Executive Summary

India’s GST reform: reducing the tax rate on Nitric Acid (HNO₃), Sulphuric Acid (H₂SO₄), and Ammonia (NH₃) from 18 per cent to 5 per cent under a two-slab system, effective from 22 September 2025 resolves the inverted duty structure. This adjustment reduces production overheads, fortifies the resilience of fertiliser and chemical supply chains. Analysis of price trends during the last few months suggests that, following the GST rate reduction, domestic prices of these chemicals are projected to decline, reflecting lower tax incidence and improved cost efficiencies.

This will:

(a) materially improve downstream manufacturer cash flows and margins,

(b) make Indian producers more cost-competitive in export markets, and

(c) stimulate incremental consumption in fertiliser and related segments as effective input costs fall and purchasing power across the chain improves.

Nitric Acid (HNO₃)

Domestic Nitric Acid suppliers can increase profitability by improving operations, positioning themselves strategically, and adding value to their products. Cost savings are achieved by using cheaper raw materials made possible after GST, along with energy-efficient production and economies of scale. Additional gains come from better supply chain management, including streamlined logistics, port handling, and inventory control. Together, these measures help maintain sustainable profit margins in both domestic and international markets.

Export and Domestic Market Margin Benefits

Prices surged to $0.446 /kg in July, representing an increase of approximately 11.5 per cent compared to April. This reflected renewed buying momentum and pre-buying by industrial and fertiliser sectors abroad due to tariffs, before moderating to $0.404 /kg in August because of global market adjustments. Overall, the export market demonstrates resilience, with margins sustained through cost-competitive production.

Domestic Ex-Bharuch prices remained relatively stable at $0.288–0.292 /kg from April to June, reflecting steady demand from fertilisers, industrial chemicals, and specialty applications. A gradual decline to $0.278 /kg in July and further to $0.264 /kg in August corresponds to seasonal consumption variations, local inventory adjustments, and competitive pricing pressures in domestic industrial sectors.

Domestic Ex-Bharuch prices remained relatively stable at $0.288–0.292 /kg from April to June, reflecting steady demand from fertilisers, industrial chemicals, and specialty applications. A gradual decline to $0.278 /kg in July and further to $0.264 /kg in August corresponds to seasonal consumption variations, local inventory adjustments, and competitive pricing pressures in domestic industrial sectors.

GST Reform Benefits in India’s Nitric Acid Domestic and Export Markets

India’s Nitric Acid is strategically diversified across the Middle East, Africa, and South Asia/Eurasia, ensuring resilience against demand and geopolitical risks. GST reforms have strengthened the entire value chain:

- Producers such as National Fertilizers Limited, GNFC, Deepak Fertilisers, Rashtriya Chemicals and Fertilizers Ltd. (RCF), Chambal Fertilisers & Chemicals Limited benefit from input tax credits, reduced cascading taxes, and lower production costs and increased margin.

- Mid-sized firms such as Sukha Chemical Industries, Prakash Chemicals, Kakadiya Chemicals, Aadhya Shakti Chems, and Vijay Gas Industry benefit from GST simplification through reduced compliance burden and smoother interstate trade.

- Exporters and traders enjoy faster tax refunds and improved margin and liquidity.

With competitive costs, strategic port access, and GST-enabled efficiencies, India sustains a strong global footprint. The outlook remains positive, marked by steady growth, improved price stability, and diversified risk management, reinforcing India’s position as a reliable global supplier of Nitric Acid.

