Product Overview

Propylene Glycol (PG) is a versatile organic compound produced through the hydration of Propylene Oxide (PO). Owing to its chemical stability, low toxicity, hygroscopic properties, and compatibility with a wide range of formulation systems, PG serves as an essential intermediate across multiple industries.

Propylene Glycol is typically classified into two grades:

- Industrial/Technical Grade, used in composites, antifreeze formulations, chemical processing, and industrial solvents.

- USP/Pharma/Food Grade, used in cosmetics, oral-care preparations, pharmaceuticals, e-liquids, processed foods, flavour carriers, and various applications requiring strict purity.

Its global consumption pattern is shaped by several macro trends: infrastructure cycles (affecting resin demand), seasonal climatic factors (impacting antifreeze and de-icing fluids), healthcare and FMCG expansion, and technological advancements within coatings and engineered materials. Because PG is derived from PO, which in turn is tied to propylene from steam crackers and refineries, its cost structure is tightly connected to crude oil, naphtha, and olefin operating rates. As a result, PG markets often mirror the volatility of upstream petrochemicals while simultaneously reflecting the demand rhythms of downstream manufacturing clusters.

Propylene Availability and Pricing

Propylene values respond sharply to fluctuations in crude benchmarks and to supply disruptions arising from cracker maintenance, unplanned outages, or constrained fluid catalytic cracker (FCC) operations. Tightness in propylene normally increases PO production costs, which then translates into firmer PG numbers. Propylene Oxide Trends and demand from end use industries.

Propylene Oxide Market Behaviour

PO economics depend heavily on regional demand patterns in polyurethanes and glycols. When PO producers face low margins or curtailed operating rates, the resulting supply shifts influence PG costs. Conversely, periods of expanded PO availability can offer cost relief.

Impact on PG Costing

The price chart (India–Hazira and Kandla) shows:

Peak around July–August 2025, corresponding with:

- Higher PO costs mid-year

- Tight propylene availability in parts of Asia

- Seasonal demand uplift for UPR in construction

Sharp decline from September onward, aligning with:

- Weakening upstream

- Demand slowdown in resin and automotive sectors

- Inventory correction cycles

India Propylene Glycol prices from $1.03–1.04 /kg (Aug 25 peak) fell to $0.92–0.94 /kg by November 25, a clear reflection of upstream easing and weak downstream pull.

Downstream Market Fundamentals

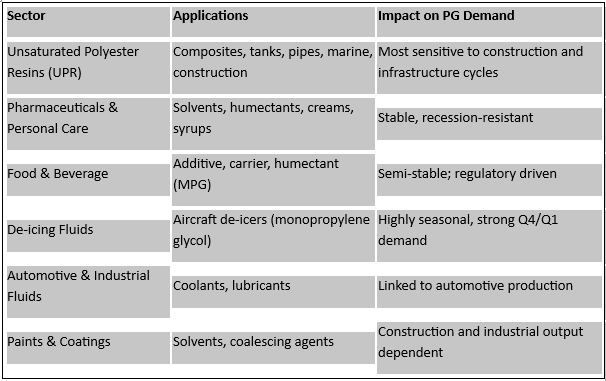

Propylene Glycol (PG) Major Application Sectors and Demand Behaviour

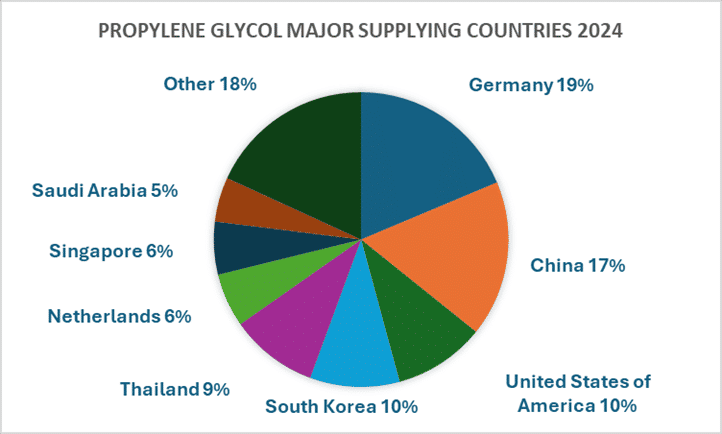

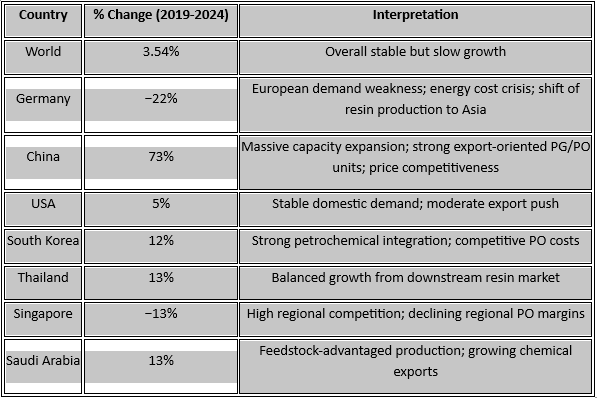

Global Export Trends (2019 → 2024)

Propylene Glycol Export Growth (per cent)

Integrated View—How Upstream, Downstream, and Trade Trends Shape PG Prices

Upstream Drivers

- Lower propylene and PO prices in second half of 2024 reduced Propylene glycol production cost.

- High Chinese PO/PG capacity, global oversupply results export price pressure.

Downstream Drivers

- Weak resin demand (construction slowdown) suppressed buying interest.

- Seasonal uplift (de-icing) insufficient to counter overall industrial softness.

- FMCG/pharma stable but not enough to absorb surplus.

Trade Influence

- Surging Chinese exports increased global competition.

- EU contraction in output raised imports but did not significantly support global prices.

- Competitive Middle Eastern supply added further price pressure.

Net Result

Propylene Glycol (PG) prices in key importing markets like India softened from $1.03–1.04 /kg to $0.92–0.94 /kg (2025) in line with:

- Upstream cost decline

- Downstream demand moderation

- Aggressive export competitiveness of Asian suppliers

-b_Big.jpg)