In 2025, India’s trade relationship with China continued to evolve amid a complex backdrop of geopolitical tensions, economic realignments, and shifting global supply chains. Despite ongoing strategic rivalry, bilateral trade between the two Asian giants remained robust, with China retaining its position as one of India’s largest trading partners. Exports from India to China in 2025 reflected a mix of traditional strengths and emerging opportunities. Core sectors such as organic and inorganic chemicals, ores, mineral fuels, and pharmaceuticals remained key pillars of India’s outbound trade. Additionally, rising demand from Chinese industries and gradual market access improvements contributed to modest growth in select high-value segments.

However, the trade equation remained asymmetrical, with India striving to narrow its persistent trade deficit. Export diversification efforts, tariff adjustments, and policy interventions—such as production-linked incentives (PLIs) and targeted trade agreements—played a critical role in shaping export patterns during the year.

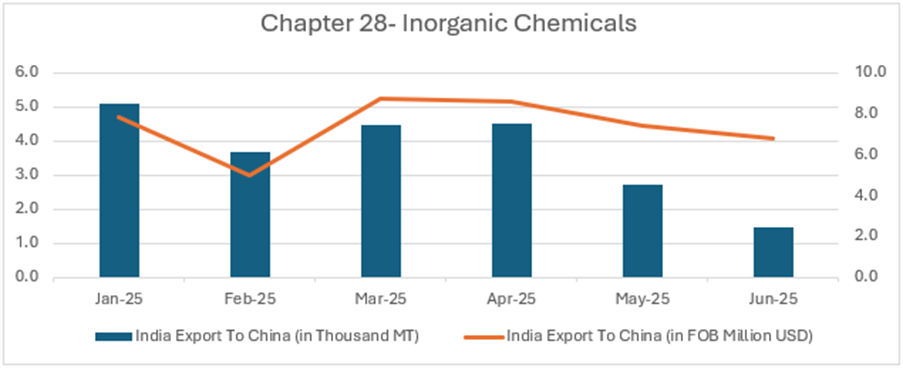

Chapter 28: Inorganic Chemicals

Key Products: Magnesium sulphate, Carbon black, Caustic soda, Aluminium oxide, Zinc sulphates and other chemical products.

Trend Overview: Early-year volumes were fluctuating; March–April values peaked; May–June showed sharp contraction in volume and value.

Demand & Supply Concerns: China market oversupplied; muted construction other industries demand, seasonal pre-holiday inventory build, and reduced Q1 2025 capacity utilisation rate vs. prior year.

Upward Phase: Pre-holiday inventory build-up; import reliance for carbon black & aluminium oxide; detergent & water-treatment demand boosted shipments in February 25-April 25.

Downward Phase: Weaker demand from construction; high Chinese inventory of caustic soda & zinc sulphates and many other chemicals; self-sufficiency cut imports in April–Jun 2025.

Tariff Note: Non-tariff barriers (quality certification, environmental compliance checks) occasionally affected inorganic imports.

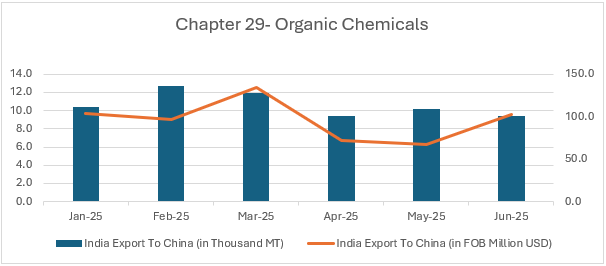

Key Products: Hydrocarbons, Halogenated derivatives, Alcohols, Phenols, Ethers, Aldehydes, Ketones, Carboxylic acids, Nitrogen compounds, Heterocyclics, Bioactives (e.g., vitamins).

Trend Overview: In Q1 2025, both volumes and values saw strong growth. In Q2 2025, volumes remained largely steady, while values continued to rise, supported and anticipated by the impact of antidumping duties applied in June 25.

Demand & Supply Concerns: Global oversupply of methanol & hydrocarbons; crude oil volatility; weaker downstream plastics & pharma demand.

Upward Phase: Strong demand for phenols, and vitamins; purchasing managers' index (PMI) of China > 50 in Feb–Mar supported resins, coatings, and pharma intermediates and pre-holiday inventory build-up.

Downward Phase: Q2 exports to China down vs Q1; volumes stable (9.4–10.1k MT Apr–Jun); weaker demand in automotive, coatings & pharma reduced halogenated derivatives imports; values dipped Apr–May, rebounded in June.

Tariff Note: DGTR/CBIC actions on import from China: Anti-dumping duties imposed on Potassium Tertiary Butoxide, Sodium Tertiary Butoxide, PEDA (2,6-Diethyl-N-(2-propoxyethyl) aniline), Acetonitrile, Vitamin A Palmitate, Insoluble Sulphur. Multiple new anti-dumping investigations initiated (PTBP, Methyl Acetoacetate, Bromo OTBN).

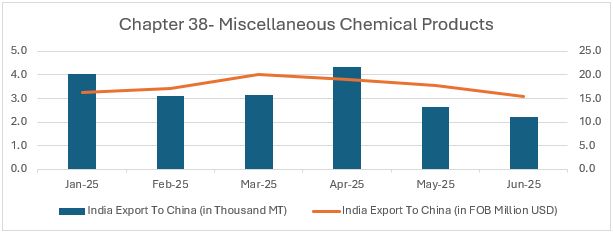

Chapter 38 – Miscellaneous Chemical Products

Key Products: Metamitron, Aclonifen, Catalysts (~15 per cent of total export), Fatty Acids, other agrochemicals & specialty chemicals.

Trend Overview: In H1 2025, India’s Chapter 38 exports to China showed moderate volatility, with shipments at 2.2–4.3 KT and FOB values $15.5–20.2M, reflecting seasonal demand, supply concerns, geopolitical factors, and fluctuations in agrochemicals.

Demand & Supply Concerns: Demand Constraints: Global destocking, competitive pricing from Chinese suppliers, and seasonal crop cycles affecting Metamitron & Aclonifen and other chemicals. Supply Constraints: Limited production capacity for specialty catalysts, e.g. fatty acids and others.

Upward Phase: Export volumes declined due to supply shortages in the market, while values remained elevated, driven by strong pricing and sustained demand for specialty products.

Downward Phase: Exports declined from 4.3 KT ($19.1 M) in Apr to 2.2 KT ($15.5 M) in Jun due to post-season destocking, lower agrochemical demand, and competitive Chinese pricing over weak market sentiments.

Tariff Note: No specific export tariffs from China for Chapter 38 products; however, global trade policies and US/EU tariffs indirectly influence competitiveness. Regulatory compliance for agrochemicals and catalysts remains a key factor for China market.

-b_Big.jpg)