The European Union is currently India’s third-largest trading partner, accounting for nearly 15–18 per cent of India’s chemical exports, valued at an estimated $8–10 billion annually. Prior to the FTA, Indian chemical exports faced average EU import duties of 4–6 per cent. These tariffs are expected to be gradually reduced to zero or near-zero, enhancing the cost competitiveness of Indian suppliers.

India–EU chemicals trade snapshot

Industry estimates suggest Indian chemical exports to the EU could grow at high single-digit to low double-digit rates in the medium term. Demand is expected to be driven by organic chemicals, specialty chemicals, pharmaceutical intermediates, agrochemical inputs, and polymers, supported by Europe’s efforts to diversify supply chains away from China.

High-growth chemical segments

Beyond exports, the FTA is likely to stimulate EU investments in India’s chemical sector, including joint ventures and greenfield projects. European chemical companies are expected to leverage India’s cost advantages, skilled workforce, and expanding domestic market while maintaining tariff-free access to the EU.

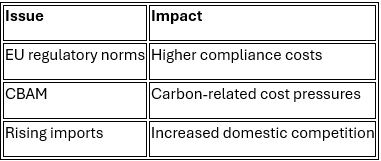

However, the agreement also presents challenges. Reduced tariffs will make EU chemical imports more competitive in the Indian market, potentially increasing pressure on domestic producers, particularly in commoditised segments.

At the same time, non-tariff barriers remain a key concern. Indian exporters will need to comply with stringent EU regulations such as REACH, environmental standards, and the Carbon Border Adjustment Mechanism (CBAM), which could raise compliance and production costs, especially for energy-intensive chemicals.

Key challenges for Indian exporters

Overall, analysts view the India–EU FTA as a structural positive for India’s chemical sector, particularly for companies focused on specialty and value-added products. Firms that invest in sustainability, regulatory compliance, and technology upgrades are expected to emerge as key beneficiaries, strengthening India’s position in global chemical supply chains.

ALCHEMPro News Desk (VK)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!