Price Trend Analysis: 2025 Performance

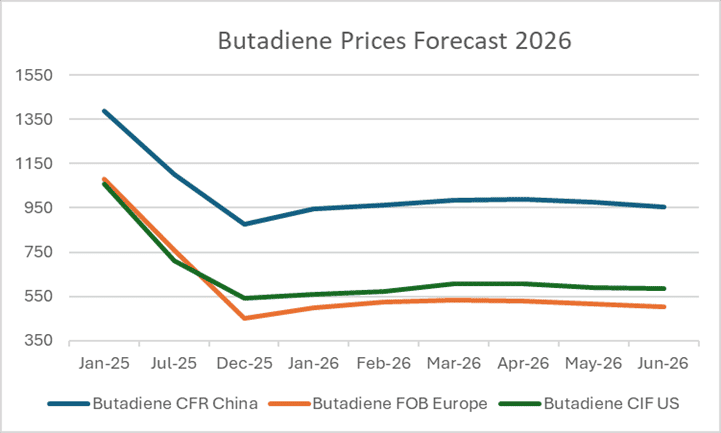

Global butadiene prices witnessed a clear downward trajectory through 2025, driven by weakening downstream demand, margin pressure in synthetic rubber chains, and ample availability from steam crackers operating at stable rates.

|

Region |

Jan-25 |

Jul-25 |

Dec-25 |

% Change (Jan–Dec) |

|

CFR China |

1390 |

1100 |

875 |

▼ ~37% |

|

FOB Europe |

1080 |

760 |

450 |

▼ ~58% |

|

CIF United States |

1060 |

710 |

540 |

▼ ~49% |

Prices declined steadily due to:

- Weak downstream demand from synthetic rubber and automotive-related sectors

- High cracker operating rates during most of the year

- Poor margins across elastomers and plastics, discouraging aggressive spot buying

Europe saw the steepest erosion, while China and the United States experienced relatively slower but still significant declines.

By late 2025, butadiene prices reached cyclic lows, setting the stage for a structural shift in early 2026.

- Q1 2026: Prices rebound from 2025 lows as supply growth remains constrained and buyers re-enter the market at attractive levels.

- Q2 2026: The strongest pricing phase, supported by planned inspections, tighter spot availability, and seasonal improvement in downstream operating rates.

- Late Q2 Signals: Momentum begins to slow as the market anticipates additional capacity and improving supply availability in the second half of the year.

Overall, butadiene prices in 2026 are expected to remain above late-2025 levels in the first half, with the second quarter likely marking the annual high point. However, as the year progresses and new capacity gradually comes online, supply-side support is expected to weaken, increasing the risk of price volatility and downward correction in the latter half of the year.

_Big.jpg)