Global Production Landscape

As of 2024, the worldwide production capacity for titanium dioxide is estimated at around 9.93 million metric tonnes annually. China accounts for the largest share of this capacity, with the US ranking second. Other key manufacturing centres include Mexico, Germany, Japan, and the United Kingdom, while notable additional capacity exists in countries such as Australia, Saudi Arabia, Ukraine, Canada, India, and Russia.

Titanium Dioxide Manufacturing process

Titanium dioxide (TiO₂) is manufactured on an industrial scale using two primary processes: the sulfate process and the chloride process. While both methods aim to produce high-quality pigment, they differ significantly in feedstock requirements, chemical reactions, processing steps, and environmental impact.

Sulphate Process

The sulphate process predominantly relies on ilmenite or titanium slag as its primary feedstock. The core chemical reaction involves digestion of the ore with concentrated sulfuric acid to produce titanium sulphate, followed by a series of refining steps. Processing includes ore digestion, removal of iron impurities, precipitation of titanium hydroxide, and final calcination to produce TiO₂ pigment. The key advantages are the ability to process lower-grade ores and comparatively lower capital investment. However, it generates significant acidic effluent requiring treatment, and product quality can vary depending on ore composition.

Chloride Process

The chloride process requires feedstock, rutile ore, synthetic rutile, or beneficiated ilmenite. Feedstock is chlorinated in the presence of coke at high temperatures to produce titanium tetrachloride (TiCl₄). This intermediate is purified via distillation and oxidised to TiO₂ pigment, with chlorine recovered and recycled. Its advantages include production of high-purity pigment, consistent particle size, and lower waste generation. However, it demands high-grade raw materials and involves higher capital and operational costs, along with the need to safely handle chlorine at elevated temperatures.

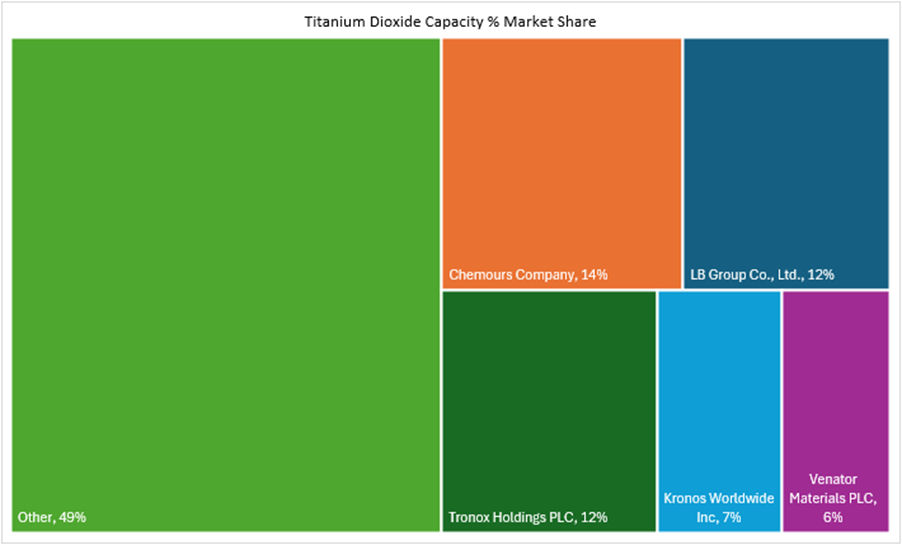

Top Titanium Dioxide (Tio2) Players

Production is concentrated among a few multinational players such as Chemours, Tronox, Lomon Billions, Venator Materials, and Kronos, who together account for a significant share of global supply. The global market is influenced by regional cost structures, raw material availability, and technological capabilities in pigment-grade TiO₂ manufacturing.

Competitive Landscape and Capacity Shifts

In North America, Chemours controls roughly half of the region’s total TiO₂ production capacity, making it the dominant competitor. LB Group has announced its intention to add approximately 200,000 tonnes of chloride process capacity, which will be introduced progressively over the next several years.

At the same time, the industry is undergoing capacity rationalisation:

- In 2023, Chemours shut down its Taiwan facility, removing about 160,000 tonnes of chloride process capacity from the market.

- In 2024, Venator confirmed the closure of its Duisburg, Germany plant, which had an estimated 50,000 tonnes of sulfate process capacity.

- Also in 2024, Tronox discontinued its sulfate production line in Varennes, Canada, further reducing available supply.

These changes reflect a trend toward streamlining operations, focusing on high-efficiency plants, and adapting to shifting market economics and environmental compliance requirements.

Key Market Drivers

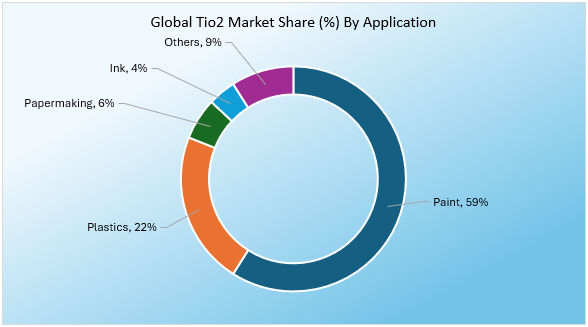

Paints and Coatings Growth: Expanding construction, infrastructure, and automotive sectors are boosting TiO₂ demand for high-opacity, weather-resistant coatings.

Plastics Sector Expansion: Rising consumption of TiO₂ as a whitening and UV-protection agent in packaging and engineering plastics.

Paper and Printing Inks: Increasing demand for high-brightness paper and specialty printing applications.

Urbanisation & Lifestyle Changes: Growing consumption of decorative paints, high-gloss finishes, and durable household products.

Import Substitution Initiatives: Government-led policies encouraging domestic manufacturing to cut import dependence.

- Global Pricing: Influenced by feedstock costs (rutile ore or chlorine slag and sulphate grade slag and sulfuric acid), energy prices, and environmental compliance expenses.

- Recent Trends: The domestic titanium dioxide market saw a price drop last week as sluggish downstream demand and elevated stock levels weighed on producers. Short-term conditions are likely to remain soft, with deal prices largely determined through individual negotiations.

- India’s Perspective: Domestic prices often track import parity levels, with currency fluctuations impacting landed costs. Investments in value chain integration can help stabilise pricing.

-b_Big.jpg)