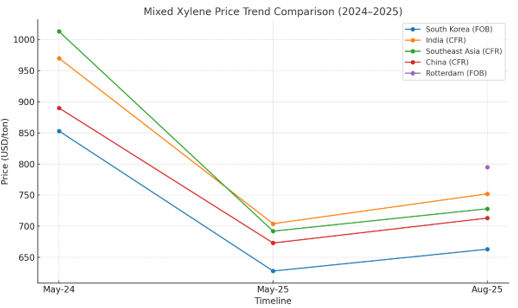

Mixed Xylene prices across key international markets exhibited pronounced volatility from mid-2024 through 2025. After peaking in May 2024, values underwent a sharp correction, entering a prolonged downtrend until May 2025. The market then registered a modest recovery through July 2025, before softening slightly in August 2025.

- South Korea (FOB): Prices fell from $853/ton in May 2024 to $628/ton in May 2025. A partial rebound to $663/ton by August 2025 reflected improved regional demand, though levels remained well below the prior year’s highs.

- India (CFR): Among the steepest corrections, prices dropped from $970/ton in May 2024 to $704/ton in May 2025, with a subsequent uptick to $752/ton in August 2025.

- Southeast Asia (CFR): The market slid from $1,013/ton in May 2024 to $692/ton in May 2025, before recovering moderately to $728/ton in August 2025.

- China (CFR): Prices declined from $890/ton in May 2024 to $673/ton in May 2025, followed by a measured rebound to $713/ton in August 2025.

- Rotterdam (FOB): Mirroring broader global trends, prices eased significantly from mid-2024 highs, with August 2025 values recorded at $795/ton.

Reason Behind Price Movements (Global Overview)

Global Mixed Xylene markets underwent a pronounced correction between May 2024 and May 2025, with values eroded by a confluence of factors. Foremost among these were volatile upstream crude oil and reformate benchmarks, which unsettled cost dynamics, coupled with persistently anaemic demand from downstream derivative chains such as phthalic anhydride, isophthalic acid, and solvent applications. The imbalance was further exacerbated by ample product availability, subdued industrial activity, and restrained procurement strategies across key consuming sectors including paints, coatings, and adhesives.

By August 2025, a degree of stabilisation emerged, reflected in a modest rebound across South Korea, India, Southeast Asia, and China. This uplift was largely attributable to seasonal replenishment, and marginal improvement in trade flows. Nevertheless, pricing levels remained materially below the elevated benchmarks of 2024, underscoring the structural oversupply and the protracted pace of recovery within core downstream markets.

Market Drivers and End-Use Industries

Mixed Xylene demand is primarily influenced by downstream derivatives and industrial applications:

- Paraxylene Production (70–75 per cent share): The largest outlet for Mixed Xylene, used in the manufacture of purified terephthalic acid (PTA) and ultimately in polyethylene terephthalate (PET) resins and fibres.

- Ortho Xylene (10-12 per cent share): Used in the production of phthalic anhydride for plasticisers, unsaturated polyester resin and alkyd resin.

- Meta-xylene and solvent (8-10 per cent share): utilised in coating, paints, adhesive, and agrochemical formulation.

- Isomer Grade Blending (5-8 per cent share): Mixed xylene is also consumed as a high-octane gasoline blending compound in the fuels sector.

Technology Licensors

The production of Mixed Xylene and its isomers is generally integrated with aromatics complexes. Major licensors include:

- UOP (Honeywell UOP)

- Axens Group

- Technip Energies

Beyond crude oil fluctuations and downstream demand from polyester and chemical intermediates, recent geopolitical and trade policy developments added further volatility to the market. The announcement by US President Donald Trump regarding new tariff measures in mid-2025 triggered uncertainty in global trade flows, weighing on investor sentiment and contributing to short-term price corrections. While the modest recovery in mid-2025 suggested an improvement in tariff-related trade disruptions, coupled with macroeconomic uncertainties and volatile feedstock costs, are likely to keep the Mixed Xylene market under pressure in the near term.

-b_Big.jpg)