In recent months, the landscape of US chemical imports has undergone a notable shift, reflecting changing global trade dynamics and supply chain realignments. While total US imports of chemicals from China have seen a steep decline through the first half of 2025, shipments from India have remained resilient — even showing mild growth. The data suggests a gradual but visible transition, as the United States increasingly diversifies its sourcing of chemical products away from China toward alternative partners like India. This emerging pattern underscores both the resilience of India’s chemical sector and the broader rebalancing of global trade dependencies in a post-pandemic, geopolitically sensitive environment.

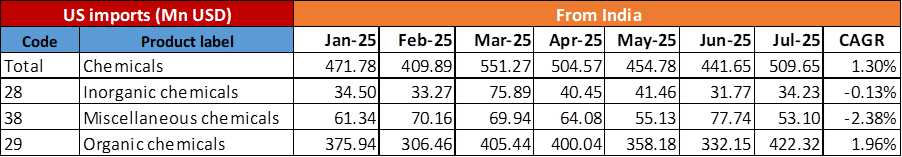

Total US imports of chemicals from India show a modest upward trend, growing from $471.78 Mn in Jan-25 to $509.65 Mn in Jul-25, with a CAGR of 1.30 per cent.

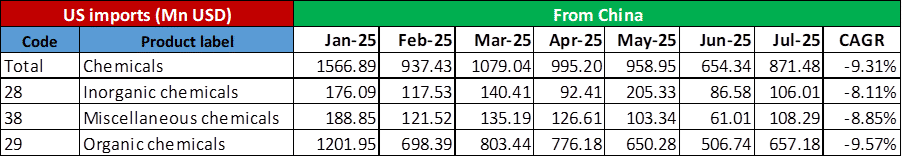

Total US imports of chemicals from China show a steep decline from $1566.89 Mn in Jan-25 to $871.48 Mn in Jul-25, with a CAGR of -9.31 per cent.

|

Country |

Jan-25 (Mn USD) |

Jul-25 (Mn USD) |

CAGR |

Trend |

|

India |

471.78 |

509.65 |

+1.30% |

Mild growth |

|

China |

1566.89 |

871.48 |

−9.31% |

Sharp decline |

Imports from India are rising slightly, while imports from China are falling steeply.

|

Product Category |

From India (CAGR) |

From China (CAGR) |

Key Takeaway |

|

Inorganic chemicals (Code 28) |

−0.13% |

−8.11% |

Stable from India, sharp drop from China |

|

Miscellaneous chemicals (Code 38) |

−2.38% |

−8.85% |

Both declining, China’s drop is much steeper |

|

Organic chemicals (Code 29) |

+1.96% |

−9.57% |

Growth from India contrasts with China’s decline |

- China remains a larger supplier (over 3× India’s value) but its exports have fallen sharply across all chemical categories.

- India’s exports are stable and slightly growing, particularly in organic chemicals, which dominate its chemical trade with the US.

- This could indicate a shift in sourcing preference—US chemical imports are diversifying toward India amid reduced dependence on China.

India: Impact & Outlook for the Chemical Industry

Current & Short-term Impact

- The India Ratings & Research (Ind-Ra) estimates that a US tariff rise (to ~50 per cent for many Indian exports to the US) could drive a single-digit decline in revenue for the Indian chemical sector in FY26.

- On Margins: According to CRISIL Ratings, operating margins for Indian specialty-chem firms that were forecast to be ~15.5-16 per cent could fall by ~150 basis points to ~14-15 per cent because of tariff pressures + price erosion.

- Export Exposure: The US accounts for around 15–18 per cent of India’s chemical exports (~US$5.7 billion in FY24 for chemicals) to the US.

- Already, costs are increasing (for producers exporting to the US), competitiveness is under threat, and stocks of some chemical companies fell (see e.g., Navin Fluorine International Ltd, SRF Limited) in reaction to tariff announcements.

- Additional Challenge: With the US raising tariffs on Chinese chemical exports, there is the risk of Chinese producers redirecting exports to India’s and other global markets — which could lead to sharper competition, price erosion in India’s domestic market and export markets.

