Expanded tariff structure

Products originating from countries with which Mexico has FTAs, such as the United States, Canada, and others under the United States–Mexico–Canada Agreement (USMCA), are exempt from these duties.

Context and global impact

Currently ranked 15th globally in textile imports, Mexico faces growing challenges in its domestic textile and apparel industry due to competition from low-priced imports. The decision to raise tariffs is intended to provide relief to domestic producers struggling to compete with major exporters of apparel and home textiles, particularly those from non-FTA countries.

The tariff hike is expected to have a ripple effect across global trade, especially affecting countries that export low-cost textiles and garments to Mexico. By targeting finished goods imports, the policy aims to curb the influx of cheap apparel and home textiles, which have been eroding the competitiveness of Mexico's domestic industry.

The timing of this decision coincides with the formal inauguration of Donald Trump as the President of the United States, potentially signalling broader geopolitical and trade recalibrations in the region.

The move underscores Mexico's efforts to balance its trade policies, protect local industries, and ensure sustainable competition in its domestic market.

Clothing (Chapters 61 and 62)

- Coats, suits, jackets, pants, dresses, shirts, and sweaters

- Textile accessories such as gloves, belts, and ties

Made-up textile articles (Chapter 63)

- Home goods (bed linens, blankets, pillowcases, curtains, towels, etc.)

- Tents, awnings, needlecrafts, rags

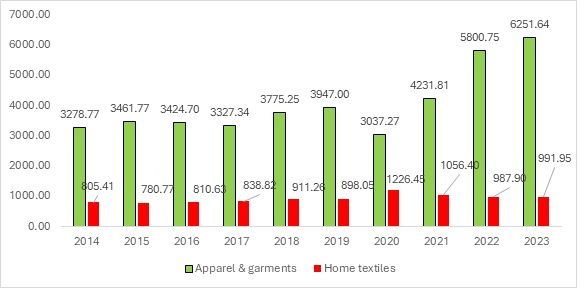

Exhibit 1: Mexico’s global imports for apparel and home textiles (in $ mn)

Source: ITC Trade Map

From 2014 to 2023, Mexico's imports of apparel and garments (first column) showed a general upward trend, rising from $3,278.77 million in 2014 to $6,251.64 million in 2023. The increase was particularly significant in 2020, likely due to shifts in global trade patterns, before stabilising in 2021 and continuing to grow. In contrast, imports of home textiles (second column) exhibited more volatility. After a slight dip in 2015 and 2016, imports grew steadily in 2017 and 2018, peaking at $911.26 million in 2018. However, home textiles imports saw a sharp decline in 2020 to $1,226.45 million, reflecting pandemic-related disruptions, before returning to a more stable level in 2021 and 2022.

Apparel and garments have particularly seen an uptick in imports post COVID-19 with resurgence levels being higher than pre-pandemic levels. This could indicate Mexican markets’ growing interest in apparel. However, home textiles, in particular, have seen a dip post the COVID-19 pandemic. Mexico’s demand for home textiles has been particularly stagnant over the years, with a slight increase only in CY 2020.

Key countries affected by tariff hikes

China, Bangladesh, and Vietnam along with India, the US, Cambodia, Turkiye, Honduras, Pakistan and Indonesia form the top 10 countries exporting apparel to Mexico. Mexico features in the top 20 of the list of major exporting countries for the listed countries.

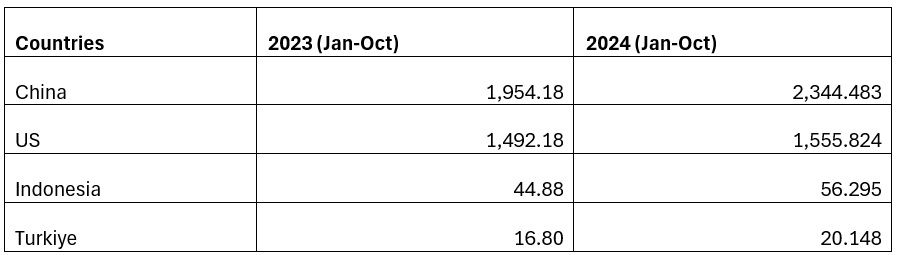

Table 1: Apparel export values of top importing countries of Mexico (January-October) (in $ mn)

Source: ITC Trade Map

*Please note that data for Bangladesh and Vietnam have not been updated

This points to the fact that Mexico is expected to perform well by the end of CY 2024, but the positive predictions could be dampened due to the implementation of the tariff increase.

