Overview of the Phosphorus Trichloride (PCl₃) market, focusing on price trends, export competitiveness, and the impact of US tariffs. It integrates data-driven insights into production costs, supply chain dynamics, and trade flows, offering a strategic perspective for market participants.

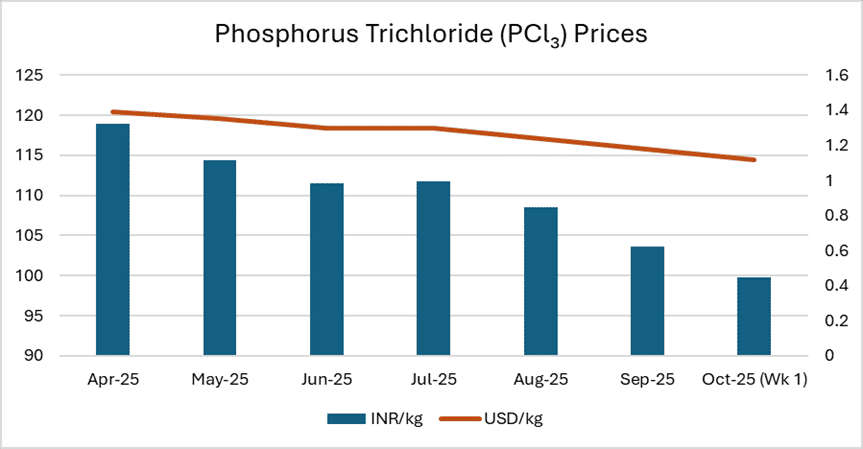

Domestic Price Trends (India – 2025)

Phosphorus Trichloride (PCl₃) prices in the Indian domestic market (Mumbai) recorded a consistent downward trend from April to October 2025, declining by approximately 16 per cent. Prices fell from ₹118.9/kg ($1.39/kg) in April to ₹99.75/kg ($1.12/kg) in the first week of October. The decline reflects easing feedstock costs, reduced international demand, and higher export availability.

Despite the implementation of US tariffs on Chinese-origin phosphorus chemicals under the Trump administration, global PCl₃ prices softened due to weak downstream demand (particularly in organophosphorus agrochemicals), declining yellow phosphorus costs in China, and increased exports from India and Germany that counteracted the tariff impact.

|

Impact Channel |

Description |

Effect Magnitude |

|

Feedstock Inflation |

Rising phosphorus and chlorine costs amid disrupted trade |

Moderate (+5–7 per cent) |

|

Freight & Logistics |

Increased cost due to realignment of shipping routes |

High (+10–12 per cent) |

|

Derivative Price Pass-through |

Downstream producers passed cost increases to glyphosate and stabiliser markets |

Moderate (+7–9 per cent) |

|

Regional Margin Shifts |

European and Indian producers gained temporary export margins |

Positive for exporters |

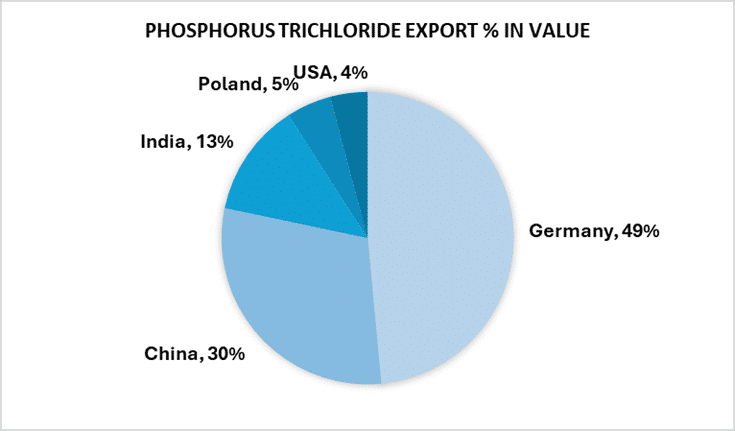

Export Price Comparison (US dollar/kg)

A comparative assessment of PCl₃ export prices indicates a significant reduction between 2022 and 2024 across all key exporting nations, signalling a global market correction and supply normalisation post-pandemic.

|

Exporter |

2022 ($/Kg) |

2024 ($/Kg) |

per cent Change |

|

Germany |

1.7 |

1.5 |

-11.8 per cent |

|

China |

2.6 |

1.3 |

-50.0 per cent |

|

India |

2.8 |

1.4 |

-50.0 per cent |

|

Poland |

2.8 |

1.6 |

-42.8 per cent |

India’s Export Outlook and Tariff Impact

India has emerged as a resilient exporter of Phosphorus Trichloride, capitalising on the US–China trade friction. Indian suppliers such as, Sandhya Group, Superform Chemistries Limited was formerly known as UPL Specialty Chemicals Limited and Excel Industries Ltd and others domestic suppliers, expanded shipments to the US market, benefiting from favourable tariff positioning and dependable feedstock availability.

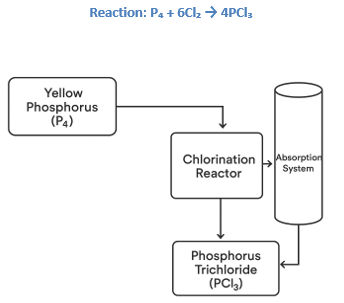

Upstream and Downstream Integration

Upstream: The production of PCl₃ depends primarily on elemental yellow phosphorus (P₄) and chlorine gas (Cl₂), both energy-intensive inputs.

Downstream: The compound is a vital precursor for phosphorus oxychloride (POCl₃), phosphorous acid, and organophosphorus pesticides such as glyphosate and chlorpyrifos. These applications tie PCl₃ demand closely to the agrochemical and industrial chemicals sectors.

|

Region |

Demand Characteristics |

End-Use Focus |

|

Asia-Pacific (China, India, Korea) |

Dominant producer and consumer base; vertically integrated operations |

Agrochemicals, stabilisers, flame retardants |

|

Europe (Germany, Poland, UK) |

Mature chemical base; stringent regulatory framework |

Stabilisers, organophosphorus intermediates |

|

North America (US) |

High specialty-grade imports |

Pharma intermediates, stabilisers |

|

Rest of World |

Emerging industrial use |

Agrochemical formulations |

Strategic Summary

The global Phosphorus Trichloride market remains sensitive to energy costs, phosphorus supply, and agrochemical sector dynamics. While tariffs reshaped trade patterns, they failed to elevate prices due to global supply realignment and overcapacity. India continues to consolidate its position as a cost-efficient supplier to the United States and Europe, leveraging strong feedstock integration and diversified downstream linkages.

-b_Big.jpg)