The US Department of the Treasury OFAC sanctions on facilitating Iranian petroleum and petrochemical trade have drawn attention in 2025, but their impact on the global methanol market remains limited. Many Asian countries and regional markets are not fully dependent on Iranian material, and alternative supplies from other Middle Eastern and other region producers help cushion the effect, preventing significant global price disruption.

United States Methanol Price Surge: August 2025 to October 2025

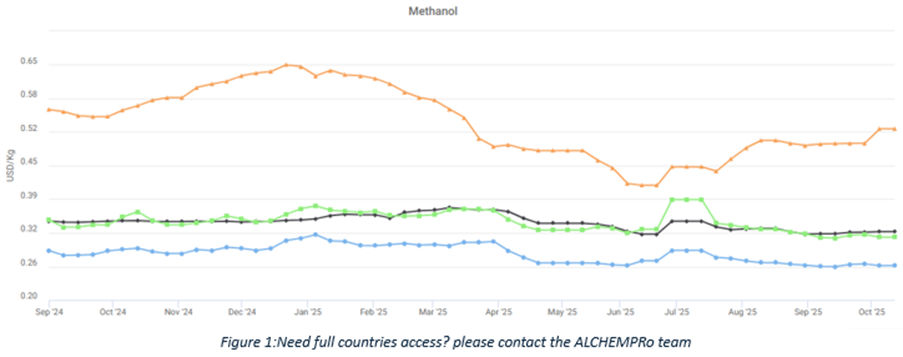

Methanol prices in the United States witnessed a notable upward surge, primarily driven by a combination of supply disruptions, import restrictions, and regional market tightness. During August 2025, limited availability of methanol was observed due to higher cost, import bans and trade sanctions, restricting global supply flow into the North American market. Simultaneously, domestic producers faced constrained production margins and limited flexibility due to high input and production costs, intensifying the regional tightness.

US Price Correction after surge in last quarter of 2024: January 2025 – May 2025 on weak demand

Following the year-end peak, methanol prices in the US began a steady downward correction in early 2025. From approximately $0.636 per kg in January 2025, prices declined consistently to around $0.42 per kg by the last week of May 2025. The price decreased week on week by approximately 34 per cent from January to May 2025 whereas increase approximately 24 per cent after dip to till October 25.

This decline was primarily attributed to:

- Weak demand from downstream derivative markets, particularly formaldehyde, acetic acid, dimethyl ether (DME), and vinyl acetate monomer (VAM), MTO, MTBE and other derivatives, which faced slower offtake amid inventory adjustments.

- Stabilisation in energy and feedstock prices, which eased production costs and reduced cost-push pressure on methanol producers.

- Subdued industrial activity in sectors such as construction, packaging, and automotive etc.

Asian Market

From July through October 2025, Asian methanol markets exhibited stable pricing, supported by alternative supply sources within the region. The US sanctions led to strategic sourcing changes but did not cause significant price fluctuations. In the Asian market, methanol prices have remained largely stable, with only slight downward adjustments. Steady demand from downstream industries has absorbed changes in supply, keeping prices in a relatively narrow range despite the sanctions.

Short-Term Market Outlook

- US methanol prices are likely to remain elevated but volatile due to sanctions, supply constraints, and recovering downstream demand.

- Asian markets are expected to stay stable, supported by regional supply alternatives and steady industrial consumption.

- Global supply-demand balance should remain stable, with energy costs and geopolitical developments as key risk factors.

Major Producing Countries: Trinidad and Tobago, Saudi Arabia, Iran, US Gulf Coast, United Arab Emirates, Venezuela, Oman, Malaysia, Chile and Russian Federation.

-b_Big.jpg)