The global ethylene market remains under pressure entering 2026, following a pronounced downturn during 2025 across all major regions. The decline has been largely driven by weak downstream polymer demand, elevated inventory levels, and continued supply additions that have outpaced end-use consumption. While prices show signs of short-term stabilisation in certain regions, the broader market structure remains unfavourable, preventing a sustained recovery.

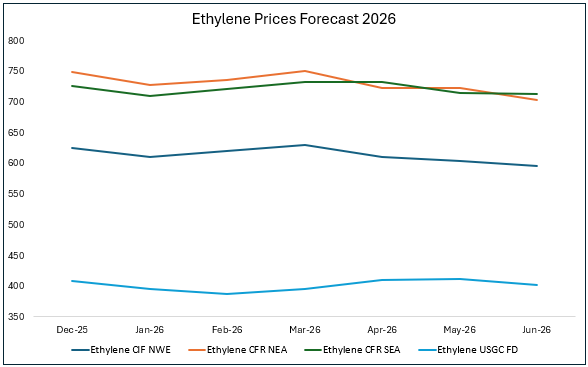

In Asia, both Northeast Asia (CFR NEA) and Southeast Asia (CFR SEA) followed a similar downward trend in 2025. CFR NEA prices eased from $880/MT in January to $825/MT in July and $748/MT by December 2025, while CFR SEA prices declined from $927/MT to $835/MT and then to $725/MT over the same period. A mild recovery is forecasted in early 2026, driven by temporary supply tightness and restocking with pre-holiday purchasing demand, but continued capacity additions and subdued derivative demand are expected to cap any upside through mid-2026.

In Northwest Europe, ethylene prices continue to trend lower as demand from key derivative sectors such as polyethylene, construction materials, and automotive applications remains subdued. Operating rates at downstream units are constrained by weak margins and cautious procurement strategies, while ample cracker availability limits any meaningful price upside. Buyers continue to adopt a hand-to-mouth purchasing approach, reflecting low confidence in near-term demand improvement.

The US Gulf Coast (FD) shows the steepest correction among all regions. This decline is driven by persistent oversupply, weak polyethylene margins, and aggressive export competition. Although a slight improvement is visible in Q2 2026 as export flows improve, the recovery remains limited, with prices stabilising near $400/MT. Overall, the global ethylene market is expected to stay in a low-margin environment through mid-2026, with short-term fluctuations driven more by operational factors than by a meaningful demand-led recovery.

Ethylene prices may experience short-term upside in the event of unplanned cracker outages or prolonged maintenance that materially constrain effective supply. A more durable price recovery would require a structural tightening of the supply demand balance, supported by higher operating rates in downstream derivatives and a deceleration in incremental capacity additions.

European Steam Cracker Rationalisation Driven by Structural Cost Disadvantages

European petrochemical producers are increasingly moving toward steam cracker rationalisation and permanent shutdowns as the region’s cost structure becomes structurally uncompetitive. Elevated energy prices, high naphtha-based feedstock costs, and rising compliance expenses have significantly increased cash production costs for European crackers. This has resulted in sustained margin pressure, particularly as downstream demand remains subdued and operating rates decline.

At the same time, the European market is facing intensified competition from lower ethylene and derivative imports, primarily from the United States, the Middle East and Asia. Producers in these regions benefit from advantaged feedstock routes such as ethane-based cracking and integrated refinery petrochemical complexes allowing them to supply the European market at more competitive price levels. This import pressure has further eroded the viability of higher-cost domestic assets.

In response, major industry players including INEOS, Dow, ExxonMobil, TotalEnergies, and others are reassessing asset portfolios, reducing exposure to structurally disadvantaged units, and prioritising capital allocation toward more competitive regions. The ongoing rationalisation highlights a broader structural shift in the global petrochemical industry, with capacity increasingly concentrated in feedstock-advantaged regions, while Europe transitions toward a more import-reliant and selectively integrated petrochemical landscape.

Ethylene prices may experience short-term upside in the event of unplanned cracker outages or prolonged maintenance that materially constrain effective supply. A more durable price recovery would require a structural tightening of the supply demand balance, supported by higher operating rates in downstream derivatives and a deceleration in incremental capacity additions.

-b_Big.jpg)