India’s cyclohexane imports are primarily sourced from neighbouring Asian countries, with Thailand emerging as the dominant supplier. In recent, Thailand accounted for nearly 780,000 MT (88 per cent) of India’s total cyclohexane imports, followed by Japan at 55,560 MT (6 per cent) and China at 43,000 MT (4 per cent). This clear concentration of sourcing highlights India’s dependency on regional producers, especially Thailand, for meeting domestic demand.

Global Trade Dynamics

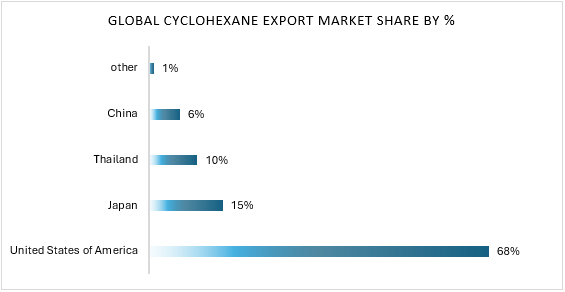

On the global stage, cyclohexane exports are concentrated among a handful of large producers. The US leads with 68 per cent of total global exports, followed by Japan (15 per cent), Thailand (10 per cent), China (6 per cent), and South Korea alongside minor contributions from other regions (1 per cent). These trade patterns reinforce the strategic dominance of a few nations in the international cyclohexane supply chain.

Cyclohexane India Import Profile (2025)

India’s cyclohexane imports are overwhelmingly concentrated in Thailand, which supplies nearly 89 per cent of total demand. Japan and China remain secondary suppliers.

India’s cyclohexane imports are overwhelmingly concentrated in Thailand, which supplies nearly 89 per cent of total demand. Japan and China remain secondary suppliers.

The US is the single largest exporter, commanding over two-thirds of global supply. Japan, Thailand, and China collectively contribute another 30 per cent.

Price Benchmarks (August 2025)

India’s import prices are closely aligned with Southeast Asia, while China maintains lower domestic pricing due to competitive internal supply.

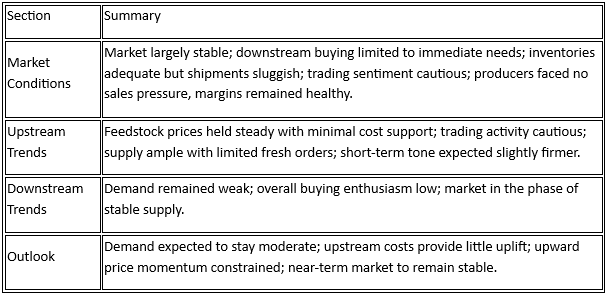

Global Cyclohexane Market Update

Downstream Applications & End-Use Industries

Cyclohexane’s primary demand comes from the nylon value chain, making it critical for textiles, automotive components, and packaging materials.

Cyclohexane’s primary demand comes from the nylon value chain, making it critical for textiles, automotive components, and packaging materials.

Forward-Looking Outlook (2025–26)

- Supply Risks: India’s reliance on Thailand poses a concentration risk, with potential exposure to regional disruptions.

- Demand Growth: Rising consumption in nylon-based products (Fibers, plastics, automotive parts) will continue to drive import needs.

- Competitive Pressures: China’s lower domestic cost base ($0.926/kg) could increase its export competitiveness if production surpluses rise.

- Strategic Outlook: India may pursue diversification of suppliers and consider domestic capacity additions, possibly via partnerships with global licensors, to secure long-term supply.

-b_Big.jpg)