Methyl Ethyl Ketone (MEK) continues to play a key role in industrial processing because of its fast evaporation and strong solvency, making it essential for producing coatings, adhesives, inks, rubber products, and various specialty chemicals. Since MEK is synthesised primarily from propylene and 2-butanol, its pricing tends to mirror fluctuations in upstream feedstocks as well as changes in production activity and demand from major end-use sectors such as construction, automotive finishing, and printing.

Methyl Ethyl Ketone Price Performance Overview

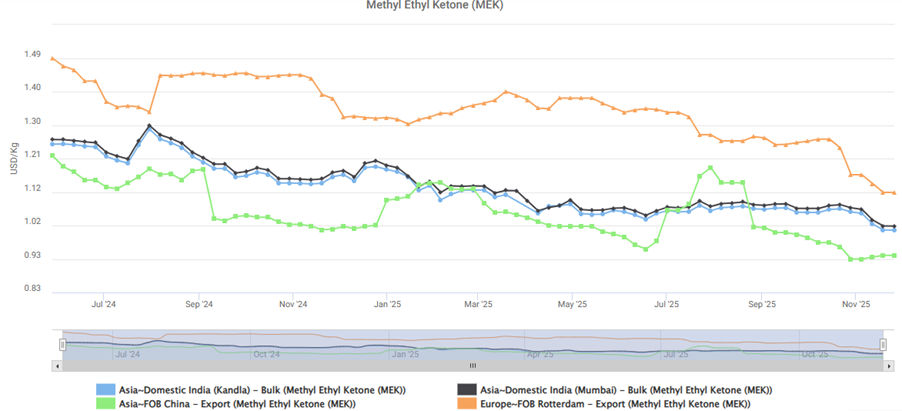

India Domestic Market

MEK values in India began August 2024 on the stronger side at $1.24/kg, supported by firmer crude and propylene costs. Over the following months, however, softer demand from coatings and adhesive manufacturers gradually pushed prices lower.

From January to May 2025, domestic trading activity remained subdued, with prices mostly confined to $1.12–1.16/kg as operating rates stayed modest and imports limited any upward movement.

A clearer downward pattern emerged by June–July 2025, when values slipped further to $1.05–1.10/kg amid lackluster industrial consumption and increased import availability.

By November 2025, prices settled around $1.02–1.10/kg, amounting to an overall decline of nearly 15 per cent from the August 2024 level.

Asia Export Market (FOB China)

Aug–Nov 2024: MEK export prices fell from $1.15/kg to $1.10/kg, a ~4.3 per cent decline driven by weak global solvent demand.

H1 2025: Prices moved within $0.98–1.05/kg, roughly 8–15 per cent lower than August 2024 levels due to lean overseas inventories.

By late 2025, prices stabilised near $0.93/kg, reflecting a 19.1 per cent decline from August 2024 levels amid prolonged weakness in coatings and printing sector demand.

Europe Export Market (FOB Rotterdam)

Europe continued to command the highest global pricing, beginning at $1.44/kg in August 2024. However, deteriorating macroeconomic sentiment prompted a late-2024 correction to $1.30–1.35/kg.

From August 2024 to November 2025, European MEK prices declined from $1.44/kg to $1.12/kg, marking a steep 22.2 per cent contraction driven by persistent weakness in coatings demand and heightened import competition.

Methyl Ethyl Ketone (MEK) Price Trend (Aug 2024 – Nov 2025)

Short-Term Global MEK Market Outlook

- Price Movement: MEK prices are expected to remain range-bound in the near term, influenced by stagnant coatings and adhesives demand and steady feedstock values.

- Demand Conditions: Key downstream sectors especially construction, automotive coatings, packaging inks, and rubber exhibit weak to moderate consumption.

- Market Sentiment: Buyers are adopting cautious procurement strategies and maintaining lean inventories.

- Profitability Pressure: Refinery and petrochemical producers face narrower margins due to depressed export realisations and weak operating economics.

- Supply–Demand Balance: The market currently sits in a technical balance, with soft demand countered by gradual supply moderation.

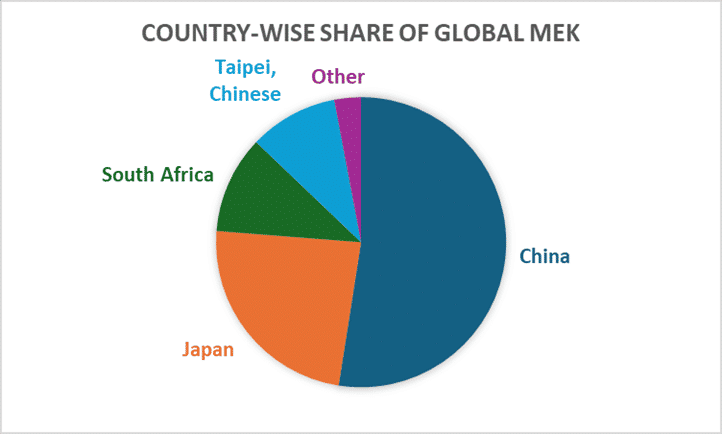

Top Methyl Ethyl Ketone Manufacturing Companies

- ExxonMobil Corporation

- Shell Chemicals

- Maruzen Petrochemical Co., Ltd.

- Sasol Limited

- Idemitsu Kosan Co., Ltd.

- ENEOS Corporation

- Zibo Qixiang Petrochemical Industry Group

- INEOS Group

-b_Big.jpg)