Market Overview

Phenol is an aromatic organic compound containing a hydroxyl group attached to a benzene ring, known for its mild acidity and high chemical reactivity. It is a key industrial raw material used in the manufacture of polymers, resins, and specialty chemicals. Major derivatives such as Caprolactam, Alkylphenols, and Phenolic Resins find extensive use in the plastics, textiles, coatings, and adhesive industries.

India’s phenol demand reached over 600 KTPA in FY 2025, marking a near twofold increase compared to FY 2019, driven by expanding consumption in downstream sectors such as resins, laminates, and engineering plastics. Phenol plays a vital role across plastics, automotive, construction, electronics, and healthcare sectors, underpinning many essential materials in modern industry.

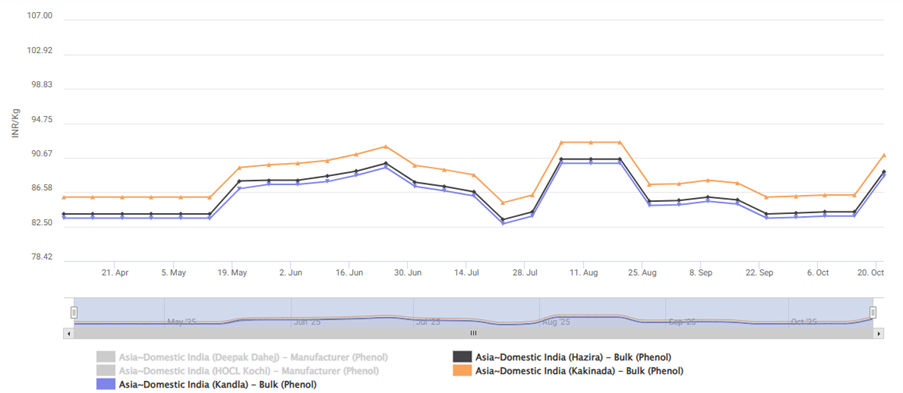

Domestic Price Trend

Phenol prices in the Indian domestic market have witnessed an upward trajectory in recent months, rising by approximately 7 per cent and currently hovering around INR 89 per kg. The price escalation is primarily attributed to increased import costs, tight international supply, and steady domestic demand from downstream derivative industries.

Supply Landscape

India’s total phenol imports registered a growth 9.20 per cent increase in FY 2025 from FY 2024, reflecting steady growth in demand and the country’s continued reliance on overseas supply to meet consumption needs. India meets its phenol demand through a combination of domestic production and imports. The domestic supply is largely catered by Deepak Phenolics Limited (a subsidiary of Deepak Nitrite Ltd), which operates one of the largest integrated phenol and acetone complexes in the country having 57 per cent market share of phenol, and Hindustan Organic Chemicals Limited (HOCL). However, despite these capacities, India remains an importer of phenol to meet growing consumption across resin, laminates, and adhesive industries.

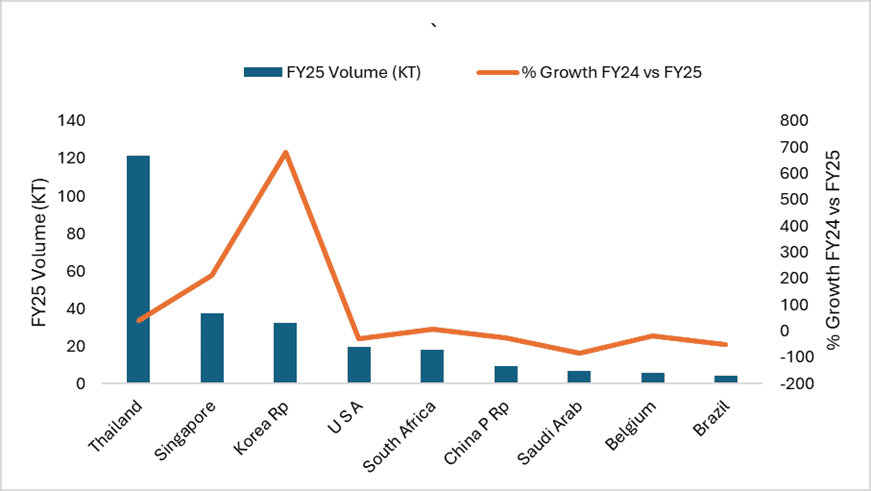

Import Analysis – Surge and Decline from FY 2024 – FY 2025

Surge in Imports

Massive growth in imports from Korea (+680 per cent) and Singapore suggests a significant shift in sourcing preferences.

