Ethylene | Propylene | Butadiene | Methanol

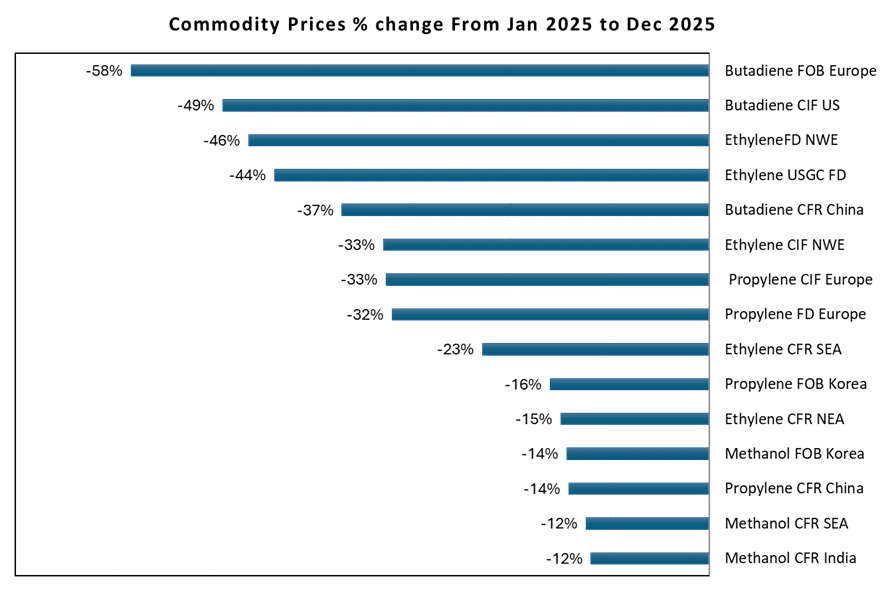

Feedstock chemical markets remained under sustained pressure throughout 2025, with prices trending lower across all major products and regions. Between January and December, prices for ethylene, propylene, butadiene, and methanol declined by approximately 12 percent to nearly 60 percent. These declines were driven by weak global demand, ongoing oversupply, lower energy prices, and elevated uncertainty related to trade and policy developments.

Despite a reduction in feedstock and energy costs, producers were unable to improve pricing or margins. Demand from downstream sectors showed limited signs of recovery, while excess supply continued to weigh on market balances. As a result, supply-side competition intensified and market conditions remained firmly in favour of buyers across global feedstock trade.

A Prolonged Commodity Downcycle

Global Commodity markets in 2025 continued to reflect a prolonged downturn shaped by slow economic growth, easing inflation, and structural oversupply, particularly in energy markets. Industrial activity remained subdued, most notably in China and parts of Europe, restricting demand growth for upstream chemical products.

Crude oil markets were oversupplied for much of the year, with Brent crude prices declining by around 17.7 percent over the period. The price weakness reflected limited demand growth among major consuming regions and elevated global production. While additional US sanctions on Russian oil producers led to short-term price increases later in the year, these effects were temporary and did not materially change underlying market conditions. Lower oil prices reduced production costs for chemical producers; however, this advantage was offset by weak downstream demand and heightened competition among exporters.

Trade and Policy Environment

Geopolitical developments, including expanded sanctions on Russian oil exports and rising tensions in the Middle East related to the Israel–Iran conflict, introduced periodic volatility into energy markets during 2025. At the same time, heightened trade tensions, tariff-related risks, and ongoing policy uncertainty continued to disrupt global trade flows.

Trade tensions, tariff risks, and ongoing policy uncertainty further distorted global trade flows, encouraging short-term inventory adjustments rather than sustained demand recovery. Although variable production costs declined, feedstock chemical margins remained under pressure due to persistent demand weakness and aggressive competition in export markets.

Petrochemical Market in 2026

The global petrochemical industry is likely to enter 2026 with more balanced operating conditions, although fundamental challenges are expected to remain in place. Incremental improvement in downstream consumption should help stabilise plant utilisation, but widespread capacity additions and divergent regional dynamics will continue to restrict any meaningful improvement in margins. Moderate growth in sectors such as automotive and industrial manufacturing is expected to support demand for polymers, elastomers, and advanced materials, yet competitive pressure is set to persist. High export availability, led largely by Asian producers, together with limited pricing leverage, is likely to prevent producers from regaining strong pricing control.

Developments in the energy sector will continue to shape petrochemical cost structures and market behaviour throughout the year. Softening crude oil and feedstock markets, combined with forward-looking supply assessments, suggest that global crude balances could shift into surplus from the middle of 2026, with excess volumes extending onward 2026. At the same time, oil demand growth is forecast to remain restrained, with consumption patterns varying widely across regions showing greater resilience in North America while remaining comparatively weak in Europe and parts of the Asian countries. These regional disparities are increasingly influencing feedstock access, refinery operating rates, and integrated production strategies, making refining capacity and integration a more decisive factor in trade flows and operating decisions than crude supply alone. Consequently, 2026 is more likely to reflect a period of operational adjustment rather than a full recovery in profitability, with performance outcomes differing markedly by region, cost structure, and level of downstream integration.

-b_Big.jpg)