Epoxy Resin Market Outlook

The global epoxy resin market, including both base resins and curing agents, is currently valued at $13.1 billion and is expanding at a compound annual growth rate (CAGR) of approximately 4.3 per cent. Within this market, epoxy resins continue to be the dominant thermosetting polymers due to their exceptional adhesion strength, chemical resistance, dimensional stability, and electrical insulation properties, making them integral across a diverse range of industrial applications.

From a regional perspective, India represents one of the fastest-growing markets with an annual growth trajectory of around 7.7 per cent. This higher growth rate compared to the global average is driven by robust demand in construction, automotive, wind energy, electronics, and coatings sectors, supported by rapid infrastructure development and manufacturing expansion.

Market Dynamics and Curing Agents

Epoxy resins achieve their performance profile through curing agents, with amines, anhydrides, and sulfones being among the most widely used categories. Sulfone-based curing agents are particularly valued for thermal stability, mechanical performance, and resistance to hydrolysis, making them critical for high-performance composites, aerospace materials, and advanced electrical applications.

Key Growth Drivers

1. Electronics & Electricals: Miniaturisation of devices, printed circuit board (PCB) production, and encapsulants are boosting epoxy demand.

2. Construction & Infrastructure: Epoxy-based coatings, adhesives, and flooring systems are widely applied for durability, corrosion protection, and chemical resistance.

3. Automotive & Transportation: Lightweight composites and structural adhesives enhance fuel efficiency and safety.

4. Wind Energy: Epoxy resins are integral to manufacturing large turbine blades, with demand increasing in renewable energy investments.

5. Industrial Coatings: Protective, marine, and industrial coatings account for a major share of consumption, particularly in emerging markets.

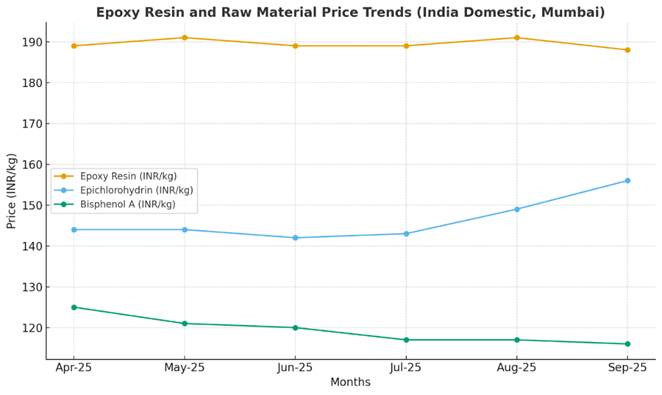

Epoxy Resin and Raw Material Market Dynamics (Apr–Sep 2025)

Epoxy Resin prices in the Indian domestic market (Mumbai) remained relatively stable in the period April–September 2025, fluctuating only within a narrow band of ₹188–191/kg. This stability is largely attributable to a balancing effect between the cost trends of its two critical raw materials Bisphenol A and Epichlorohydrin.

Bisphenol A (BPA)

• Prices exhibited a downward trajectory, falling from ₹125/kg in April 2025 to ₹116/kg in September 2025.

• This continuous softening trend reflects ample supply availability, weaker downstream demand in polycarbonate and epoxy markets, and possible global oversupply pressures.

• The steady decline in Bisphenol A helped to provide a cost cushion for epoxy resin manufacturers, partially offsetting the upward movement in other raw materials.

Epichlorohydrin (ECH)

• Prices displayed a firming trend, rising from ₹144/kg in April 2025 to ₹156/kg in September 2025.

• The escalation was most pronounced in August–September, reflecting tightening supply conditions and higher input costs from propylene derivatives.

• Rising Epichlorohydrin costs exerted upward pressure on epoxy resin production margins, counteracting the relief provided by softer Bisphenol A prices.

Impact on Epoxy Resin

• Despite contrasting raw material movements, epoxy resin prices remained range-bound at ₹188–191/kg, signalling balanced cost dynamics.

• The decline in Bisphenol A costs supported manufacturers against the cost escalation of Epichlorohydrin, resulting in stable resin market pricing.

• End-user demand in coatings, adhesives, composites, and construction sectors likely played a role in maintaining price equilibrium.

Competitive and Strategic Landscape

• Global players are focusing on high-performance formulations, green chemistry initiatives, and bio-based epoxies to reduce environmental impact.

• Indian manufacturers are increasingly integrating backward into raw materials and forward into specialised formulations to capture higher value.

• Strategic alliances and joint ventures between global resin producers and regional formulators are enhancing market penetration.

-b_Big.jpg)