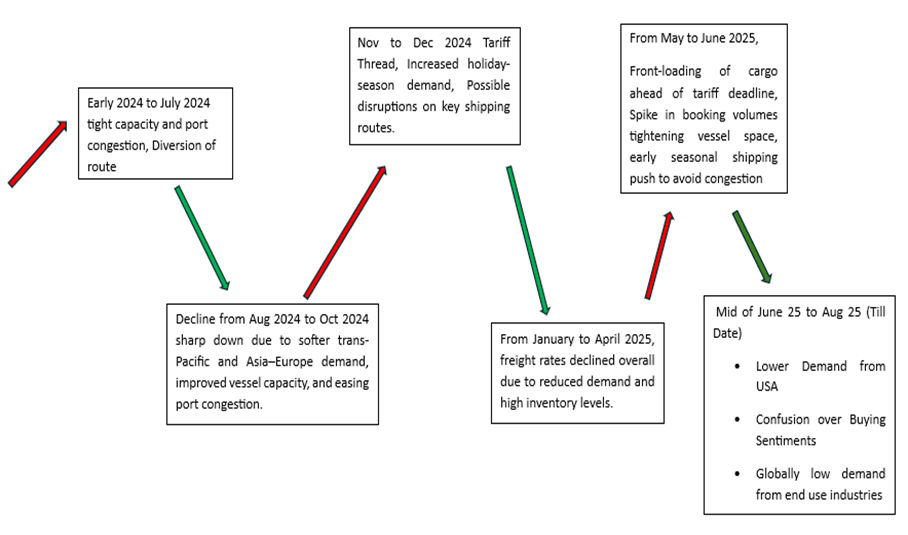

Over the past year, global freight costs have moved through distinct phases of sharp increases, steady declines, and brief rebounds. Rates rose strongly during the late peak season, fuelled by limited vessel availability, seasonal shipping demand, and ongoing logistical challenges.

Such as those recorded on mid-June 25 to till, freight rates showed varying movements approx.: China to New York fell by 48 per cent, China to Los Angeles dropped by 56 per cent, China to Genoa decreased by 22 per cent, while China to Rotterdam inched up by 16 per cent.

As the year progressed, market conditions shifted. The combination of improved capacity, slower global trade flows, high inventory levels, and easing congestion contributed to a sustained downward trend in freight costs. Temporary surges still occurred, triggered by short-lived demand spikes, port disruptions, or policy-related shipment rushes.

Looking ahead, the market remains sensitive to macroeconomic shifts, trade policy changes, and operational disruptions. While current freight levels have moderated compared to peak periods, volatility is expected to persist, requiring shippers and industries especially those with global supply chains to maintain flexible logistics strategies and proactive cost management.

Repercussions for the Chemical Sector

The chemical sector, heavily dependent on international logistics for both raw materials and finished goods, is highly sensitive to freight market movements. Changes in rates can:

Raise Landed Costs: Increased shipping expenses directly elevate the final delivery price of chemical products, eroding competitiveness in price driven markets.

Redirect Trade Flows: Persistent freight price disparities between regions can encourage shifts toward nearer or more cost-efficient suppliers.

Pressure Profit Margins: Manufacturers tied to fixed-price contracts face margin erosion when freight spikes occur unexpectedly.

Influence Inventory Planning: Rate volatility can lead buyers to advance purchases before anticipated cost hikes or delay orders when rates are high.

Alter Regional Price Differentials: Freight changes can either expand or compress price gaps between markets, impacting arbitrage opportunities.

In the most recent period, from mid-June to August 2025, the shipping market has experienced a significant slowdown. Demand from the US has weakened, contributing to uncertainty in buying sentiments across the industry. Additionally, global demand has diminished, particularly from end-use industries, further exacerbating the decline. This combination of factors reflects an environment marked by cautious purchasing behaviour and overall subdued freight activity, highlighting continued volatility in the sector as players navigate shifting market dynamics.