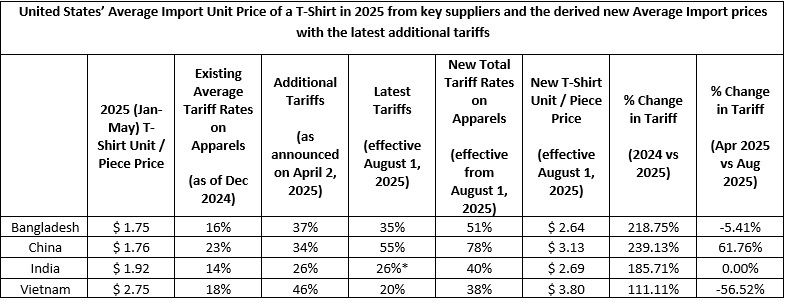

We consider four top textile and apparel manufacturing countries—China, India, Bangladesh and Vietnam, and in today’s context analyse the average import unit price of a T-shirt into the US, based on the latest tariff rates. The 2025 average import unit price is calculated based on the United States’ reported import trade values and quantities. These figures reflect CFR (Cost and Freight) terms.

Table 1: Understanding the latest US Tariff from a T-shirt price POV

*Subject to change with the anticipation of a trade deal announcement.

(The above values are indicative cost prices based on the import trade data analysis)

Following President Trump’s tariff announcement on April 2, various countries responded in different ways. Some, such as China, imposed retaliatory tariffs, while others like India and Vietnam initiated discussions to explore potential trade deals and agreements. A deadline of July 9, which was recently extended to August 1, was set for these negotiations. During this period, tariffs were temporarily suspended, and a universal 10 per cent tariff was applied across all countries.

China: Following the reciprocal tariffs announced by the US on April 2, 2025, a period of intense escalation ensued, with US tariffs on Chinese goods rising from an initial 34 per cent to as high as 245 per cent. Subsequently, with trade negotiations, both countries reached a temporary agreement in Geneva last month. Under this accord, the US reduced its tariffs on Chinese imports to 55 per cent, while China lowered its retaliatory tariffs to 10 per cent, marking a significant de-escalation from the previously imposed triple-digit rates by both sides.

India: After being included in the US tariff list in April 2025, India has actively pursued a trade agreement. Negotiations are reportedly in the final stages, and a deal could soon be announced. In case a deal is not materialised, Indian products will attract a duty of 26 per cent in the US from August 1.

Bangladesh: On July 7, Bangladesh received a formal notice from the US about the impending tariff hike. The new rate of 35 per cent (slightly down from the earlier 37 per cent, announced on April 2) is currently one of the highest among major apparel exporters.

Vietnam: Despite securing a trade deal, Vietnam will face a 20 per cent tariff on its exports to the US—a reduction from the previously proposed 46 per cent, but still double the current 10 per cent rate, which is applicable equally to most countries.

Observations from Table 1

ALCHEMPro News Desk (AP)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!