A Structural Shortfall: Supply vs. Consumption

India’s PVC resin output has remained largely stagnant in recent years. Meanwhile, domestic consumption has surged to around 4.3 million metric tonnes (MMT) annually, supported by robust growth across key downstream sectors such as construction, agriculture, water management, infrastructure, and allied industries.

This has resulted in a demand supply gap of nearly 2.8 MMT, positioning India as the world’s largest importer of PVC suspension resin, accounting for around 20 per cent of global imports. In the last fiscal year, imports supplied nearly 65 per cent of India’s total PVC suspension resin consumption.

Import Dependence has Become Embedded in the Market

The combination of stagnant domestic capacity and expanding end-use demand has made imported material an essential part of India’s PVC ecosystem. Despite heavy reliance on overseas supply, the market has remained stable, supported by a diversified base of global suppliers.

In FY24, most of India’s PVC imports originated from a concentrated group of producers:

- China: around 40 per cent of total inflows

- Japan and Taiwan: each contributing more than 14 per cent

- South Korea and the United States completing the majority share

India continues to absorb large volumes of surplus global PVC because its downstream industries exhibit broad, structural, and consistent demand growth.

Domestic Capacity Expansion Momentum

India’s domestic PVC capacity development pipeline (such as Adani) has expanded considerably, with multiple large-scale investment proposals aimed at reducing the country’s entrenched reliance on imported resin. Expansion would significantly narrow the structural supply–demand deficit, reduce vulnerability to global market fluctuations, and strengthen long-term supply security across the domestic vinyl value chain.

Will New Capacities Fully Bridge the Gap?

Despite the scale of upcoming expansions, India’s PVC supply demand imbalance may persist well beyond the medium term. PVC consumption is closely linked to high-growth sectors that continue to expand at a sustained pace:

- Construction and Real Estate: Rapid urbanisation, housing demand, and commercial infrastructure development.

- Agriculture: Extensive use of PVC pipes in irrigation systems, micro-irrigation, greenhouses, and water distribution.

- Infrastructure Development: Government-backed investments in water supply, sanitation, industrial utilities, and smart city projects.

Given the strong, structural growth in these industries, PVC demand is expected to rise steadily and may continue to outpace even the expanded domestic supply. As a result, while new capacities will narrow the deficit, complete substitution of imports remains unlikely in the foreseeable future.

- India stands at a transitional stage, supported by significant planned investments in PVC production.

- However, strong long-term consumption trends mean imports will remain necessary for supply stability.

- Maintaining access to multiple international supply sources will remain crucial as the industry grows.

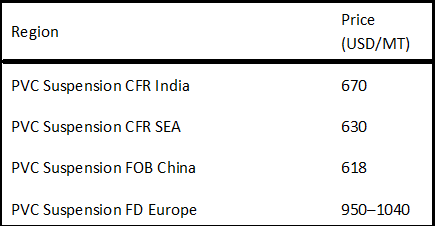

Global PVC prices remain weak due to sluggish downstream demand and high inventories, which continue to pressure market sentiment across major regions with short fluctuations.

-b_Big.jpg)