Cambodia’s textile export market is a cornerstone of the country’s economy, contributing significantly to GDP and generating large-scale employment opportunities. Globally recognised as a key player in garment manufacturing, Cambodia’s export market is heavily focused on readymade garments (RMG). With textiles and apparel accounting for over 70 per cent of the nation’s total exports, the industry continues to drive Cambodia’s trade and economic growth.

Historical Growth

The rapid growth of Cambodia’s textile sector began in the 1990s, fuelled by substantial foreign direct investments (FDI), competitive labour costs, and preferential access to global markets through trade agreements such as the Generalised System of Preferences (GSP) and the Everything But Arms (EBA) initiative by the European Union. These favourable conditions transformed Cambodia into an attractive destination for investors. Key advantages, including a young, cost-effective workforce and a growing network of manufacturing hubs, further accelerated the sector’s development, establishing the country as a competitive player in the global textile and apparel market.

Key Export Destinations

The primary export markets for Cambodia’s textiles include:

1. United States: One of Cambodia’s largest trading partners, particularly for RMG and knitwear

2. European Union: Supported by duty-free access under the EBA scheme, EU countries have been major importers of Cambodian apparel

3. Asia-Pacific: Regional neighbours like Japan, South Korea, and China also account for a growing portion of Cambodia’s textile exports

Industry Structure

The Cambodian textile export market is primarily structured around:

1. Cut-Make-Trim (CMT) operations: Many factories focus on assembly rather than end-to-end production

2. Dependence on Imported Raw Materials: Cambodia heavily relies on China for fabric, yarn, and other raw materials due to limited local production capacity

3. Small and Medium Enterprises (SMEs): In addition to large-scale manufacturers, SMEs play a crucial role in the supply chain.

Cambodia’s Textile Trade Performance (2018–2023)

Table 1 highlights Cambodia’s textile trade performance over six years from 2018 to 2023, showcasing trends in exports, imports, and trade balance:

Table 1 highlights Cambodia’s textile trade performance over six years from 2018 to 2023, showcasing trends in exports, imports, and trade balance:

1. Exports:

• Cambodia's textile exports grew steadily from $8.01 billion in 2018 to a peak of $9.34 billion in 2022, driven by strong global demand.

• A decline to $8.15 billion in 2023 suggests potential challenges like rising competition or reduced global demand post-COVID recovery.

2. Imports:

• Imports increased modestly from $5.14 billion in 2018 to $5.71 billion in 2022, reflecting Cambodia’s reliance on raw materials like fabrics and yarns.

• A marginal decline to $5.34 billion in 2023 may indicate reduced production or diversification of supply sources.

3. Trade Balance:

• Cambodia maintained a positive trade balance throughout the period, with its surplus fluctuating between $2.69 billion (2021) and $3.63 billion (2022).

• The decline in 2023 to $2.81 billion signals potential pressures on export competitiveness.

The data underscores Cambodia’s strength as a net exporter in the textile sector. However, its heavy dependence on imported raw materials and external demand poses risks to sustained growth. To enhance resilience, investments in local raw material production and diversification into value-added products are crucial.

By 2025, Cambodia’s textile and apparel exports are expected to grow steadily due to trade agreements, a young and cost-competitive labour force, and increasing investment in sustainability. However, challenges such as global economic uncertainties, wage increases, and stricter compliance requirements from international buyers may influence its performance.

Sustained Export Growth

Cambodia’s textiles and apparel exports have shown steady expansion and reached approximately $10 billion, with strong demand from major markets like the US, the EU, and Japan. The products which are majorly exported are apparel and home textiles. Apparel export remains the mainstay of Cambodian exports. This figure is projected to grow modestly by 2025, fuelled by global demand for low-cost garment manufacturing.

Key Markets are the US, the largest buyer, particularly for knitted apparel, and the EU, despite stricter sustainability regulations, is expected to remain a key partner due to Cambodia’s duty-free access under the EBA scheme.

Key Markets are the US, the largest buyer, particularly for knitted apparel, and the EU, despite stricter sustainability regulations, is expected to remain a key partner due to Cambodia’s duty-free access under the EBA scheme.

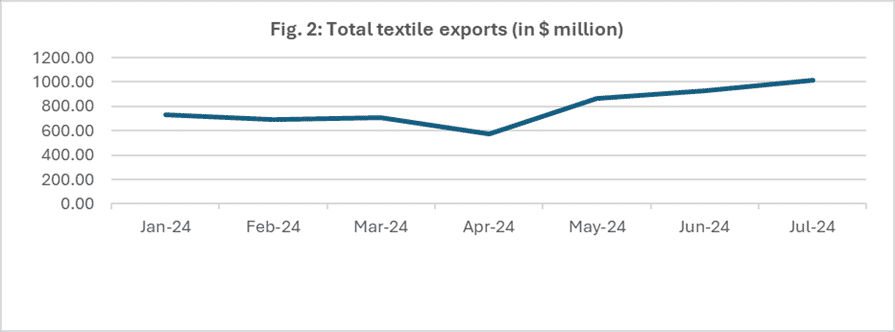

The recent trend from January 2024 to July 2024 (Fig.2) indicates that the export values are increasing steadily.

Leveraging Trade Agreements for Market Diversification

Cambodia has signed several trade agreements that will positively impact its export sector in 2025. The Cambodia-China Free Trade Agreement (CCFTA) and the Regional Comprehensive Economic Partnership (RCEP) facilitate better access to Asian markets, particularly China, which could become a bigger buyer of Cambodia’s textiles and apparel. The Cambodia-Korea Free Trade Agreement opens up opportunities in the South Korean market for textiles and garments.

