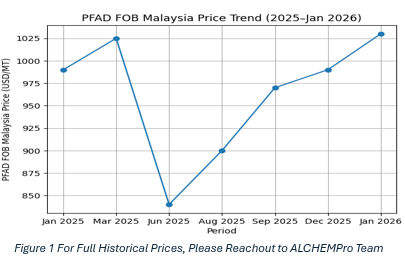

Palm Fatty Acid Distillate (PFAD), a key by-product of crude palm oil refining, experienced a complete price cycle during 2025, shaped by seasonal demand, supply-side imbalances, and downstream consumption trends. While PFAD prices broadly followed movements in Crude Palm Oil (CPO), they displayed higher volatility due to their dependence on oleochemical, soap, feed, and industrial demand.

Strong Start to 2025: Seasonal Demand-Led Price Surge (January–March 2025)

At the beginning of 2025, PFAD prices strengthened steadily from January through March, driven by seasonal demand across major downstream industries. Increased production of soaps and detergents ahead of summer demand, improved operating rates at oleochemical plants, and restocking activity by fatty acid producers supported higher PFAD offtake.

Firm Crude Palm Oil prices further reinforced bullish sentiment across the palm complex, allowing PFAD prices to move upward in tandem during the first quarter.

Market Correction Phase: Oversupply and Inventory Pressure (April–June 2025)

From April to June 2025, PFAD prices entered a pronounced correction phase as the market shifted from demand-led momentum to a supply-heavy environment. While downstream demand moderated, the dominant factor behind the price decline was excess supply and elevated inventory levels.

Key contributors included:

- High PFAD production from refiners, supported by uninterrupted crude palm oil processing

- Ample availability of crude palm oil as a raw material, enabling producers to maintain high operating rates

- Inventory accumulation at producer, trader, and port levels, particularly in Malaysia and Indonesia

- Slower export offtake, resulting in delayed inventory liquidation

- Buyers adopting a cautious procurement strategy, waiting for further price correction

Despite these pressures, CPO prices remained relatively resilient due to food and biodiesel demand, creating a divergence within the palm complex.

As a result, PFAD FOB Malaysia prices declined sharply and reached a cycle low of around $840 per metric ton in June 2025, while CPO prices held near $1,000 per metric ton. This phase underscored PFAD’s heightened sensitivity to supply-side imbalances.

Stabilisation and Gradual Recovery: Second Half of 2025

Following the June bottom, PFAD prices began to stabilise as excess inventories were gradually absorbed by the market. Seasonal tightening in palm oil production, improved demand visibility from oleochemical producers, and steady manufacturers buying from soap and other consumer and higher raw material prices supported a slow recovery.

By December 2025:

- PFAD FOB Malaysia prices recovered to around $990 per metric ton

- Indian import prices (CIF Kandla) strengthened amid restocking

- Domestic ex-factory prices showed volatility but normalised as inventories aligned with consumption

CPO prices during this period fluctuated within a firm range, continuing to provide structural support to PFAD.

Renewed Strength into Early 2026

Entering January 2026, PFAD prices gained further momentum, supported by improved downstream confidence and tighter supply conditions.

- PFAD FOB Malaysia rose to around $1,030 per metric ton

- Import and domestic prices followed the upward trend

- CPO prices softened marginally but remained historically elevated, anchoring the palm complex

PFAD–CPO Relationship and Market Sensitivity

PFAD prices in 2025 were influenced by upstream crude palm oil availability, biodiesel blending dynamics, and downstream demand from soaps, oleochemicals, and feed sectors. High CPO supply and steady refinery run rates increased PFAD output, while biodiesel mandates continued to support CPO prices rather than PFAD directly. As downstream demand weakened mid-year, PFAD prices fell more sharply due to oversupply. In the second half, tighter palm oil supply, improved biodiesel sentiment in the palm complex, and higher downstream operating rates supported recovery. This cycle highlighted PFAD’s higher sensitivity to combined supply, biodiesel policy, and end-use demand shifts.

Outlook and Key Takeaways for Clients

- PFAD experienced a full price cycle in 2025: early-year strength, mid-year correction, and year-end recovery

- Supply-side pressures and inventory build-up were the primary drivers of the mid-year decline

- Downstream demand normalisation remains key to sustaining price stability

- PFAD prices are expected to remain volatile but supported as long as CPO fundamentals stay firm

-b_Big.jpg)