The petrochemical industry continues to underpin modern manufacturing systems, supplying essential inputs for plastics, fibres, coatings, and solvents. Entering 2026, the sectors is undergoing structural adjustment amid persistent capacity surpluses, fluctuating crude oil prices, and changing global trade patterns. Although short-term conditions remain challenging, the long-term outlook is supported by expanding downstream industries in emerging markets, stronger polymer demand, and increasing integration between refining and petrochemical operations.

Over 80 per cent of India’s key feedstocks are directed into specific downstream uses polypropylene and polyethylene into polymers, benzene into alkylbenzene and cumene, and butadiene into synthetic rubbers highlighting a highly integrated petrochemical chain.

Market Classification of Petrochemical Products

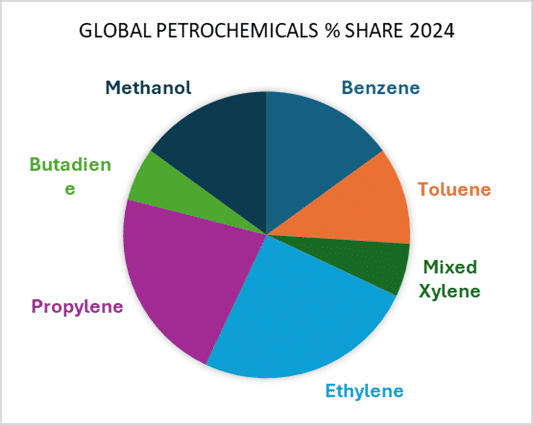

The basic petrochemical market can be grouped into four main categories: Olefins, Aromatics, Methanol, and Feedstocks.

Global Olefins Market Overview – Ethylene, Propylene, Butadiene (2020–Mid November 2025)

|

Chemical |

Export Volume 2020–2024 (%) |

% change (2024–2028) |

Price Change (%) |

Global Price Range (Mid-Nov 2025, USD/ton) |

|

Ethylene |

1.9% |

2.1% |

28.4% |

610 – 740 |

|

Propylene |

-17.4% |

4.3% |

23.6% |

690 – 810 |

|

Butadiene |

-6.3% |

3.5% |

25.8% |

585 – 805 |

Petrochemicals Market Dynamics and Current Scenario

Demand Trends and Forecast Drivers

- Demand growth in petrochemicals remains concentrated in packaging, infrastructure, and mobility applications, with the Asia–Pacific region contributing the majority of incremental expansion.

- India, Vietnam, and Indonesia are emerging as new demand centres, compensating for the slower pace of expansion in advanced economies.

- The growing role of bio-based and recycled feedstocks is challenging traditional polymers while supporting diversification in raw material sourcing.

- Global petrochemical consumption is projected to increase by approximately 5 per cent annually through 2030, driven by polymerisation capacity growth and downstream investment.

Global Petrochemical Import Landscape (2024)

The 2024 petrochemical trade landscape reveals Asia’s dominance in demand and the Middle East’s advantage in cost-efficient supply. China leads benzene and cumene imports, underscoring its deep integration into styrene, phenol, and bisphenol-A chains. India and South Korea drive toluene demand for solvent and polyurethane production, while Belgium serves as Europe’s redistribution hub for mixed xylenes.

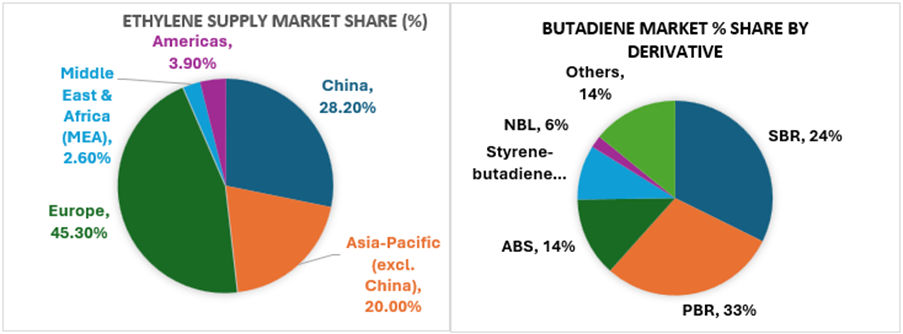

In olefins, China and Belgium each account for 28 per cent of ethylene imports, reflecting regional polymer capacity expansion amid tight supply. China’s 31 per cent propylene import share highlights its heavy reliance on external sources for polypropylene and acrylonitrile output. Butadiene imports remain concentrated in South Korea and Europe due to strong synthetic rubber demand.

Methanol trade continues to be led by gas-rich exporters such as Trinidad & Tobago and Saudi Arabia, maintaining global cost competitiveness. Overall, trade flows emphasise Asia’s manufacturing pull, Europe’s logistical centrality, and the Middle East’s feedstock advantage defining the current structure of global petrochemical interdependence.

Competitive and Regulatory Landscape

- Large-scale integrated complexes in China, Saudi Arabia, and India are redefining global cost competitiveness.

- Environmental frameworks such as the EU Green Deal and China’s carbon-neutral initiatives are prompting producers to adopt low-emission technologies and circular production models.

- Consolidation is expected to continue as smaller, standalone operators face pressure from compliance costs and tightening margins.

Trade, Pricing, and Profitability

- Regional trade networks are realigning around feedstock advantages and intra-regional integration.

- Prices of ethylene, propylene, and methanol remain closely linked to crude oil and natural gas markets, showing continued volatility in 2024

- Profitability in derivatives such as polypropylene and polystyrene remains constrained due to oversupply in Asian markets.

- Costs related to logistics and protective tariffs continue to affect price parity across regions, although gradual stabilisation is expected by mid-2026.

Petrochemical Market Outlook (2025–2030)

The medium-term outlook for the basic petrochemical industry is cautiously optimistic, characterised by:

- Capacity Rationalisation: A global shift toward optimising existing assets and improving utilisation rates.

- Feedstock Diversification: Expanding the use of LPG, ethane, and recycled or circular carbon sources.

- Investment Priorities: Increasing focus on higher-value intermediates such as styrene, polyols, and acrylates to strengthen margins.

- Decarbonisation Efforts: Greater emphasis on carbon capture, electrified cracking, and renewable feedstock integration to align with sustainability goals.

-b2_Big.jpg)