Acetic Acid Market Overview

The global acetic acid market is projected to grow $24.56 per cent billion by 2030, registering a CAGR of approx. 6.25 per cent. This growth is driven by increasing demand across industries such as textiles, plastics and polymers, chemicals, pharmaceuticals, food processing, coatings, and water treatment. In the textile sector, acetic acid is used extensively for rayon production, fabric dyeing, and synthetic fibre manufacturing, while the plastics and polymer industry consumes it for purified terephthalic acid (PTA) and polyester products. The chemical sector relies on acetic acid for vinyl acetate monomer (VAM), acetic anhydride, and acetate esters, and it also serves as a key intermediate and preservative in pharmaceuticals and food processing.

India Acetic Acid Market

India’s demand for acetic acid has risen from 1,029 thousand metric tonnes in FY 2018 to approximately 1,304 thousand metric tonnes in FY 2025, reflecting a CAGR of 3.44 per cent. At this growth rate, demand is expected to add few more points reach approximately at a CAGR 6.5 per cent thousand metric tonnes by FY 2030. Growth is fuelled by the textile industry, where acetic acid is vital for rayon, dyeing, and synthetic fibre processing; the chemical sector, for production of VAM, acetic anhydride, and acetate esters; and the plastics and polymer industry, for PTA and polyester products. Additional demand comes from pharmaceuticals, food processing, water treatment, and coatings, where acetic acid functions as a key intermediate and solvent.

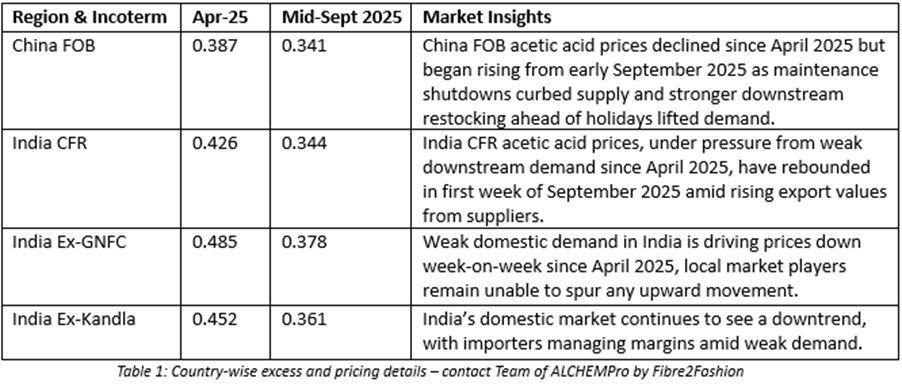

Acetic Acid Pricing Trends (US dollar per kg)

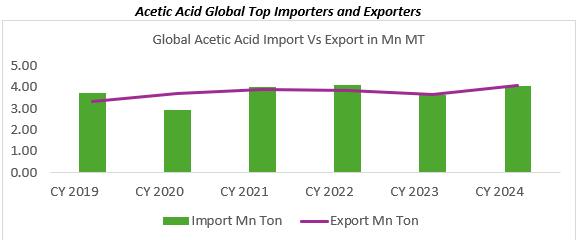

- Overall, trade shifted from a slight net importer in 2019 to a generally balanced trade position from 2020 onward, with imports and exports staying closely aligned around 3–4 Mn MT.

- The top five importers of acetic acid in Q1 2025 were India, Belgium, Japan, Turkey and Brazil. India remains the largest importer, highlighting its growing downstream chemical and textile industries.

- The top five exporters in Q1 2025 are China, US, Korea, Malaysia, and Taiwan other Asian Countries, with US and China leading the export market, supported by its large-scale production capacities and competitive pricing.

- Vinyl Acetate Monomer (VAM): Adhesives, paints, and coatings.

- Acetic Anhydride: Pharmaceuticals, cellulose acetate, specialty chemicals.

- Acetate Esters: Solvents for inks, coatings, and adhesives.

- Purified Terephthalic Acid (PTA): Polyester and PET feedstock.

- Ethanol: Industrial synthesis.

- Textiles: Rayon, fabric dyeing, and synthetic fibre demand.

- Chemicals: Expanding global chemical output supports feedstock demand.

- Wider Uses: Steady uptake in plastics, paints, pharmaceuticals, food & beverages, and water treatment.

- China: Market remains volatile amid inventory tightness; recovery depends on supply normalisation.

- India: CFR imports are becoming attractive as freight relief in Aug-25 first and competitive Chinese offers give importers stronger margins, despite domestic firmness and slight surge in freight in first half of September 2025.

- Global: Long-term growth anchored in textiles, polyester, pharmaceuticals, coatings, and water treatment applications.

-b_Big.jpg)