India plays a dual role in the bromine value chain being an exporter of sodium bromide, an importer of bromine, and also a bromine exporter. This complex trade balance makes the domestic sodium bromide market particularly sensitive to fluctuations in raw material availability.

During the ongoing rainy season in India, bromine production has been constrained due to operational challenges, resulting in tight supply and lower inventories. Consequently, domestic sodium bromide prices have firmed significantly rising from $0.978 per kg in mid-April to $1.126 per kg in the first week of August. This upward trend reflects both the higher cost of bromine feedstock and reduced supply from domestic producers.

A similar situation is unfolding in China, where bromine inventories are also under pressure due to seasonal supply limitations and production slowdowns during the rainy period. Bromine prices in China have surged, with current market offers ranging around $3.8 per kg, amplifying cost pressures on sodium bromide producers.

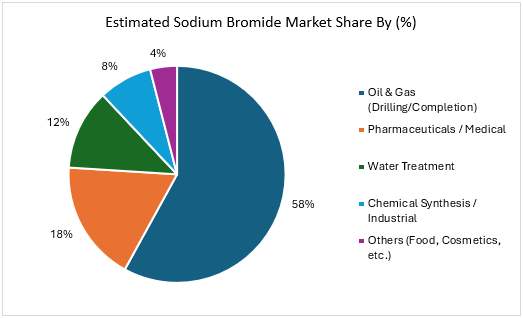

Given the simultaneous supply tightness in both India and China two major players in the sodium bromide trade global spot prices are expected to remain elevated in the near term, particularly for oilfield services, water treatment, and specialty chemical markets that rely heavily on this compound.

Globally, Israel leads sodium bromide exports with a 20 per cent share, followed closely by China at 19 per cent. The United States accounts for 14 per cent, while other notable exporters include India (5 per cent), Jordan (4 per cent), Belgium (4 per cent), and Netherlands (4 per cent), with smaller nations collectively representing 15 per cent. This distribution highlights a concentrated supply base where changes in production or trade flows in leading countries have a direct impact on global pricing and availability.

Short-Term Market Outlook – Sodium Bromide

- India: Prices are expected to remain firm to bullish in the coming weeks due to continued tight supply of bromine during the rainy season, limited producer inventories, and firm import costs. Any relief is likely only after seasonal production normalises, expected post–September.

- China: Sodium bromide prices are projected to remain elevated in the short term, driven by persistent tightness in bromine supply. The ongoing rainy season has disrupted bromine extraction activities, reduced overall availability and slowed down replenishment of inventories. With bromine prices currently in the range of $3.8/kg, production costs for sodium bromide have risen significantly, limiting the ability of manufacturers to offer competitive export prices.

- Global Trade: With Israel and China controlling ~39 per cent of exports and both India and China facing feedstock constraints, international spot prices are likely to hold steady at elevated levels through Q3 2025.

- Demand Side: Stable-to-strong demand from oil & gas, water treatment, and specialty chemical sectors will continue to absorb available supply, limiting downward price corrections.

- Risk Factors: Any further delay in bromine production recovery, geopolitical disruptions in major exporting nations, or unexpected oilfield demand spikes could push prices even higher in the short term.

Overall Trend (Aug–Sep 2025) Firm to Bullish, with limited downside risk until feedstock supply improves.