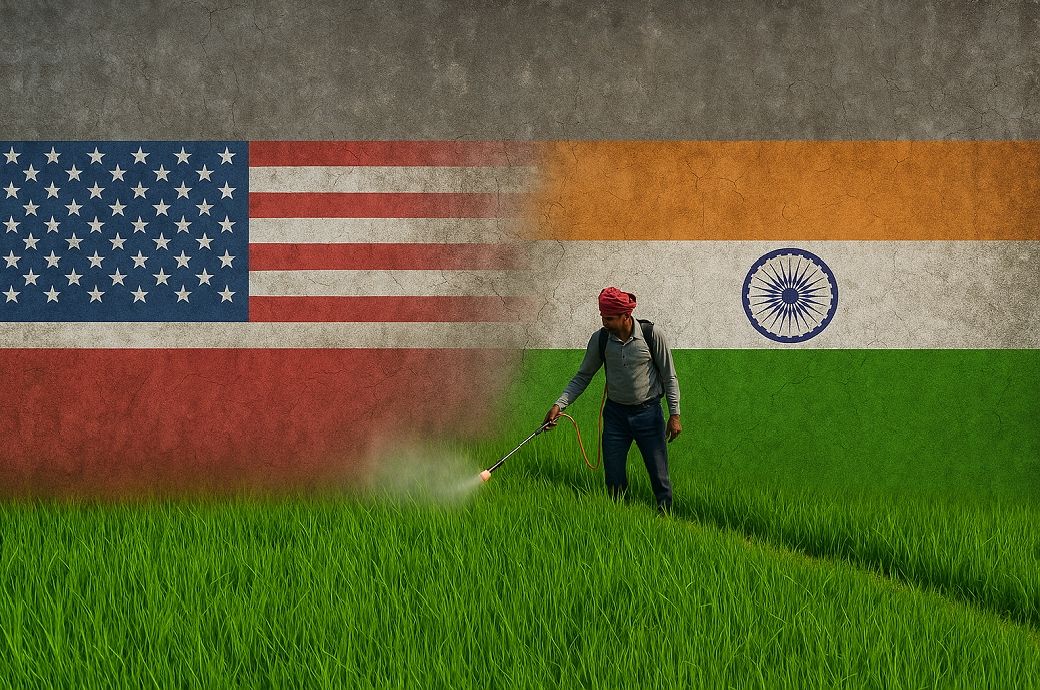

Following President Donald J Trump’s Executive Order to double tariffs on Indian imports to 50 per cent, India’s agrochemical sector is facing a significant export challenge. The measure—part of the US administration’s broader response to India’s ongoing trade ties with the Russian Federation, particularly its crude oil purchases—carries major implications for Indian chemical exporters, especially those supplying the US agricultural input market.

The US remains a key destination for Indian herbicides, fungicides, organic fertilisers, and crop protection products, many of which now face an uncompetitive cost structure due to the sharp increase in tariff barriers.

High-Risk Categories: Herbicides, organic fertilisers, and fungicides, rodenticides which together represent over $660 million in US-bound exports, now face a 50 per cent cost penalty, threatening both volume and margin.

Scenario Analysis: Indian Exporter Response Paths

The following outlines a set of plausible scenarios that may unfold if current trade dynamics persist. These projections are intended to offer a directional view of how Indian agrochemical exporters could potentially respond to sustained shifts in US demand and tariff pressures.

Export Decline & Market Realignment

Tariff Absorption by Large Exporters

Manufacturing Diversification to Tariff-Neutral Countries

Conclusion

The US tariff escalation to 50 per cent on Indian imports presents a significant hurdle, but it does not eliminate all avenues for trade. High-exposure products such as herbicides, fungicides, and organic fertilisers may experience a temporary decline in export volumes. However, Indian companies are well-positioned to adapt and recover through strategic market redirection, competitive pricing, supply chain innovation, and active global diplomacy.

With strong cost leadership, a solid compliance track record, and extensive global reach, India’s agrochemical sector is likely to remain a key player in the global crop protection and fertiliser markets despite short-term trade tensions.

ALCHEMPro News Desk (VK)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!