Cambodia is focusing on penetrating emerging markets in Asia-Pacific, Africa, and the Middle East, aiming to reduce its over-reliance on traditional markets through diversification beyond the US and EU.

Growing Focus on Sustainability

The Cambodian textile industry is witnessing a significant shift towards sustainability to meet the evolving demands of international buyers. By 2025, compliance with global sustainability standards, such as the EU’s Green Deal and the Corporate Sustainability Due Diligence Directive (CSDD), will become a critical requirement. In response, Cambodian manufacturers are proactively investing in eco-friendly production methods, renewable energy sources, and sustainable materials, including organic cotton and recycled polyester.

Additionally, an increasing number of factories in Cambodia are achieving green certifications such as LEED (Leadership in Energy and Environmental Design), showcasing their commitment to environmental sustainability. These efforts align with the sustainability objectives of major global brands like H&M, Adidas, and Gap, enhancing Cambodia’s reputation as a responsible and competitive supplier in the global textile market.

Increase in Minimum Wages

Cambodia increased its monthly minimum wage to $208 in 2025, with further hikes anticipated in the coming years. While this move aims to improve living standards for workers, it poses potential challenges to Cambodia’s competitiveness against lower-cost manufacturing rivals like Bangladesh and Myanmar. However, to offset rising labour costs and maintain their global market position, factories are increasingly investing in automation technologies and productivity improvements.

Despite the wage increases, Cambodia retains critical advantages, including a young labour force and high female participation rates (over 80 per cent in the garment sector). These factors strengthen its workforce appeal. However, without significant gains in productivity and operational efficiency, there is a risk that buyers may shift sourcing to alternative, lower-cost destinations. Ensuring a balance between fair wages and enhanced efficiency will be key to sustaining Cambodia’s competitiveness in the global textile industry.

Emphasis on Value Addition

Cambodia is gradually transitioning from being a low-cost garment manufacturing hub to producing higher-value products as it moves up the value chain. This shift includes expanding into fashion apparel, activewear, and technical textiles such as performance fabrics for sportswear. Partnerships with global fashion brands are playing a pivotal role in fostering skill development and driving innovation in the sector.

In the coming years, Cambodia is expected to significantly increase its share of Original Design Manufacturing (ODM), offering design and product development services beyond traditional cut-and-sew operations. This move towards value addition will enhance Cambodia’s competitiveness and diversify its product offerings.

Building Resilient Supply Chains

Currently, Cambodia relies heavily on imported raw materials, particularly fabrics from China. However, the industry is actively working to build domestic textile manufacturing capabilities to reduce dependency and shorten lead times. The Cambodia Textile and Garment Industry Federation is advocating for investments in upstream activities, such as spinning, weaving, and dyeing, to strengthen the local supply chain.

Additionally, Cambodia’s participation in the RCEP is enhancing its integration into regional supply chains. This membership offers cost advantages and facilitates smoother material flows, strengthening the country’s position in the regional textile and apparel trade.

Embracing Digitalisation and Automation

Cambodian factories are increasingly adopting Industry 4.0 technologies to improve efficiency, traceability, and productivity. This includes the use of AI, blockchain, and automated cutting and sewing systems, which are helping to modernise operations and meet the evolving demands of global buyers.

Digitalisation is also becoming essential for meeting the traceability requirements set by international regulations, particularly in the EU. Additionally, Cambodia is exploring direct-to-consumer (D2C) e-commerce models, enabling manufacturers to connect directly with end consumers via online platforms, opening new revenue streams and reducing reliance on traditional buyers.

These advancements underscore Cambodia’s commitment to modernising its textile sector and aligning with global trends, ensuring long-term sustainability and competitiveness in the global market.

Competition and Geopolitical Challenges

Cambodia faces intense competition from established low-cost textile hubs like Bangladesh, Vietnam, and Myanmar, which continue to attract global buyers due to their cost advantages and well-developed infrastructure. Emerging players like Ethiopia and Egypt, currently developing their garment industries, are likely to further intensify the competitive landscape.

Global economic challenges, including slowdowns, inflation, and reduced consumer spending in major markets such as the US and EU, pose additional risks to Cambodian apparel exports. Furthermore, political instability, shifts in trade policies, and changes in preferential trade agreements may create uncertainties for the industry.

Key Segments Driving Growth by 2025

• Fast Fashion: Cambodia remains a key destination for global fast-fashion brands, thanks to its competitive costs and ability to deliver rapid turnaround times.

• Sustainable Apparel: With growing demand from eco-conscious consumers, organic and recycled textiles are set to become a major growth driver.

• Activewear: Functional and performance textiles, such as moisture-wicking and anti-odour fabrics, are gaining traction, catering to the rising global demand for activewear.

• Luxury Brands: Cambodia is increasingly collaborating with premium brands, leveraging its high-quality craftsmanship and adherence to stringent compliance standards.

Conclusion

In the coming years, Cambodia’s textile and apparel exports are expected to experience modest growth, driven by its focus on sustainability, participation in trade agreements, and adaptability to shifting global market demands. However, to maintain competitiveness, Cambodia must prioritise:

• Productivity improvements to offset rising labour costs.

• Value addition through diversification into high-end and technical textiles.

• Supply chain resilience, including domestic raw material production and enhanced logistics capabilities.

Despite challenges such as rising competition and geopolitical risks, strategic investments in green technologies, local fabric production, and digitalisation will position Cambodia as a reliable, efficient, and sustainable sourcing destination in the global textile and apparel landscape.