China Maleic Anhydride: Market Insights

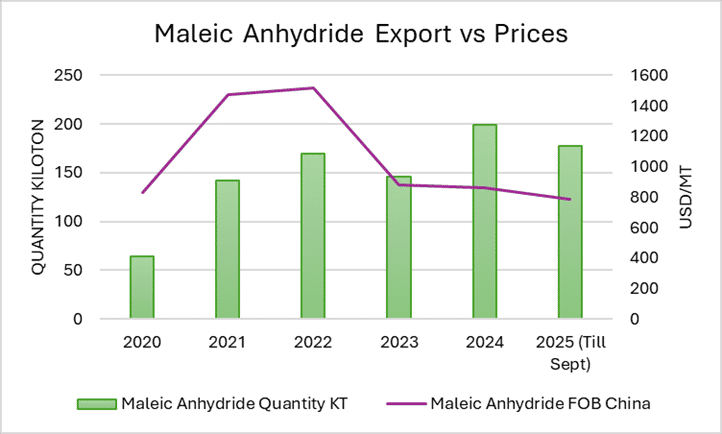

The Maleic Anhydride market has undergone significant structural shifts over the 2020–2025 period, shaped by evolving demand cycles, global supply realignments, and sharp corrections in petrochemical pricing. Export volumes and FOB China prices reflect a market transitioning from pandemic-driven tightness to a more balanced and cost-competitive environment.

Post-Pandemic Recovery and Expansion (2020–2022)

The period from 2020 to 2022 marked a robust expansion phase, with export quantities rising sharply from 64 KT to 168 KT. Strong global demand for unsaturated polyester resins, composites, and industrial intermediates combined with constrained international supply supported elevated operating rates. Prices surged simultaneously, peaking at $1,516/MT in 2022, driven by high feedstock n-butane costs, energy price inflation, and limited logistics availability.

Demand Softening and Price Normalisation (2023)

In 2023, the market shifted into a correction phase. Export volumes dipped to 146 KT, reflecting weaker downstream consumption in construction, automotive composites, and polymer sectors. Excess inventory accumulation and improved plant availability reduced pricing leverage, resulting in a steep decline to $878/MT, ushering in the first major price normalisation after the 2021–2022 highs.

Supply-Led Expansion and Competitive Pricing (2024–2025)

2024 marked a resurgence in export activity, reaching 199 KT, supported by aggressive Asian supply, improved logistics efficiency, and demand stabilisation in global composites markets. However, despite high export activity, prices continued to trend downward settling at $859/MT indicating that supply strength outpaced demand recovery.

By 2025, exports maintained healthy levels at ~177 KT, but prices fell further to $784/MT in September and currently in the mid of November at the level of $735/MT underlining a buyers’ market characterised by oversupply, declining feedstock costs.

- Oversupply pressures are likely to persist as Asian producers continue to dominate global exports.

- Downstream UPR demand remains steady but not strong enough to absorb rising supply volumes at premium prices.

- FOB China will continue acting as the global benchmark, reflecting broader petrochemical cost trends and China’s export posture.

- The market is entering a low-price equilibrium, favouring downstream resin and composite manufacturers but pressuring producer margins.

- Near-term pricing is expected to stay range-bound unless feedstock prices spike or capacity rationalisation occurs.

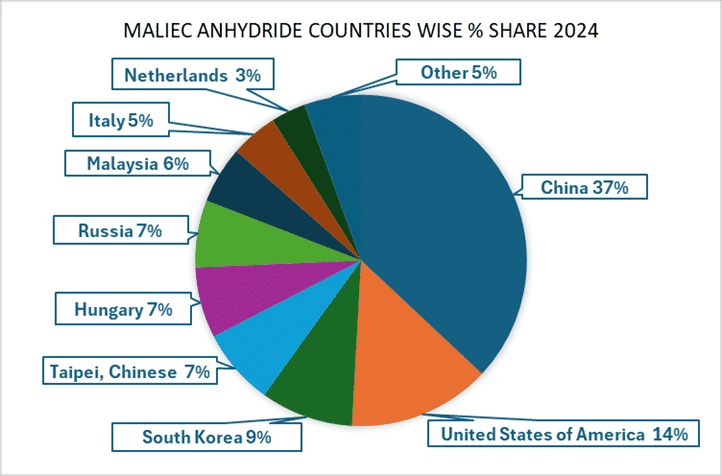

Global Maleic Anhydride Market: Country-Wise Share Overview

The global Maleic Anhydride market is characterised by a geographically diverse production landscape, with a clear dominance by Asian manufacturers. China accounts for the largest share at 37 per cent, underscoring its position as the world’s primary production hub, driven by extensive industrial capacity, abundant feedstock availability, and strong downstream demand from unsaturated polyester resins, lubricants, and additives.

- The United States holds a 14 per cent share, reflecting the strength of its mature chemical industry and well-established manufacturing infrastructure. South Korea (9 per cent) and Chinese Taipei (7 per cent) further reinforce Asia’s substantial influence in global supply, supported by technologically advanced facilities and export-oriented production models.

- Within Europe, Hungary (7 per cent), Russia (7 per cent), Italy (5 per cent), and the Netherlands (3 per cent) contribute steadily to the regional market, leveraging integrated petrochemical complexes and proximity to downstream resin and plasticiser industries. Malaysia, with a 6 per cent share, stands out in Southeast Asia as a key regional producer benefiting from strategic feedstock integration.

- The remaining 6 per cent is distributed among other producing countries, representing smaller-scale or emerging market participants that collectively supplement global supply.

- China remains the dominant market, dictating global trends

- Export volumes rose sharply from 64 KT (2020) to 199 KT (2024), indicating strong supply-side.

- Prices peaked at $1,516/MT in 2022, but corrected to $784/MT by 2025, reflecting oversupply and easing feedstock costs.

- 2023 marked a transition year, with volumes softening and prices entering a sustained downward correction.

- Despite high export activity in 2024–2025, pricing power remained weak.

-b_Big.jpg)