India’s agrochemical sector is bracing for a sharp blow as the United States enforced a 50 per cent tariff on a wide range of Indian chemical imports, including herbicides, fungicides, and organic fertilisers. The move, part of a broader escalation in trade protectionism, puts at risk an estimated $1.7 to $2.2 billion in annual agrochemical exports to the US—a critical market for Indian producers. With organic chemicals and crop protection products among the hardest-hit categories, industry players warn of falling volumes, squeezed margins, and disrupted global supply chains unless urgent mitigation strategies are adopted.

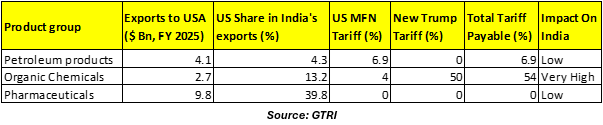

New US sectoral Tariffs on Indian Goods (applicable from Aug 27)

1. Exposure of Agrochemical Categories (~$660 million)

According to AlchemPro, herbicides, fungicides, organic fertilisers, and rodenticides together represent over $660 million in US-bound exports from India. A 50 per cent tariff would effectively add an equivalent cost burden, significantly undermining price competitiveness and likely leading to reduced export volumes and profit margins.

2. Organic Chemicals Hit Hard

According to the Global Trade Research Initiative (GTRI), organic chemicals qualify as a ‘very high impact’ export category. India’s shipments of these chemicals to the US reached approximately $2.7 billion in 2024. Faced with newly imposed tariffs, exports in this sector may fall sharply—by as much as 50-70 per cent—as price competitiveness deteriorates. Because organic chemicals constitute a substantial share of agrochemical intermediates, the downturn is likely to trigger extensive ripple effects across the broader agrochemical industry.

3. Chemical Exports Overall at Risk

According to AlchemPro, exports of chemicals—excluding pharmaceuticals—accounted for roughly $5.7 billion in India’s US-bound shipments in FY 2024. Analysts project that the recent tariff hike could precipitate a steep decline in these exports, potentially trimming $2–7 billion by FY 2026. Although this assessment covers the entire chemical segment, organic agrochemicals are expected to absorb a disproportionately large share of the fallout, owing to their elevated tariff exposure.

4. Broader Export Shock

The Global Trade Research Initiative (GTRI) forecasts that India’s total exports to the US could fall sharply—from $86.5 billion in FY 2025 to $49.6 billion in FY 2026—marking a 43 per cent contraction. Among the most impacted sectors is chemicals, where micro, small, and medium enterprises (MSMEs) contribute nearly 40 per cent of export value, leaving them particularly vulnerable to trade disruptions.

As per GTRI, India’s key chemical production clusters are already experiencing the ripple effects of US trade measures. In Gujarat—across hubs like Ankleshwar, Vapi, Dahej, Jhagadia, and Nandesari—companies, particularly in agrochemicals and dyes, are facing paused orders, contract renegotiations, and reduced operational shifts. Maharashtra’s exporters of cosmetic ingredients and surfactants, especially in Tarapur and Taloja, are grappling with tightening cash flows. Meanwhile, regions in Tamil Nadu, Andhra Pradesh, and Telangana—such as Cuddalore, Manali, Vizag, and Hyderabad—report stalled shipments in specialty and pharmaceutical intermediates.

As per GTRI, India’s key chemical production clusters are already experiencing the ripple effects of US trade measures. In Gujarat—across hubs like Ankleshwar, Vapi, Dahej, Jhagadia, and Nandesari—companies, particularly in agrochemicals and dyes, are facing paused orders, contract renegotiations, and reduced operational shifts. Maharashtra’s exporters of cosmetic ingredients and surfactants, especially in Tarapur and Taloja, are grappling with tightening cash flows. Meanwhile, regions in Tamil Nadu, Andhra Pradesh, and Telangana—such as Cuddalore, Manali, Vizag, and Hyderabad—report stalled shipments in specialty and pharmaceutical intermediates.

As India’s competitiveness declines, the US is likely to pivot to alternative sources: high-value chemicals from the EU (Germany, Belgium, Netherlands, Ireland), dyes and agrochemicals from China, fluorochemicals and solvents from Chemours, Mexico, and Canada, and electronic chemicals and surfactants from South Korea, Taiwan, Thailand, and Malaysia. This shift underscores the urgency for Indian exporters to reassess strategies amid evolving global supply chains.

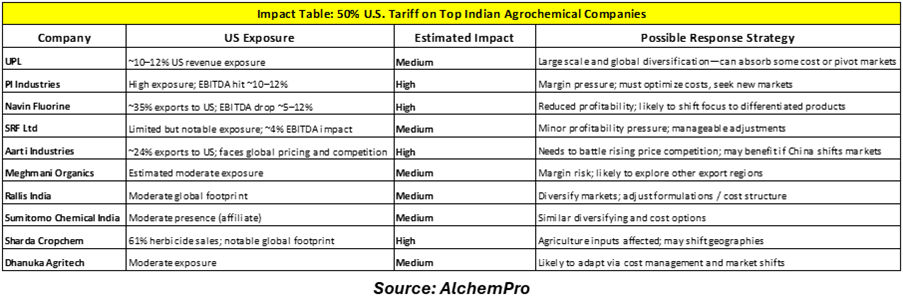

Possible Impact on Top Agrochemical players in India based on their US Exposure

-b_Big.jpg)