Industry Overview

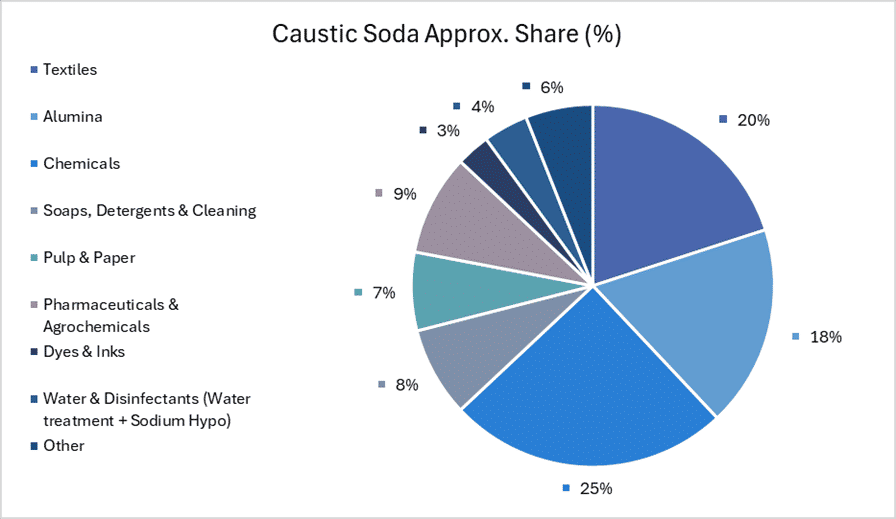

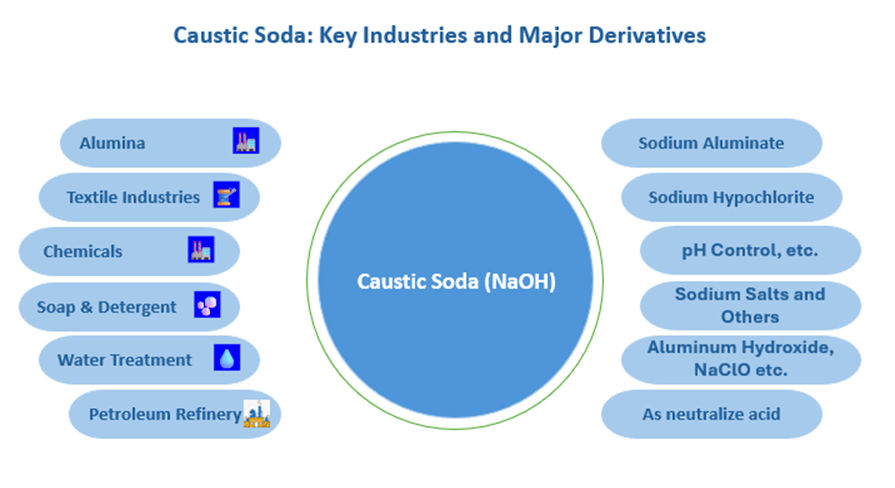

Caustic Soda, chemically known as Sodium Hydroxide (NaOH), is a fundamental industrial alkali and a critical building block for multiple downstream industries. It is extensively utilised in textiles, pulp and paper, alumina, pharmaceuticals, dyes, soaps, detergents, fertilisers. Its strong alkali properties also make it vital for neutralisation, saponification, effluent treatment, and chemical synthesis processes.

India Caustic Soda Price Outlook

Domestic bulk prices of Caustic Soda at Dahej rose from $0.416 per Kg in June 2024 to $0.493 per Kg in January 2025, reflecting an increase of approximately 18.5 per cent over the period. However, prices softened thereafter, declining to $0.411 per Kg in August 2025, returning close to June 2024 levels due to weak demand. In the near term, prices are expected to remain broadly firm, with marginal upward adjustments from last two weeks likely, driven by evolving market dynamics and shifting buyer sentiment.

India’s reliance on Caustic Soda imports remains negligible, with inbound volumes at very low levels, highlighting limited dependency on overseas markets. In contrast, the country continues to maintain a strong export position, underscoring its surplus production capacity and competitive advantage in global trade.