Sulphuric Acid (H₂SO₄)

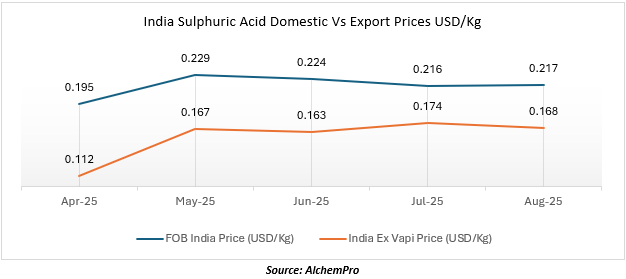

India’s sulphuric acid export market exhibited moderate price fluctuations during the period from April 2025 to August 2025. With Ex-Vapi prices ranging between $0.112–0.174 /kg during Apr–Aug 2025 and FOB (Free on Board) prices in dollar per kilogram recorded a peak of $0.229 /kg in May 2025, followed by a gradual decline to $0.216 /kg in July 2025, before marginally recovering to $0.217 /kg in August 2025. The price movement reflects seasonal variations in global demand, raw material cost fluctuations, and competitive pressures in key importing regions.

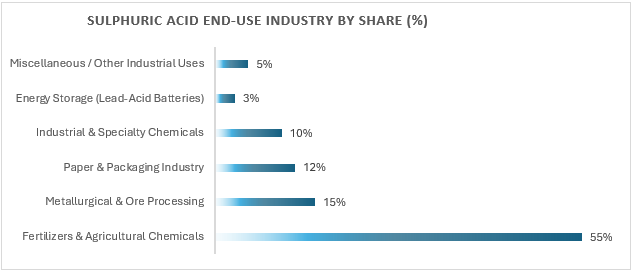

This GST reform not only strengthens downstream manufacturer margins and eases working-capital pressure but also enhances India’s competitiveness in export markets through smoother input tax credit flows and quicker GST refund realisation. Moreover, lower procurement costs across the chain are expected to stimulate incremental consumption, particularly in fertiliser, metals, and chemical intermediates, while simultaneously improving purchasing power and affordability across the entire value chain.

Export Destinations

Indian Sulphuric Acid is exported to diverse geographies, with a strategic focus on high-demand regions. Key destinations include Middle East / Gulf, North Africa, Sub-Saharan Africa, South Asia / Indian Subcontinent, Central America / Caribbean, North America and Middle East / Western Asia. These regions represent major industrial hubs with significant demand for Sulphuric Acid in fertiliser production, chemical intermediates, and metallurgical processes.

Sulphuric Acid Major Indian Players

India’s sulphuric acid market is supported by a combination of established chemical manufacturers and trading houses: Hindalco Industries Limited, Hindustan Zinc, Gujarat State Fertilizers & Chemicals Limited (GSFC), Prakash Chemicals International Private Limited, Industrial Solvents and Chemicals Private Limited, Kesvi Maxiple LLP, Ankitraj Expotrade Private Limited, Gee Gee Kay Private Limited, DDH Impex, LDH Impex, Biorise Remedies, Kunal Chemicals, Golchha Chemical Industries, Asian Fertilizers Limited and many more.

Market Outlook

The Indian sulphuric acid market is expected to maintain steady growth due to the rising industrial consumption across targeted regions. Price stability is likely to be influenced by global raw material availability, regional demand-supply dynamics, and competition from other global exporters. Strategic partnerships with key industrial consumers in Middle East, Africa, and North America could further strengthen India’s export position.

Ammonia (NH₃)

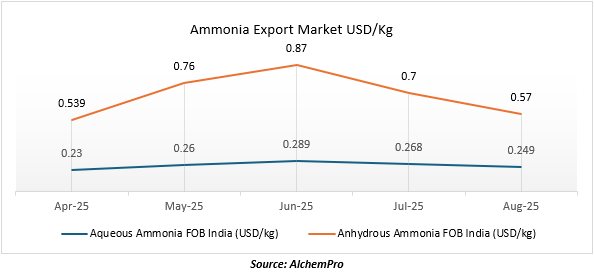

Ammonia prices in India exhibited significant volatility between April and August 2025, driven by fluctuations in global demand, raw material costs, and seasonal consumption cycles across fertiliser and industrial segments.