- South Korea and Singapore emerged as key alternate suppliers amid tightening availability from traditional sources such as the US and Saudi Arabia.

- Competitive pricing and improved logistics from Southeast Asia allowed Indian buyers to diversify supply chains.

Thailand’s 121 KT of Phenol exports to India highlight its growing significance as a stable and reliable supplier in the regional market. This reflects Thailand’s robust production capacity and consistent export reliability in meeting India’s phenol demand.

Decline in Imports

Imports of phenol into India witnessed a notable decline from key traditional suppliers. Shipments from Saudi Arabia (−85 per cent) and other countries fell sharply due to geopolitical factors, trade restrictions, and better cost availability.

Imports from the US (−30 per cent) and China (−27 per cent) declined amid strong domestic demand due to tight export allocations, and a strategic shift by Indian buyers to diversify supply sources and reduce dependency on these markets.

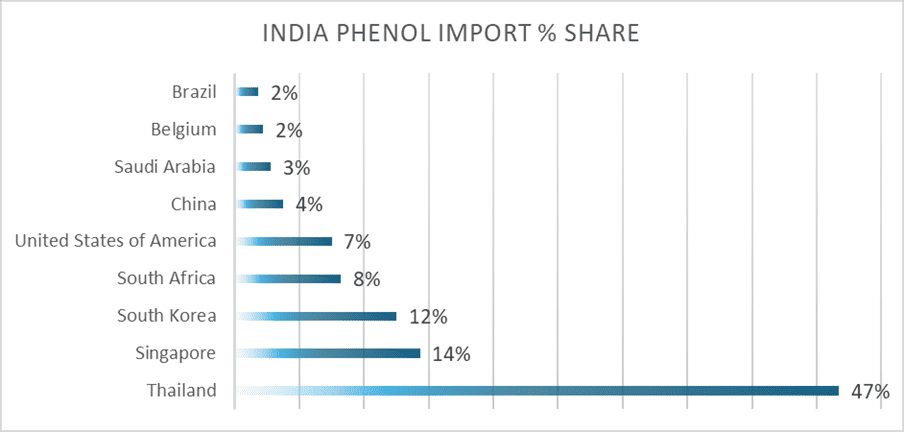

India’s phenol import distribution by country for FY 2024–2025, highlighting a strong concentration of supply from Thailand (47 per cent), followed by Singapore (14 per cent) and South Korea (12 per cent). Together, these three nations account for over 70 per cent of total imports, reflecting India’s growing dependence on Southeast Asian producers for steady and competitively priced phenol supplies.

In contrast, imports from Saudi Arabia, China, and the United States have moderated, indicating a strategic diversification of sourcing and reduced reliance on traditional Western and Middle Eastern suppliers. The evolving import pattern underscores India’s shift toward regional trade alignment to enhance supply security and cost

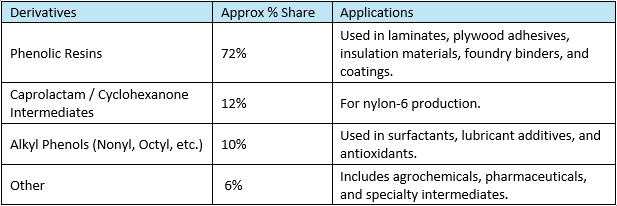

Phenol Derivative Per Cent Share in Phenol

Key Factors Influencing Phenol Prices

- Feedstock Costs

- Downstream Demand

- Plant Operations

- Global Trade Flow & Regional Balance

- Crude Oil & Energy Costs

- Currency Fluctuations

- Environmental Regulations

- Seasonal Demand

- Market Sentiment

-b_Big.jpg)