Production and Capacity Utilisation in India (FY 2024–25)

In FY 2024–25, India’s Caustic Soda production reached 5.05 million MT over an installed capacity of 6.40 million MT compared to installed capacity of 4.4 million MT in FY19, reflecting a strong capacity utilisation of about 80 per cent. Caustic soda capacity rose from 6.0 million MT in FY24 to 6.4 million MT by FY25, indicating steady expansion to meet rising downstream demand.

The sector continues to benefit from growing consumption across end-use industries such as textiles, pharmaceuticals, agrochemicals, and others. With India strengthening its position as a global manufacturing hub, capacity utilisation levels remain robust, highlighting balanced supply-demand fundamentals in the domestic market.

Caustic Soda Leading Manufacturers

The Indian market is supported by the presence of several established players driving large-scale production and capacity. Key manufacturers include:

- Grasim Industries Ltd.

- DCM Shriram

- Gujarat Alkalies and Chemicals Limited (GACL)

- Epigral Limited

- Kutch Chemicals Industries Ltd.

- Tata Chemicals and more

The high utilisation rate reflects stable operational efficiency and healthy domestic demand, positioning India as one of the leading producers in Asia.

Manufacturing Process

Caustic Soda is produced through the chlor-alkali process, which involves the electrolysis of brine (sodium chloride solution). The process yields Caustic Soda, Chlorine, and Hydrogen as co-products.

1. Membrane Cell Process (current standard)

- Produces high-purity Caustic Soda.

- Energy-efficient, environmentally friendly, and widely adopted.

2. Diaphragm Cell Process

- Produces dilute Caustic Soda requiring concentration.

- Lower purity compared to membrane technology.

3. Mercury Cell Process (phased out)

- Discontinued due to environmental hazards from mercury.

India has fully transitioned to the membrane cell process, in line with global environmental regulations and energy-efficiency mandates.

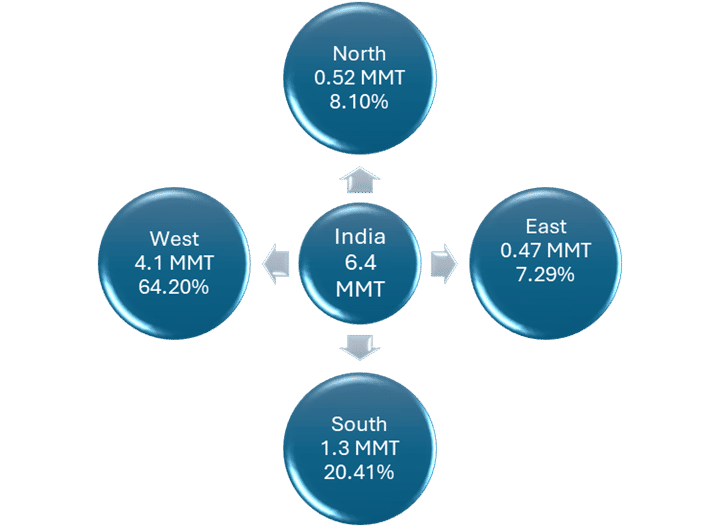

Caustic Soda Regional Capacity Distribution

The Caustic Soda industry in India is regionally skewed, with West Zone being the production hub due to industrial clustering and raw material availability.

Demand Drivers

Caustic soda demand in India is driven by its wide industrial applications:

- Textiles and Pulp & Paper: For bleaching, scouring, and delignification.

- The Aluminium Industry: Alumina refining requires large quantities of caustic soda.

- Soaps and Detergents: For saponification and cleaning formulations.

- Water Treatment: For pH regulation and effluent treatment.

- Pharmaceuticals and Dyes: As a chemical intermediate.

- Petrochemical Industry: For production of pesticide intermediates and fertiliser blends.

With strong growth in infrastructure, housing, consumer goods, and packaging, Caustic Soda consumption is expected to rise further.

Key Points

- Negligible import dependence; strong export presence.

- Key manufacturers: Grasim, DCM Shriram, GACL, Epigral, Kutch Chemicals, Tata Chemicals.

- Production fully transitioned to energy-efficient membrane cell technology.

- West Zone is the main production hub.

- Growth expected with rising infrastructure, housing, packaging, and consumer goods sectors.

-b_Big.jpg)