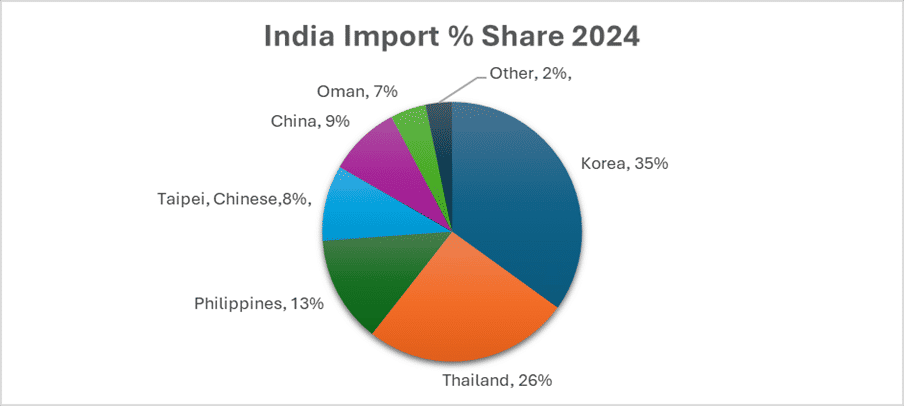

The Indian Toluene market is currently navigating a phase of constrained supply and firm pricing, influenced by escalating geopolitical tensions and trade-related disruptions. Sanctions on Iranian petrochemical exports and continuing regional conflicts have restricted trade routes, creating volatility in the global aromatic hydrocarbons supply chain. These disruptions have directly impacted India’s import flows, resulting in tightened domestic availability and higher procurement costs for downstream manufacturers.

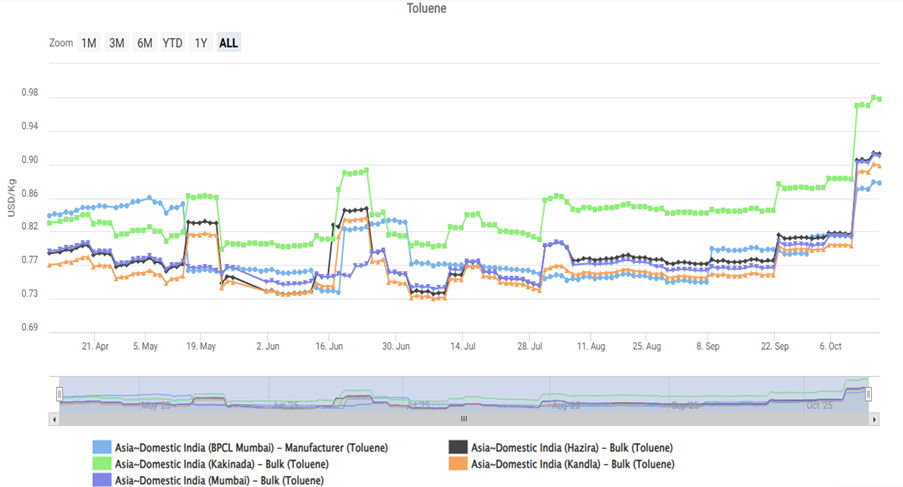

At present, Toluene prices in the Indian market range between ₹77 and ₹89 per kilogram, marking an increase of over 10 per cent from the recent low. Western India, India’s major petrochemical trading and consumption hub has witnessed relatively steady pricing, whereas some inland regions are observing slightly elevated rates due to limited supply inflow and limited logistical constraints. Over recent sessions, the market has shown stable-to-firm movement, reflecting a delicate balance between incoming supply and demand from end-use sectors such as paints, coatings, adhesives, and pharmaceuticals.

Source: ALCHEMPro

The dual pressure of restricted imports and sustained geopolitical uncertainty continues to weigh on market sentiment. Downstream industries are maintaining cautious procurement strategies purchasing steadily to meet operational needs but avoiding excessive stock buildup amid price volatility. Even with moderate demand conditions, the constrained supply situation has kept the market from easing, reinforcing a firm undertone across trading regions.’

Market Outlook: Prices Poised for an Upward Move

Looking ahead, the Indian Toluene market is expected to maintain a firm-to-bullish trajectory in the near term, with a strong likelihood of price escalation. Persistent geopolitical instability, coupled with uncertainty surrounding global crude oil and petrochemical feedstock flows, is anticipated to exert upward pressure on costs. If import arrivals remain sluggish over the coming weeks, the market could witness another round of price increases as traders and end-users compete for limited cargoes.

In the medium term, the market trend will hinge on improvements in international logistics and trade flows from major exporting regions such as the Middle East and Southeast Asia. Should supply channels stabilise, prices may see marginal correction; however, any further escalation in geopolitical risks or new trade restrictions could push prices higher once again.

Overall, the outlook for the Indian Toluene market remains cautiously optimistic but tilted toward firmness, with prices expected to remain within or above the current range in the short run. Downstream consumers are likely to adopt a measured, wait-and-watch approach, balancing cost control with the need to secure supply amid ongoing uncertainties.

Key Highlights – Indian Toluene Market

- Toluene prices at ₹77–89/kg range, up over 10 per cent from recent lows amid tight supply.

- Geopolitical tensions and import disruptions continue to restrict availability.

- Domestic supply remains limited, keeping market sentiment firm.

- Downstream demand steady from paints, coatings, resins, and pharmaceuticals.

- Prices are expected to surge further in the near term if import inflows remain weak and geopolitical pressures persist.