Executive Summary

The conclusion of the India–New Zealand Free Trade Agreement (FTA) on 22 December 2025 marks a pivotal shift in bilateral trade architecture, with zero-duty access on 100 per cent of India’s exports and tariff liberalisation across 70 per cent of India’s tariff lines. While the headline narrative focuses on textiles, services, and agriculture, the agreement has material medium- to long-term implications for the chemical, pharmaceutical, and industrial inputs markets, particularly in organic chemicals, inorganic chemicals, pharmaceutical formulations, and fuel-linked intermediates.

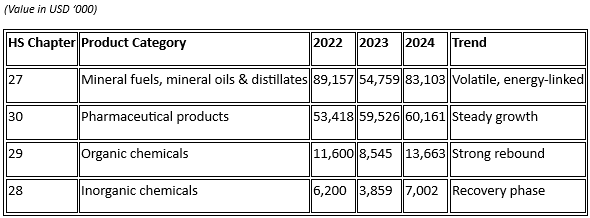

Chemicals Already Show Upward Elasticity: Trade Baseline (2022–2024)

India’s Chemical and Pharma Exports to New Zealand

Key Observation

Even before FTA implementation, organic chemicals and pharmaceuticals showed resilience and recovery in 2024, signalling latent demand elasticity that can be unlocked further through tariff elimination and regulatory streamlining.

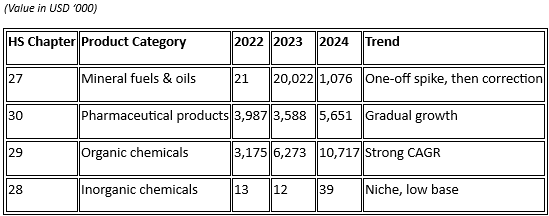

New Zealand’s Chemical and Pharma Exports to India

Key Observation

New Zealand’s organic chemical exports to India more than tripled between 2022 and 2024, albeit from a small base, reflecting specialty-grade, high-purity, or agri-linked chemical flows rather than bulk commodities.

FTA Impact Analysis: Chemical Sector Lens

1. Tariff Elimination = Immediate Cost Competitiveness

Zero-duty access for Indian exports directly improves landed cost economics for:

- Pharmaceutical formulations and APIs

- Specialty organic intermediates

- Performance chemicals used in coatings, construction, and agri-inputs

Indian chemical exporters gain an advantage over non-FTA suppliers (China, EU) in the New Zealand market.

Impact: Higher export volumes, improved margins, and deeper penetration in a regulated, high-quality market.

2. Regulatory Cooperation Boosts Pharma and Fine Chemicals

Mutual recognition of GMP and GCP inspections from US FDA, EMA, UK MHRA reduces:

- Approval timelines

- Compliance duplication

- Cost of market entry

This framework indirectly benefits high-value intermediates, excipients, and specialty chemicals linked to pharma manufacturing.

Impact: Acceleration of India’s pharmaceutical exports, with spillover demand for organic solvents, intermediates, and formulation chemicals.

3. Agricultural Productivity Partnerships Drive Agrochemical Demand

Centres of Excellence for apples, kiwifruit, and honey will:

- Increase use of crop protection chemicals, micronutrients, and specialty formulations

- Drive demand for fungicides, insecticides, plant growth regulators, and formulation solvents

Market access safeguards protect Indian farmers while technology transfer raises chemical intensity per hectare.

Impact: Incremental domestic demand for agrochemical actives and formulation chemicals in India.

4. Duty-Free Industrial Inputs Lower Manufacturing Costs

Zero-duty access on wooden logs, coking coal, and metal waste and scrap improves:

- Cost structures for steel, engineering goods, and construction

These sectors are downstream consumers of chemicals:

- Resins, coatings, adhesives

- Industrial gases

- Rubber chemicals and process oils

Impact: Indirect uplift in domestic chemical consumption through manufacturing expansion.

5. $20 Billion Investment Commitment: Chemical Capex Multiplier

Investment inflows over 15 years into:

- Manufacturing

- Infrastructure

- Innovation ecosystems

Chemical sector benefits via:

- New specialty chemical units

- Pharma and medical device parks

- Contract manufacturing and export-oriented units

Impact: Structural demand growth for bulk chemicals, solvents, intermediates, and utilities.

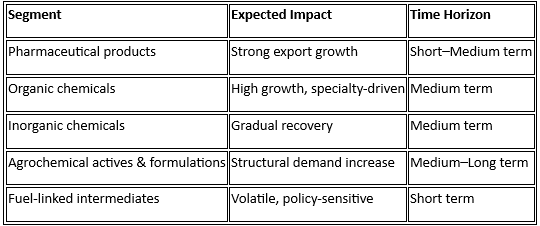

Market Outlook: Chemicals Under the FTA Regime

-b_Big.jpg)