Several countries play a key role in supplying these garments to the US market, each with varying levels of competitiveness based on factors like pricing, trade policies, and production efficiency. In view of the shifting tariff landscape, particularly with the rising duties on Chinese exports to the US, Fibre2Fashion examines the competitive positioning of major exporters in the evolving market.

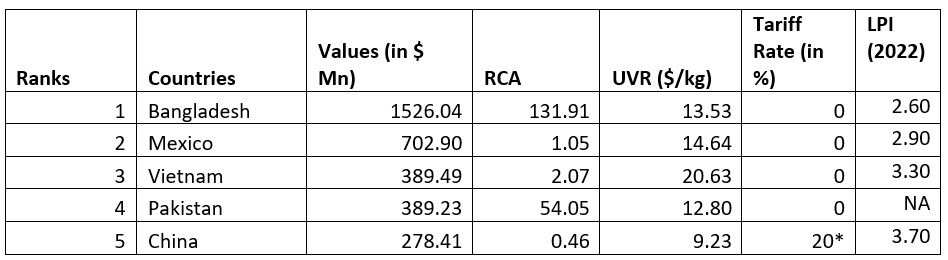

Table 1: Top 5 Exporting Countries and Trade Statistics in 2024 - Men’s Cotton Trousers, Overalls, and Shorts (HS 620342)

Source: TradeMap and F2F Analysis, * Effective from 4th March 2025

Note: RCA - Revealed Comparative Advantage; UVR - Unit Value Realisation; LPI - Logistic Performance Index

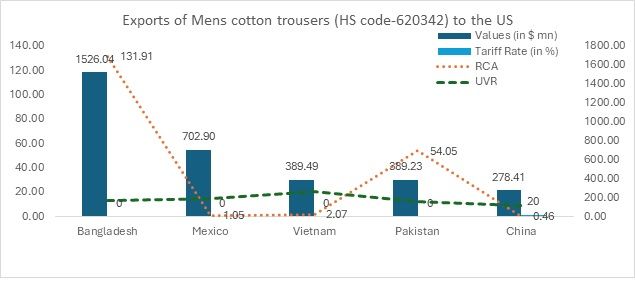

Figure 1: Top 5 Exporting Countries and Trade Statistics in 2024 - Men's Cotton Trousers, Overalls, and Shorts (HS 620342)

Source: UN Comtrade, F2F Analysis

Source: UN Comtrade, F2F Analysis

Bangladesh - Dominant with exceptional comparative advantage

Bangladesh dominates the market with an exceptional Revealed Comparative Advantage (RCA) of 131.91, highlighting its strong competitive edge in producing men’s cotton trousers, overalls, and shorts. With a Unit Value Realisation (UVR) of $13.53/kg, Bangladesh offers these garments at highly competitive prices, reinforcing its position as the top supplier. This combination of a high RCA and low UVR makes Bangladesh the clear leader in this segment, ensuring its stronghold in the US market through cost-effective production and pricing advantages.

Mexico - Strong market, moderate competitiveness

Mexico holds an RCA of 1.05, indicating a slight comparative advantage, though it is far less pronounced than Bangladesh (131.91). With a UVR of $14.64/kg, higher than Bangladesh’s, Mexican exports are relatively less competitive in terms of pricing. While Mexico remains a notable exporter, its limited RCA and higher UVR make it less competitive in this segment.

Mexico’s cotton trousers industry faces a significant challenge with the 25 per cent tariff on Mexican imports into the US starting on March 4, 2025 (this is currently not applicable for products covered under the USMCA). Already positioned in the mid-priced segment, this tariff will further weaken its competitiveness, making it more vulnerable to displacement by Bangladesh’s lower-cost cotton apparel. Despite Mexico’s logistical advantage due to its proximity to the US, the tariff increase is expected to have an overall negative impact, reducing its appeal as a key supplier.

