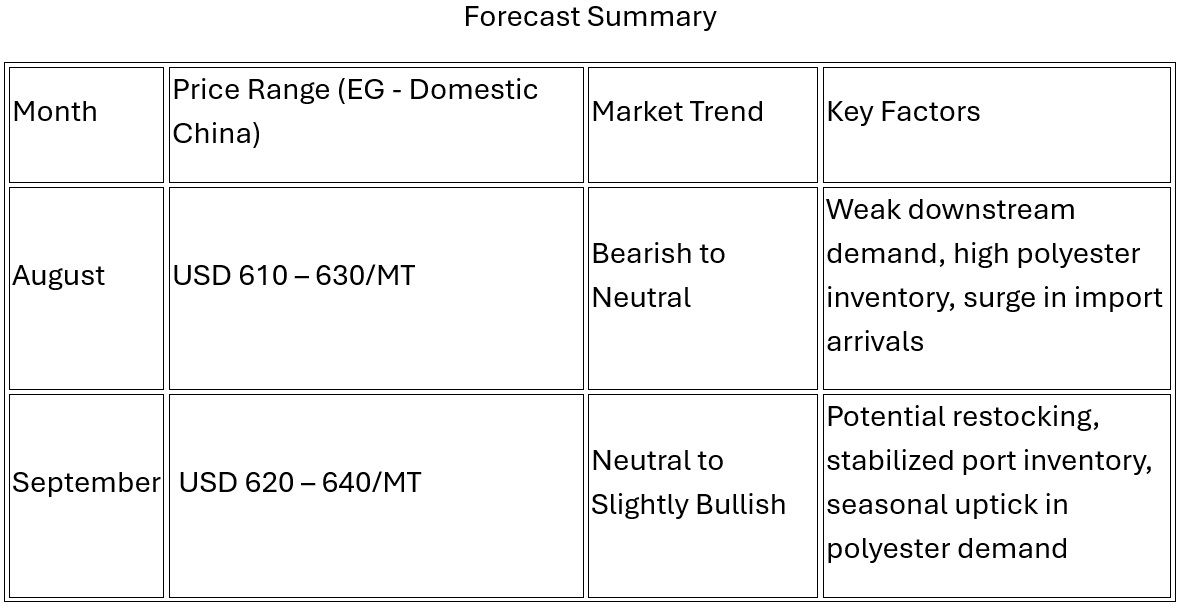

Market Forecast – Q3 2025 (August–September)

Looking ahead, the Chinese ethylene glycol market is expected to come under short-term pressure due to persistent weakness in downstream operations and a significant increase in import arrivals from late July onward. Although low port inventory and rebounding coal prices had initially lent some support, the anticipated supply influx combined with sluggish polyester demand is likely to weigh on prices through August. A potential stabilisation may occur in September if downstream restocking or seasonal activity picks up.

- Inventory Planning

Buyers should consider moderate stockpiling in August to hedge against potential price increases in September.

- Monitor Feedstock & Tariff Announcements

With US–China trade talks underway, a potential three-month extension of the tariff pause could ease import costs. Monitoring ethylene price movements and evolving trade policies remains vital for short-term market planning.

- Diversify Supply Sources

For exporters, identifying alternative markets beyond the US will help mitigate trade risk and maintain operational stability.