Titanium Dioxide (TiO₂) is a high-performance white inorganic pigment known for its exceptional opacity, brightness, and ultraviolet resistance. It serves as a key functional ingredient across multiple end-use industries, including paints and coatings, plastics, paper, inks, cosmetics, and food additives, where it enhances whiteness, durability, and light stability. In the Chinese market, TiO₂ prices are influenced by fluctuations in feedstock costs, production efficiency, and demand cycles across downstream manufacturing sectors.

Titanium Dioxide Price Performance Overview

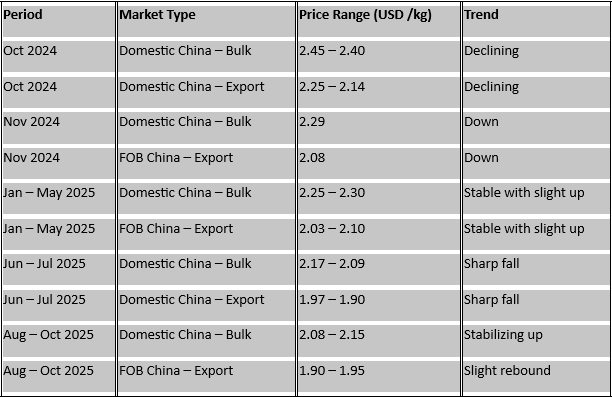

Titanium Dioxide prices in China have a steady downward with marginal up trend between October 2024 and October 2025, both in domestic and export markets.

China Domestic Market

- Prices started around $2.41 /kg in October 2024, reflecting relatively firm demand and higher production costs.

- Through the last quarter of 2024, a gradual softening occurred, reaching approximately $2.29 /kg by late November 2024.

- During the first half of 2025, prices remained broadly stable around $2.25–2.33 /kg, supported by moderate consumption in coatings and plastics sectors.

- A noticeable dip occurred by June 2025, when domestic bulk prices fell below $2.10 /kg, driven by weaker downstream demand and excess inventories.

- By October 2025, the market stabilised slightly around $2.14/kg, suggesting a price floor amid cost pressures and limited supply adjustments.

China Export Market

- Export prices were lower than domestic levels throughout the year, reflecting competitive pressures and global demand moderation.

- In November 2024, export prices averaged around $2.11 /kg, versus the domestic level of $2.32 /kg, maintaining a differential of roughly $0.21 /kg.

- From January to May 2025, export quotations hovered between $2.04–2.12 /kg, as overseas buyers maintained cautious procurement.

- A small rebound was visible in early Oct 2025, but prices eventually settled close to $1.94 /kg, marking the lowest level within the observed 12-month period.

Market Interpretation

- Persistent softness: The year-long downward trajectory reflects sluggish downstream activity in paints, coatings, and plastics, coupled with high inventories among Chinese producers.

- Domestic export gap: The spread of around $0.15–0.25 /kg between local and FOB prices highlights stronger cost support domestically, while export competition kept international quotes under pressure.

- Price stabilisation: By Q4 2025, both segments showed signs of stabilisation, suggesting the market may have found a short-term equilibrium after months of decline.

Titanium Dioxide Prices Trend (Oct 2024 – Oct 2025)

Recent Update – LB Group Expands Global TiO₂ Footprint with Venator Acquisition

LB Group Co., Ltd has entered into an agreement to acquire Venator Materials’ titanium dioxide manufacturing facility located in Greatham, United Kingdom, along with related TiO₂ assets. This strategic acquisition aligns with LB Group’s long-term objective to expand its global production network and strengthen its presence in the European pigment market. By integrating the Greatham operations, LB Group aims to enhance its high-performance TiO₂ product portfolio, leverage advanced manufacturing expertise, and reinforce supply stability for its international customer base.

Short-Term China Titanium Dioxide (TiO₂) Market Outlook

- Price Movement: Prices are expected to remain range-bound in the short term, with limited volatility amid stagnant market activity.

- Demand Conditions: Downstream sectors such as coatings, plastics, and paper are showing moderate consumption, with no significant rebound in procurement.

- Market Sentiment: Participants remain cautious, adopting a conservative procurement strategy and deferring bulk purchases due to weak order inflows.

- Profitability Pressure: High input costs coupled with sluggish end-use demand are compressing producer margins, discouraging aggressive price revisions.

- Supply Demand Balance: The market is currently in a technical equilibrium phase, with stable costs counterbalanced by weak offtake.

-b_Big.jpg)