Vietnam – Expanding presence but facing pricing challenges

Vietnam holds an RCA of 2.07, reflecting a modest competitive advantage in the production of men’s cotton trousers, overalls, and shorts. However, with a UVR of $20.63/kg, Vietnam’s products are priced significantly higher than those from cost-effective suppliers like Bangladesh and Pakistan. While its higher Logistics Performance Index (LPI) gives it an edge in supply chain efficiency, Vietnam’s weaker comparative advantage and higher pricing limit its competitiveness in the US market.

Pakistan – Strong competitive advantage

Pakistan demonstrates a high RCA of 54.05, establishing itself as a key player in the segment. With a UVR of $12.80/kg, Pakistan offers cost-effective products, pricing its exports closer to Bangladesh’s levels. This combination of a strong RCA and relatively low UVR enhances Pakistan’s position in the US market, allowing it to compete effectively and capture a larger share of demand.

China – Limited competitive edge, struggling amid tariff pressures

China holds an RCA of 0.46, indicating a weak comparative advantage in the US market for products defined under HS 620342. While its UVR of $9.23/kg makes it the lowest-cost supplier among the major exporting countries, its pricing advantage is being eroded by rising tariffs.

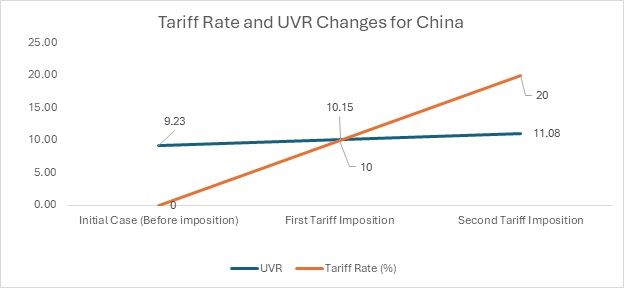

From February 4, 2025, to March 3, 2025, the US imposed a 10 per cent tariff on Chinese exports in this category, followed by a further increase to 20 per cent from March 4, 2025. These tariff hikes significantly raise the landed cost of Chinese trousers and shorts, reducing their competitiveness against alternative suppliers like Bangladesh, Pakistan, Vietnam, and Mexico.

Impact of US tariff on Chinese exports: With the first tariff imposition on February 4, 2025, the tariff rate increased to 10 per cent. This rise in the tariff burden led to an increase in the UVR as production and export costs escalated. As a result, the UVR would have likely increase to around $10.15/kg, reflecting the growing challenges posed by the higher tariffs. The increase in the UVR shows that the products are becoming more expensive, which could make them less competitive in price-sensitive markets.

Figure 2

Source: F2F Analysis

In the second tariff imposition, effective from March 4, 2025, the tariff rate rose further to 20 per cent. This substantial increase would push the UVR to approximately $11.08/kg or higher. The higher tariff burden will continue to raise costs, further diminishing the cost-effectiveness of the products. As a result, the products will be pushed into a higher-priced segment, limiting their competitiveness and making it harder to compete with lower-priced alternatives.

The Future Outlook

Bangladesh dominates the US market for men’s cotton trousers, overalls, and shorts, backed by an exceptional RCA of 131.91 and a low UVR, enabling it to offer cost-effective products that align with US consumer demand. Its ability to produce at scale while maintaining competitive pricing solidifies its leadership.

Pakistan, with a high RCA and competitive UVR, emerges as a strong contender but faces challenges in overtaking Bangladesh’s market dominance. Vietnam and Mexico, despite being active exporters, struggle due to higher UVRs and weaker RCAs, making them less competitive in price-sensitive segments. Further erosion to Mexico’s competitiveness may happen after April 2, 2025, if new tariffs are announced by President Trump.

China, traditionally a major supplier, is losing ground due to its low RCA and rising tariffs (10 per cent in February, increasing to 20 per cent in March 2025). These tariffs erode its cost advantage, but it still happens to have the lowest UVR despite the tariff imposition.

Overall, in view of the new tariffs imposed by the US, Bangladesh is best positioned to expand its market share, leveraging its cost efficiency, strong comparative advantage, and sustained export growth.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!