Market Overview

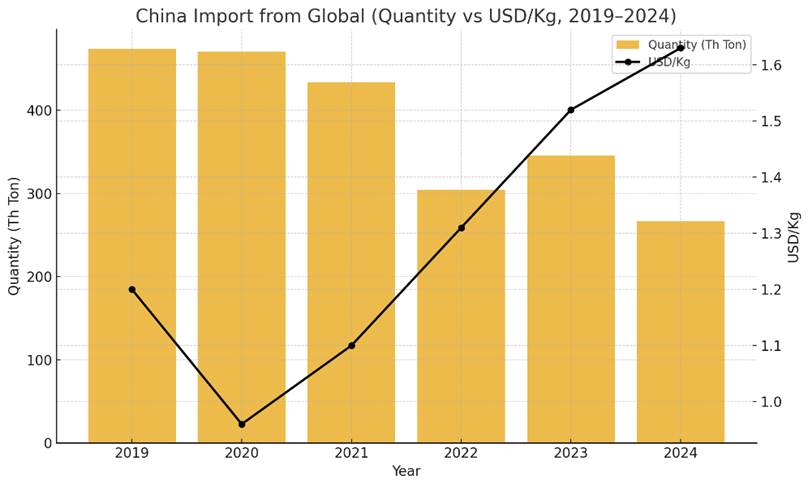

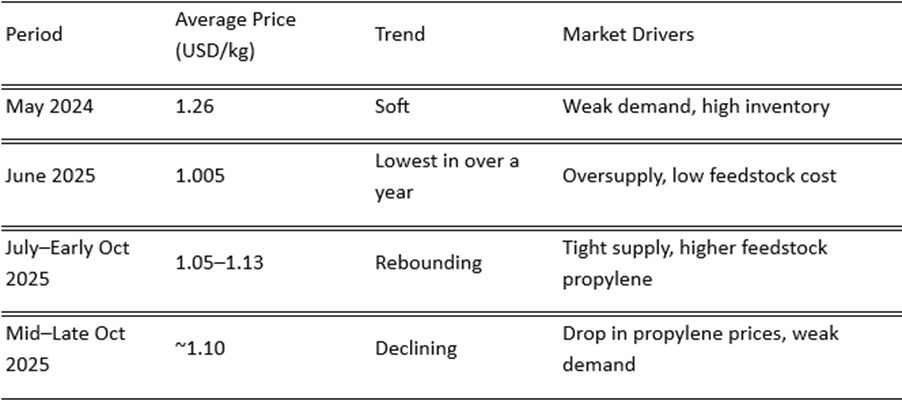

The Chinese Propylene Oxide (PO) market moved through a period of volatility in October 2025, following a brief rebound earlier in the third quarter. After more than a year of gradual decline, Propylene Oxide prices recovered from $1.005 per kg in June 2025 to roughly $1.13 per kg by early October 2025, reflecting a 12.4 per cent gain since June. This rise came after a prolonged ~23 per cent fall between May 2024 and June 2025.

However, the recovery proved short-lived. As October progressed, prices started to weaken again due to limited downstream demand, falling raw-material costs, and a slightly loose supply environment.

During the early part of the quarter, support came from maintenance turnarounds, reduced production rates, and firm propylene feedstock prices. Later, as crude oil softened and propylene supply normalised, both cost support and buyer sentiment waned, exerting renewed downward pressure on Propylene Oxide values.

Feedstock and Cost Dynamics

Propylene, the main feedstock for Propylene Oxide, experienced several price swings through the second half of the year. After firming between July and September driven by higher crude prices and maintenance activities at propane dehydrogenation (PDH) facilities propylene costs eased in October as operations resumed and feedstock supply improved.

This reduction in propylene prices weakened cost support for PO, narrowing producer margins. In response, several manufacturers opted to scale down operating rates or temporarily suspend production to prevent oversupply and stabilise the market. Despite these adjustments, overall supply conditions remained balanced to slightly surplus, and market momentum softened.

Feedstock availability is currently sufficient, and most producers are expected to maintain steady production levels into the near term.

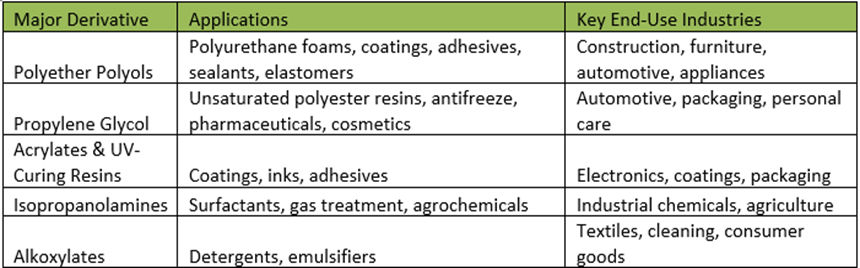

Downstream Derivative Overview

Propylene Oxide serves as a vital feedstock for several major derivatives in China’s chemical value chain:

Demand Conditions – October 2025

- Polyether Polyols: Demand remained sluggish, with buyers purchasing only as needed after the national holiday period.

- Propylene Glycol: Operating rates improved slightly, supported by modest recovery in domestic consumption.

- Acrylates and UV Resins: Stable to weak trends persisted, and export interest stayed limited.

Overall, tepid downstream activity and cautious inventory management restricted any meaningful price recovery.

Propylene Oxide Market Outlook (Q4 2025)

For the remainder of 2025, the Chinese Propylene Oxide market is projected to stay stable to slightly weaker. While production control and selective output cuts may offer temporary support, muted consumption especially from polyether polyol and coatings sectors will likely keep price growth in check.

Feedstock propylene trends will be the key determining factor. If propylene prices stabilise, PO could hold steady, but further weakness in feedstock markets may pull PO values lower.

Outlook Highlights:

- Supply: Stable, with occasional production moderation.

- Feedstock: Propylene prices declining; reduced cost support.

- Demand: Flat to weak, dominated by subdued polyols and resins consumption.

- Prices: Expected to fluctuate within a narrow range, with a slight downward tendency.

- Sentiment: Cautious; market participants are monitoring both feedstock and demand conditions closely.

- PO prices rose from $1.005/kg (June 2025) to $1.13/kg (early October 2025) before softening again later in the month.

- A ~23 per cent fall between May 2024 and June 2025 was followed by a 12 per cent rebound in the third quarter of 2025.

- Lower propylene feedstock prices undermined earlier cost support.

- Downstream demand remained sluggish across major derivative sectors.

- Supply conditions are currently balanced to slightly ample.

- The near-term outlook points to a stable-to-soft market with limited upside potential.

-b_Big.jpg)