Outlook/Medium Term

Domestically, demand in India remains healthy; growth is expected, especially for the domestic-oriented chemical companies (those not heavily reliant on US exports). Ind-Ra notes that for firms with limited US exposure and domestic focus, the hit will be minimal.

For the export-oriented segment:

- Revenue growth (for specialty chemicals) is expected to be modest — say 7–8 per cent growth next fiscal but driven largely by volumes not by price/rate improvements. CRISIL projects 8-9 per cent domestic revenue growth, but exports for these firms only 4-5 per cent because of structural pressures.

- Margin Pressures: the return on capital employed (ROCE) for many is forecast at ~13 per cent, down from ~16-18 per cent pre-pandemic. Increased competition (including from China) and tariffs make margin recovery uncertain.

Bigger Structural Shifts: The tariff environment means Indian chemical firms may need to:

- Diversify export markets beyond the US.

- Move up the value chain toward more specialty/niche chemicals (less commoditised).

- Monitor feedstock costs, logistics, currency fluctuations (rupee depreciation can help somewhat).

Macro Growth Potential: Because India has one of the fastest-growing domestic chemical markets (driven by infrastructure, petrochemicals, domestic consumption), the domestic opportunity remains robust. But the export shock from tariffs means the upside will be uneven.

Key Risk: If Chinese chemical producers dump products into India/other markets (because of blocked US access) the resulting price war could hit Indian margins more than just the US tariff exposure itself.

In Summary, Indian chemical industry is facing headwinds from US tariffs — especially the export-oriented firms. But the domestic side offers resilience. Margins are under pressure, exports will grow slower, and some firms may see revenue declines. But over time, growth is still possible if the firms adapt.

China: Impact & Outlook for the Chemical Industry

Current & Short-term Impact

- The global chemical industry outlook (for both China and others) is slowing partly due to trade/tariff pressures. For example, Chinese experts expect China’s chemical production growth to slow to ~5.5 per cent in 2025 and only ~1.3 per cent in 2026, due to a combination of housing/construction slump + tariff impacts.

- For China Specifically: Raw material feedstock cost pressure (e.g., ethane/propane from US) has increased because of tariffs. For example, China imposed high tariffs on US ethane, the US imposed high tariffs on Chinese goods, leading to cost/margin pressures for Chinese chemical firms.

- Over-Capacity: China has major capacity expansions in petrochemical/chemical segments (e.g., purified terephthalic acid (PTA), PET chips) which are now under pressure due to slowing demand, pricing pressure and export hurdles.

- Export Diversion: With US tariffs restricting access for Chinese chemical exports, Chinese firms are redirecting exports to non-US markets (Asia, Africa, Europe), often at lower prices, which increases competition globally and further erodes margins.

Outlook/Medium Term

- Growth prospects are weak in the near term for China’s chemical production unless demand recovers and structural imbalances are addressed.

- Longer Term: China will likely see structural adjustment – closing older, inefficient plants; moving toward higher-value specialty chemicals; focusing more on domestic demand; sourcing feedstocks differently. For example, firms shifting from US ethane to Middle East/Russia feedstocks.

- Competitive Pressure: With oversupply and lower global prices (due partly to China dumping excess product), margins will be under pressure not only domestically but also for Chinese firms exporting abroad. The firms that survive will be those with best cost structures and specialization.

- For Global Markets: The redirection of Chinese chemicals into other markets may threaten producers in other countries (including India) — price competition will intensify.

- Risk & Opportunity: While tariffs hurt Chinese exporters to the US, they also push China to upgrade, integrate vertically, reduce dependence on US feedstocks/supply chains, which may yield medium-term benefits. But in the immediate term the pain is significant.

In Summary, the Chinese chemical industry is under significant pressure: export market contraction (especially to the US), margin erosion due to cost increases and oversupply, slowing domestic demand (especially construction/infrastructure). The best outlook is for selective segments (higher value, specialities) but many commodity segments face low growth or even decline.

-b_Big.jpg)