As more consumers prefer new apparel and clothes that are more sustainable and have a transparent value chain, the choice is shifting now to buy materials with a higher value in recyclability. However, the main factors to be considered even today from the perspective of the producers and the consumers are the quality, durability, and the price.

The basic difference between cotton and polyester and what influences their prices

Cotton and polyester differ fundamentally as materials. Cotton, a natural, plant-based fibre, is influenced by seasonal factors and agricultural conditions, while polyester, a synthetic fibre derived from crude oil, is more sensitive to fluctuations in oil prices. While the prices of both materials are primarily shaped by basic supply and demand dynamics, each is also subject to unique influencing factors. Cotton prices can be heavily impacted by weather patterns, crop yields, and agricultural policies, whereas polyester prices are more directly tied to global oil market trends.

Table 1 outlines the key factors that drive price fluctuations for both cotton and polyester. A closer look at the table reveals that cotton is particularly vulnerable to factors like water availability, labour costs, and government policy decisions. As a natural, agriculture-based product, cotton production is labour-intensive, especially in major producing countries like India and China, where it supports the livelihoods of millions. This dependence on agriculture makes cotton highly sensitive to government intervention. In India, for instance, the government influences cotton prices early on by setting a Minimum Support Price (MSP) to provide price stability for farmers. India and China, along with the United States, are among the world’s top subsidisers of cotton, further underscoring the role of policy in shaping cotton’s market price. This government involvement reflects the importance of cotton, often called ‘white gold’, to the economies and agricultural communities of these countries.

A closer look at the table reveals that cotton is particularly vulnerable to factors like water availability, labour costs, and government policy decisions. As a natural, agriculture-based product, cotton production is labour-intensive, especially in major producing countries like India and China, where it supports the livelihoods of millions. This dependence on agriculture makes cotton highly sensitive to government intervention. In India, for instance, the government influences cotton prices early on by setting a Minimum Support Price (MSP) to provide price stability for farmers. India and China, along with the United States, are among the world’s top subsidisers of cotton, further underscoring the role of policy in shaping cotton’s market price. This government involvement reflects the importance of cotton, often called ‘white gold’, to the economies and agricultural communities of these countries.

Polyester, by contrast, is more directly affected by petroleum prices, as it is a synthetic fibre derived from crude oil. Consequently, the price of polyester yarn or staple fibre tends to fluctuate with the global crude oil market. Recently, a stable and even declining trend in crude oil prices has led to reductions in polyester yarn prices. In India, polyester prices are also influenced by import quotas on polyester yarn, adding another layer to its price dynamics. Meanwhile, in China, polyester prices are heavily affected by domestic manufacturing levels in addition to crude oil prices, reflecting the country’s high production capacity and its role as a global supplier.

This overview highlights the distinctive factors influencing the price volatility of cotton and polyester, driven by agricultural dynamics for cotton and petroleum-based dependencies for polyester.

Prices of cotton and polyester yarn

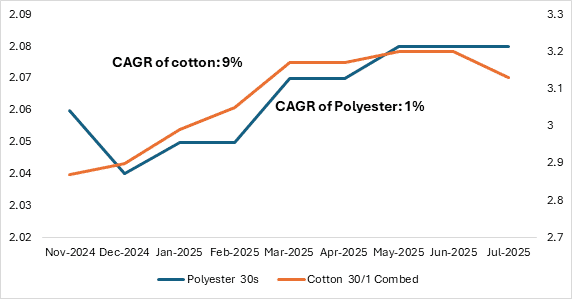

The prices of cotton and polyester yarn are influenced by a variety of factors and the trends are observed to be different. From the analysis of the prices so far, cotton prices are still higher than the prices of polyester yarn in India. Where the price of cotton was reduced by around 1 per cent, the price of polyester was reduced by around 3 per cent as of the last week ended November 2024.

The profitability of polyester companies is set to increase by the year 2025; as the implementation of the Quality Control Order (QCO) in India can prevent the increase in the import of polyester yarn in India. As of the week ending November 10, 2024, the price of the polyester yarn was $2.04/kg, which was lower as compared to the price of cotton ($3.12/kg). Thus, there is a difference of $1.04/kg between both materials, which is a big difference if seen from the macro scenario.

Exhibit 1: Prices of cotton yarn and polyester yarn (in $/kg)

Source: TexPro, F2F analysis

Source: TexPro, F2F analysis

When it comes to cotton yarn, the prices are still high as compared to the prices of polyester yarn due to an influence of:

-

Raw Cotton Prices: Cotton yarn prices are significantly influenced by raw cotton prices. In countries like India and China, for example, the governments set a minimum price for cotton, and in China, the total area used for the cultivation of the cotton crop is highly regulated by the government. Therefore, raw cotton availability is one of the prime influences on the price of cotton yarn. In India, the price of cotton depends significantly on the monsoon patterns in the country.

