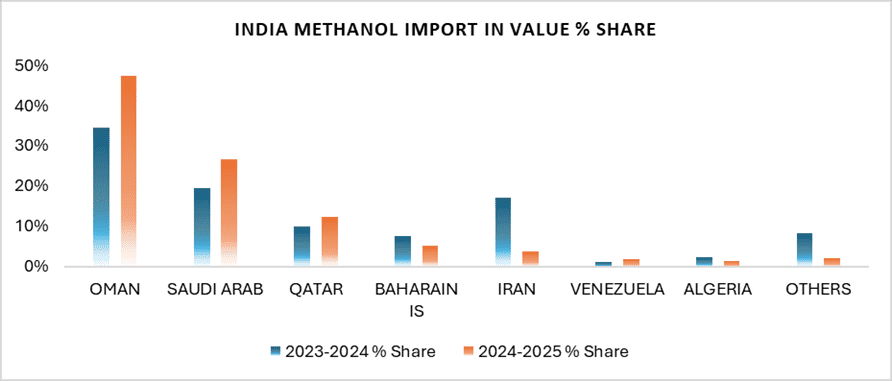

The US sanctions on Iran, a key low-cost methanol producer, have significantly restricted direct imports to India, disrupting traditional domestic trade flows. Consequently, India has shifted to sourcing from Oman, Saudi Arabia, Qatar and other suppling countries. However, since most supplying countries are from the Middle East, buyers are awaiting a clear and stable framework for trade.

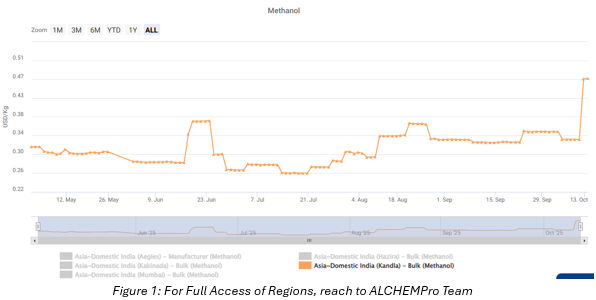

The recent US sanctions on Iranian petroleum and petrochemical trade have significantly disrupted regional methanol supply chains, propelling Indian methanol prices to approximately ₹40 per kg up from the previous day’s level of ₹28-29 per kg, marking a sharp surge of nearly 38 per cent.

These developments underline the urgency of strengthening domestic methanol production capacity or shift to green methanol to ensure energy security, reduce import vulnerability, and support the growth of downstream chemical industries.

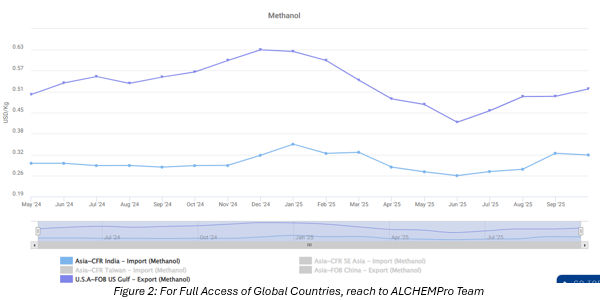

India’s Multiple Major Trading Regions Prices

Impact of Sanction on Indian Market

India’s domestic methanol and derivative markets have consequently entered a cautious holding pattern. Due to sanction on Iranian material, Importers and downstream processors are exhibiting restraint in contracting new cargoes until greater clarity emerges regarding both international compliance risks and future price trajectories. The hesitation is amplified by the potential ripple effect on derivative industries including formaldehyde, acetic acid, dimethyl ether (DME), and olefins where elevated feedstock costs could compress margins and weaken competitiveness in both domestic and export-oriented applications.

To mitigate exposure to geopolitical volatility, India has already undertaken gradual diversification of its methanol sourcing base. Official trade data indicate that imports from Iran, which accounted for nearly 17 per cent of total methanol imports in FY24, have declined sharply to around 4 per cent in FY25 (value terms, US dollars million). This contraction reflects a deliberate pivot toward alternative suppliers in Oman, Saudi Arabia, Qatar and other suppling countries, whose stable political and logistical frameworks offer a measure of supply security.

India’s Import-Driven Methanol Market

India’s methanol consumption reached 3.12 million metric tons (MMT) in FY 2024–25, while domestic production was only 0.18 MMT. This wide gap highlights India’s dependence on imports to meet industrial and energy sector requirements. Due to the limited availability of natural gas, the primary feedstock for methanol synthesis, domestic production remains constrained, and this deficit cannot be bridged through alternative production routes at present. The situation underscores the strategic need to expand methanol and green methanol capacity to enhance energy security and reduce import dependency. Strengthening local manufacturing would also ensure a sustainable feedstock base for downstream chemical industries.

-b_Big.jpg)