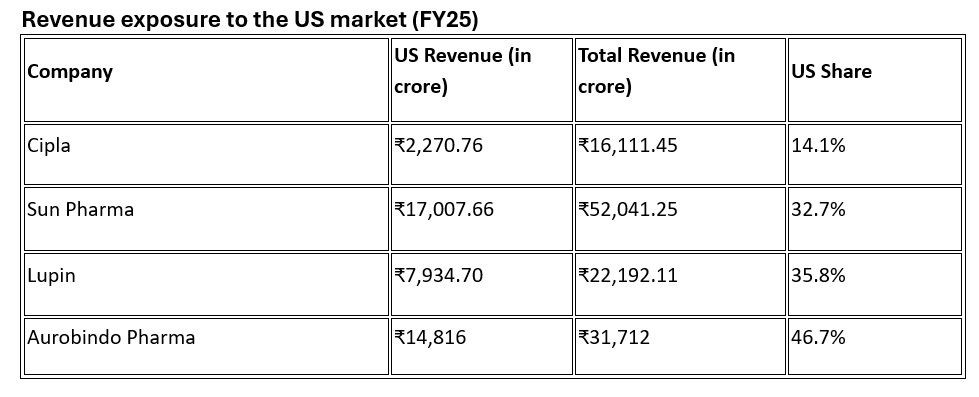

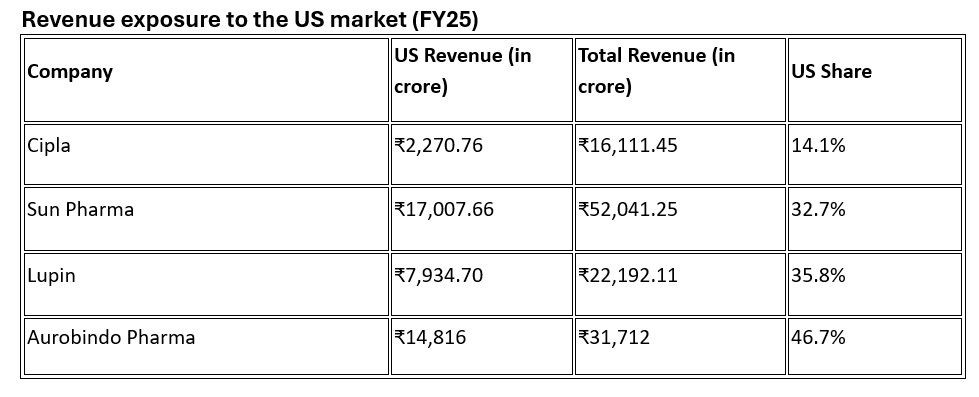

Indian pharmaceutical exporters are navigating a complex global trade landscape. China has reduced import duties on Indian pharma products by 30 per cent, effectively enabling near-zero-cost access, providing a significant growth opportunity in a key Asian market. Conversely, the United States has announced a 100 per cent tariff on imported branded and patented drugs, effective October 2025, pressuring Indian companies reliant on US sales.US revenue exposure highlights vulnerability: Aurobindo Pharma (46.7 per cent) and Lupin (35.8 per cent) are highly exposed, while Sun Pharma (32.7 per cent) faces moderate risk due to its branded portfolio. Cipla (14.1 per cent) and many more remains comparatively insulated, primarily driven by generics.

Indian pharmaceutical exporters face contrasting global developments.

China has cut import duties on Indian pharma products by 30 per cent, boosting market access.

Meanwhile, the US will impose a 100 per cent tariff on branded drugs from October 2025.

This puts pressure on companies with high US exposure, such as Aurobindo, Lupin, and Sun Pharma.

India's pharmaceutical sector faces a bifurcated global trade environment. While a 100 per cent US tariff on branded and patented drugs, effective October 1, 2025, poses challenges, the country's generic drug exports remain largely unaffected. This dual scenario necessitates strategic adjustments for Indian pharmaceutical companies. Implications for Indian Pharmaceutical Exporters

Implications for Indian Pharmaceutical Exporters

1. Tariff Scope and Market Impact

- The US tariff primarily targets branded and patented drugs. While generics may be exempt under a narrow interpretation, the prevailing uncertainty can impede strategic planning and operational continuity.

- China’s near-zero import duties significantly improve the cost competitiveness of Indian exports, offering a valuable alternative market to mitigate US exposure.

2. Profitability Considerations

- US: 100 per cent tariff creates a substantial cost burden. Companies with a significant branded portfolio, such as Sun Pharm and many more experience margin compression if importers resist passing on the tariff.

- China: Reduced import duties enhance profitability and market access, potentially offsetting losses from US exposure.

3. Strategic Pathways

- Portfolio Segmentation: Distinguish between US tariff-sensitive products and less vulnerable categories.

- Market Diversification: Expand footprint in China and other Asian markets to counterbalance US dependency.

- Capex and Manufacturing Strategy: Consider US production facilities to gain tariff exemptions while exploring partnerships or joint ventures in China to capitalsie on favourable duty structures.

- Supply Chain Resilience: Strengthen regulatory compliance and logistics to navigate global trade uncertainties efficiently.

Conclusion

While the US' 100 per cent tariff presents a formidable challenge to Indian pharmaceutical exporters, China’s reduction of import duties offers a strategically significant growth avenue. Companies like Cipla, Sun Pharma, Lupin, and Aurobindo Pharma and many more companies can leverage China’s favourable policies to diversify revenue streams, enhance margins, and mitigate geopolitical trade risks. Continuous monitoring of policy developments, revenue allocations, and strategic investments will be critical for Indian pharma to sustain global competitiveness in this dynamic landscape.

ALCHEMPro News Desk (VK)

Implications for Indian Pharmaceutical Exporters

Implications for Indian Pharmaceutical Exporters