Between January and October of 2023 and 2024, Mexico saw an increase in apparel imports from all four listed countries. China, the largest exporter, experienced a notable rise from $1,954.18 million to $2,344.48 million, a significant increase of about 20 per cent. The United States also saw growth, with exports rising from $1,492.18 million to $1,555.82 million, a 4.3 per cent increase. Indonesia's apparel exports to Mexico showed a substantial jump, growing from $44.88 million to $56.30 million, an increase of approximately 25.5 per cent. Turkiye, though still a smaller exporter, also experienced growth, rising from $16.80 million to $20.15 million, a 19.9 per cent increase. All four countries demonstrated positive growth in apparel exports to Mexico, with Indonesia and China experiencing the most significant increases.

Exhibit 2: India’s apparel exports to Mexico in CY 2024 (January-June) (in $ mn)

Source: ITC Trade Map

India has also shown a positive trend in CY 2024 compared to CY 2023, with exports peaking primarily at the start of the calendar year and mid-year.

Despite Mexico's lower overall apparel imports, it is one of the few countries that demonstrated remarkable growth, especially during the COVID-19 period and in post-COVID-19 conditions. However, the increase in tariffs—from 20 per cent on apparel and 15 per cent on home textiles to a significant 35 per cent—is expected to impact the textile and apparel industry. This sector is already facing challenges due to a lack of funding, economic crises affecting traditional exporters, and current geopolitical conflicts involving both real-world warfare and trade disputes through tariffs.

What can countries do to emerge as winners in the Mexican market?

Mexico’s decision came to light during its strained relationship with the US, its primary importer of apparel and home textiles. The tariff increase could benefit domestic producers of finished goods; however, Mexico has chosen to close its doors to cost-effective and potentially higher-quality apparel and home textiles. This is likely to result in substantial consumer losses for Mexican consumers.

China - Despite not having a trade agreement in place, Mexico and China have had long-standing trade relations, with several Chinese companies operating in Mexico. China has also tactfully positioned itself as a major foreign direct investment (FDI) partner, thereby sidestepping many tariffs that were or will be imposed on non-Mexican goods. The term ‘maquiladora’ reflects China's strategy, as Chinese companies may send textile and apparel goods to the US under the guise of being produced in Mexico. Overall, China stands a good chance of maintaining its presence in Mexico through FDI techniques.

Bangladesh & Vietnam - Mexico applies a Most Favoured Nation (MFN) tariff on Bangladesh, which does not benefit Bangladeshi apparel and home textile exporters. These exporters gain better value from higher-income markets such as the EU and the US. Mexico could lose out in terms of cost-effectiveness if it continues to raise tariff rates. Bangladesh is likely to focus on markets where it has stronger relations, particularly the US in this case. A similar scenario applies to Vietnam, which is emerging as a significant contender for apparel exports to the US, potentially foregoing Mexico as a market in the process.

US - Strained relationships under the Trump administration have affected trade relations between the neighbouring countries. US apparel companies have used nearshoring techniques to reduce shipping times and lower costs. However, Mexico’s proximity to the US, coupled with non-trade-related issues, could further deteriorate trade relations. This reluctance might result in higher costs for US apparel and home textiles, compounded by the increased tariff rates.

India - India could be adversely affected by the increase in tariffs on both apparel and home textiles. Given Mexico’s preference for cost-effectiveness and proximity, India loses out to competitors such as China, Bangladesh, and Vietnam on both fronts. However, India primarily exports cotton-related products to Mexico, despite the country's significant demand for man-made fibre-related products. India can only improve its trade relations with its largest Latin American trade partner by improving its cost-effectiveness in the Mexican market.

Summative View

Mexico's decision to raise tariffs on apparel and home textile imports will significantly impact global trade, affecting major exporters such as China, the US, Bangladesh, Vietnam, and India. While the measure is intended to bolster domestic manufacturing, it risks limiting consumer access to affordable goods and exacerbating existing economic and geopolitical tensions. China may maintain its presence in the Mexican market through strategic foreign investments, whereas countries like India and Bangladesh may pivot to alternative markets to mitigate potential losses. Ultimately, Mexico's protectionist approach is likely to disrupt established trade partnerships and reshape the global textile and apparel industry's dynamics.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!