- Aqueous Ammonia: Export prices stood at $0.230 /kg in April 2025, before rising sharply in domestic terms to $0.260/kg in May and $0.289 /kg in June, reflecting strong seasonal demand and tariff concern from downstream fertiliser and industrial applications. However, prices corrected to $0.249 /kg in August, highlighting inventory adjustments and global oversupply pressures.

- Anhydrous Ammonia: FOB export prices averaged $0.539 /kg in April, with domestic equivalents rising to $0.760/kg in May and $0.870/kg in June amid peak fertiliser demand, tightening supply and tariff concern. By August, prices corrected to $0.570/kg, aligning with reduced procurement activity and softer global benchmarks.

Both aqueous and anhydrous ammonia displayed a pronounced mid-year price escalation followed by correction, reflecting strong seasonality in fertiliser consumption, volatility in natural gas feedstock costs, and international market dynamics.

Domestic Producers and Exporters Driving India’s Ammonia Trade

Ammonia Supply Co, IFFCO, Chambal Fertilisers & Chemicals Limited, Bombay Ammonia and Chemical Company, Jaysons Ammonia and Chemicals Private Limited, Kanpur Ammonia Supply Co, Mysore Ammonia and Chemicals Limited, Prerana Ammonia and Chemicals Private Limited and Surat Ammonia and Chemical Company.

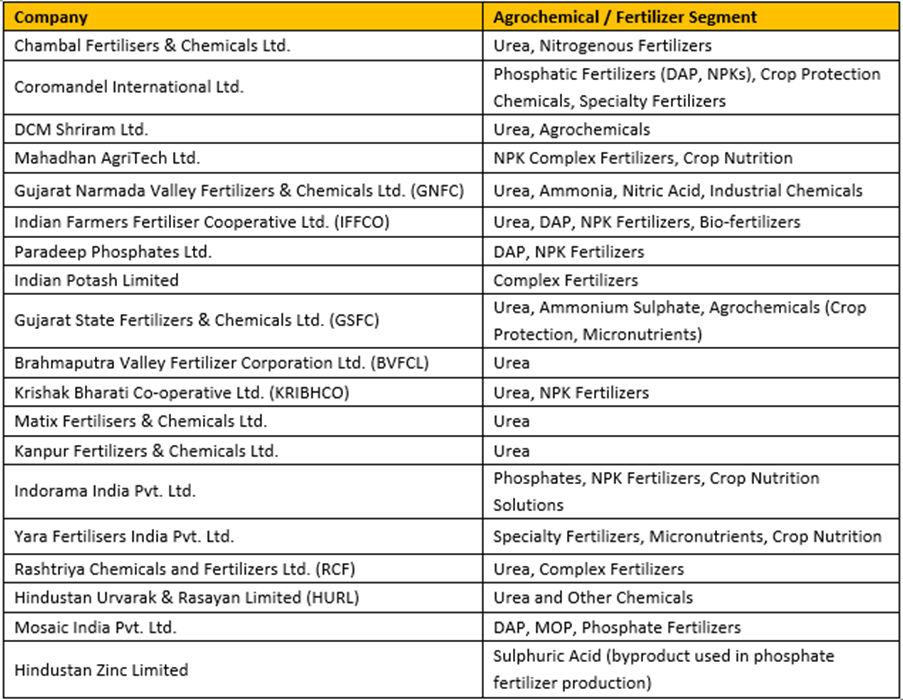

Agrochemical/Fertiliser Companies & Segments (GST Reform Beneficiaries)

GST Reform Impact on Nitric Acid, Sulphuric Acid, and Ammonia Value Chains

The cut in GST from 18 per cent to 5 per cent on Nitric Acid (HNO₃), Sulphuric Acid (H₂SO₄), and Ammonia (NH₃) is a decisive policy measure that lowers input costs, corrects duty distortions, and strengthens competitiveness across the fertiliser and chemical value chain. By correcting the long-standing inverted duty structure, the reform reduces procurement costs, streamlines compliance, and enhances liquidity across the supply chain.

