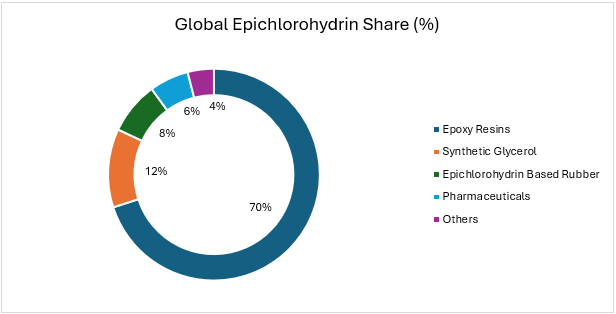

The market for Epichlorohydrin (ECH) is forecast to grow consistently, advancing from an estimated $3.0 billion in 2025 to nearly $4.5 billion by 2035, which corresponds to a CAGR 4 per cent over the decade. This growth is fueled primarily by the strong demand for epoxy resins, which remain the dominant application, serving critical roles in coatings, adhesives, composites, and electronics manufacturing. Rising infrastructure investment, lightweight automotive design, and renewable energy development are further boosting consumption. Globally Epichlorohydrin (ECH) production is predominantly derived from glycerin, contributing about 80 per cent, while propylene accounts for the remaining 20 per cent.

In addition to epoxy resins, ECH finds increasing applications in water treatment chemicals, elastomers, and specialty adhesives, underscoring its versatility across industrial sectors. Regionally, Asia-Pacific commands the largest share, driven by China and India’s expanding manufacturing base, while North America and Europe continue to contribute with demand from advanced industries such as aerospace, electronics, and wind energy.

Looking ahead, the market is gradually shifting toward glycerine derived epichlorohydrin, reflecting a broader industry move toward sustainable and environmentally responsible production methods.

India Market Dynamics

In India, domestic production capacity of Epichlorohydrin is limited to around 50,000 tons per annum, whereas the current demand is estimated at nearly 118,000 tons per annum (KTPA). This wide supply–demand gap makes the country highly dependent on imports to meet consumer and industrial requirements.

Epichlorohydrin Price Trends

The Indian Epichlorohydrin (ECH) market witnessed notable volatility in 2025. Prices ₹143/kg in April, before climbing to nearly ₹150/kg by mid-July on the back of higher feedstock costs and tight supply. However, August recorded a marginal correction, though values stayed elevated compared to earlier. Overall, the market remained supported by firm raw material trends and cautious buying activity from downstream users.

ECH – Expected Pricing Trend (Next Quarter, India)

1. Feedstock Cost Influence

- Glycerine-based ECH: Prices will remain sensitive to fluctuations in glycerine availability. Any tightness in the oleochemical sector or rising biodiesel production costs could push glycerine higher, thereby exerting upward pressure on ECH pricing.

- Propylene-based ECH: Propylene markets are showing signs of firmness due to steady demand in downstream polypropylene and propylene oxide sectors. If crude oil trends remain elevated, propylene-linked ECH costs may edge up further.

2. Import Dependency in India

- With India’s domestic capacity at ~50 KTPA against demand of ~118 KTPA, imports will continue to dictate local prices. Any supply constraints or freight cost surges from major exporting regions (China, South Korea, Thailand) could keep the domestic market firm.

3. Supply–Demand Balance

- Downstream demand from epoxy resins, water treatment, and rubber applications is expected to stay moderate-to-strong in Q4. However, buyers may exercise caution in procurement at elevated levels.

4. Price Outlook (India, Next Quarter)

- Base Case: Prices expected to hover in the range of ₹145–158/kg.

- Upside Risk: Further firming possible if glycerine and propylene costs surge or if import supply tightens.

- Downside Risk: Mild corrections could occur if demand from epoxy resin and construction segments softens or if feedstock costs ease.

Overall Epichlorohydrin Market

The market is likely to remain firm with a bullish bias, driven by cost-push factors from both glycerin and propylene, alongside India’s structural import dependency. Epichlorohydrin demand is expected to grow steadily, supported by the expanding epoxy resin and water treatment chemical segments. In India, reliance on imports will persist until new production capacity is added. Prices will remain volatile in the short term, closely tracking feedstock dynamics (particularly propylene and glycerin) and global supply balances.

-b_Big.jpg)