-

Export Demand: Demand from other countries plays a crucial role in affecting cotton yarn prices. Increasing consumer preference for natural fibres like cotton boosts demand for cotton yarn. Cotton’s popularity in apparel contributes to the strong demand for cotton yarn. India’s cotton exports have grown by an average of 13 per cent over the last five years (2020-2024). Cotton’s recyclable and sustainable qualities, which appeal to environmentally conscious consumers, further drive the demand for cotton.

-

Spinning Capacity: India holds 20 per cent of the world’s spinning capacity, giving it a major role in global cotton yarn production. India’s high production capacity supports its strong presence in the global cotton market.

The prices of polyester are reducing due to the following reasons:

-

Competition from Imports and Domestic Production: India imports about 12 per cent of its polyester yarn, and these imports exert downward pressure on domestic yarn prices. Cheaper yarn imports, particularly from China, challenge Indian producers, who struggle to compete. Unlike global trends where raw material prices have decreased, prices for Purified Terephthalic Acid (PTA)—a key component in polyester production—remain high in India. This discrepancy leads to narrower profit margins for some Indian companies.

-

Lower Production Costs: Compared to cotton, polyester has a lower production cost. Being a petroleum-based product, polyester benefits from multiple sourcing options, as petroleum is available in many countries, reducing dependency on specific suppliers. This flexibility in sourcing makes polyester more cost-competitive than cotton.

-

Decreased Demand: Globally, demand for polyester yarn has been sluggish due to economic uncertainty. Indian yarn producers face challenges from delayed payments and weakened demand, further driving down polyester yarn prices. Although some forecasts suggest that polyester yarn producers may see improved profitability due to import restrictions on polyester yarn, demand remains a crucial factor influencing price stability and profit margins.

Forecasts

Analysis of price forecasts from TexPro indicates that cotton prices are projected to increase at a compound annual growth rate (CAGR) of around 9 per cent, while polyester prices are expected to rise by just 1 per cent. This forecast highlights a notable disparity between the data and consumer trends. Despite the per capita consumption of cotton remaining largely stagnant—averaging 2.91 kg according to the Food and Agriculture Organization (FAO), with a slight expected increase to 3.01 kg in 2024—global mill consumption of cotton is on the rise. This shift suggests a growing preference for natural fibres in textile production.

The predicted price increase for cotton is driven by rising mill consumption and stable per capita consumption, coupled with the uncertainty surrounding global cotton yields. Cotton prices are influenced by agricultural factors, which remain highly dependent on seasonal cycles and unpredictable weather conditions. The anticipated dip in cotton prices in 2025 could signal a potential recovery in global yields, but the overall stability of cotton production remains uncertain due to its reliance on climate and seasonal variations.

Exhibit 2: Forecasted prices of cotton and polyester (in $/kg)

Source: TexPro, F2F analysis

On the other hand, polyester, which currently accounts for 71 per cent of the global fibre market share, is experiencing a price increase. This rise could be attributed to the growing shift toward synthetic fibres, driven by their cost-effectiveness and the ability to recycle polyester with comparable quality. Looking ahead to 2025, geopolitical tensions, potential changes in the US administration, and the possibility of a trade war could disrupt global markets. Additionally, if the US becomes more deeply involved in oil market dynamics, this could lead to price hikes in polyester yarn due to its reliance on petroleum-based raw materials. These factors may drive up the cost of polyester yarn globally, affecting the broader textile market.

What to infer

In this price battle, the key differentiating factor between cotton and polyester is uncertainty. Cotton’s supply is entirely dependent on nature, which places the demand factor as secondary. A reduction in cotton yields due to unpredictable weather events like rain, drought, or even a supply ban from major producers such as China can cause global cotton prices to fluctuate significantly. While this comparison is India-specific, the situation is similar globally. With no immediate alternatives to cotton, the natural fibre continues to enjoy strong demand, leading to higher prices, which can benefit yarn producers.

On the other hand, polyester is more readily available and has several substitutes, which puts downward pressure on its yarn prices. Despite polyester’s significant market share, the presence of many competitors and close substitutes that offer similar functionalities leads to continuous price competition. While polyester is generally cheaper than cotton, the current battleground in the textile industry is shifting towards ‘sustainability’ and ‘comfort’—areas where cotton has a competitive edge.

Recycled polyester, although a more sustainable option, remains expensive and raises questions about the environmental impact of its production process. As a result, while polyester remains the cheaper option in terms of pricing, cotton maintains its position as the preferred natural fibre, particularly due to its sustainability appeal and comfort factor. This will likely drive continued demand for cotton, despite the cost differences.