1. Impact on Manufacturers

- Large Producers such as National Fertilizers Limited, GNFC, RCF, Chambal Fertilisers, Hindalco, GSFC, IFFCO, and Hindustan Zinc gain from improved input tax credit flows and reduced working capital blockages, translating into stronger operating margins.

- Mid-sized firms including Sukha Chemical Industries, Prakash Chemicals, Kakadiya Chemicals, Aadhya Shakti Chems, and Vijay Gas Industry benefit from simplified compliance and smoother interstate trade, allowing better regional market access.

- Exporters and traders enjoy quicker tax benefits, improved liquidity, and sharper cost competitiveness in international markets.

2. Impact on End Users

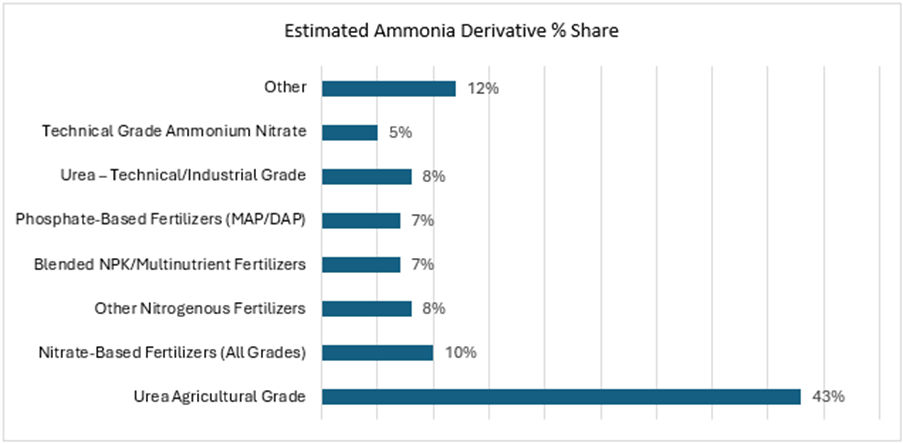

- Fertiliser producers (urea, DAP, NPK, and ammonium sulphate manufacturers) will see reduced raw material costs, enabling more affordable nutrient products for the agricultural sector.

- Industrial chemical users such as metals, explosives, dyes, and intermediates industries will benefit from softer input costs, improving production economics and boosting global competitiveness.

- Agrochemical companies leveraging nitric acid and ammonia for downstream formulations will enjoy greater cost flexibility, facilitating market expansion and higher adoption rates.

3. Market Dynamics

- Consumption Growth: Lower effective input prices will stimulate incremental demand across fertilisers, agrochemicals, and industrial segments, supporting higher domestic offtake.

- Price Softening Downstream: With cost savings passed along the chain, downstream industries and end-use markets will benefit from moderated price levels, improving affordability and widening market access.

- Export Competitiveness: By aligning cost structures with international benchmarks, India’s chemical and fertiliser producers will consolidate their positions as reliable suppliers to the Middle East, Africa, South Asia, and North America and improve margins.

4. Value Chain Strengthening

This GST reform supports the entire value chain of Nitric Acid, Sulphuric Acid, and Ammonia:

- Upstream: Reduced tax burden on feedstocks enhances producer margins.

- Midstream: Fertiliser and industrial chemical producers benefit from lower working-capital requirements and smoother logistics. GST reforms lower input taxation, making raw materials more affordable for midstream fertiliser and chemical manufacturers, while reduced end-product prices stimulate broader consumption and demand growth across downstream markets.

- Downstream: End-use industries enjoy more stable pricing, fostering competitiveness in domestic and global markets.

- End Consumers: Farmers and industrial buyers ultimately gain from cost-efficient fertilisers and industrial inputs, reinforcing demand growth.