On the other hand, T-shirts made from man-made fibres such as polyester or nylon are engineered for durability, shape retention, and wrinkle resistance. These fabrics dry quickly and often include moisture-wicking properties, making them suitable for sportswear and activewear. Despite these advantages, synthetic garments tend to be less breathable and may feel less soft against the skin. Additionally, as they are derived from petrochemicals and are not biodegradable, synthetic fibres raise environmental concerns.

While man-made fibre-based apparel generally costs less per ton, cotton remains a popular choice due to its natural comfort and breathability. However, cotton production is dependent on raw cotton—a commodity vulnerable to price fluctuations caused by weather conditions and farming trends. Man-made fibres, by contrast, offer greater price stability and consistent supply, making them increasingly attractive in global trade.

MMF-based apparel continues to grow in popularity thanks to practical benefits such as durability, easy maintenance, quick drying, and affordability. Its alignment with fast fashion also supports wider adoption. As the apparel industry evolves, Fibre2Fashion examines how both cotton and synthetic apparel are performing across key markets, tracking their current trends and future growth trajectories.

Global Export Performance: Cotton vs MMF

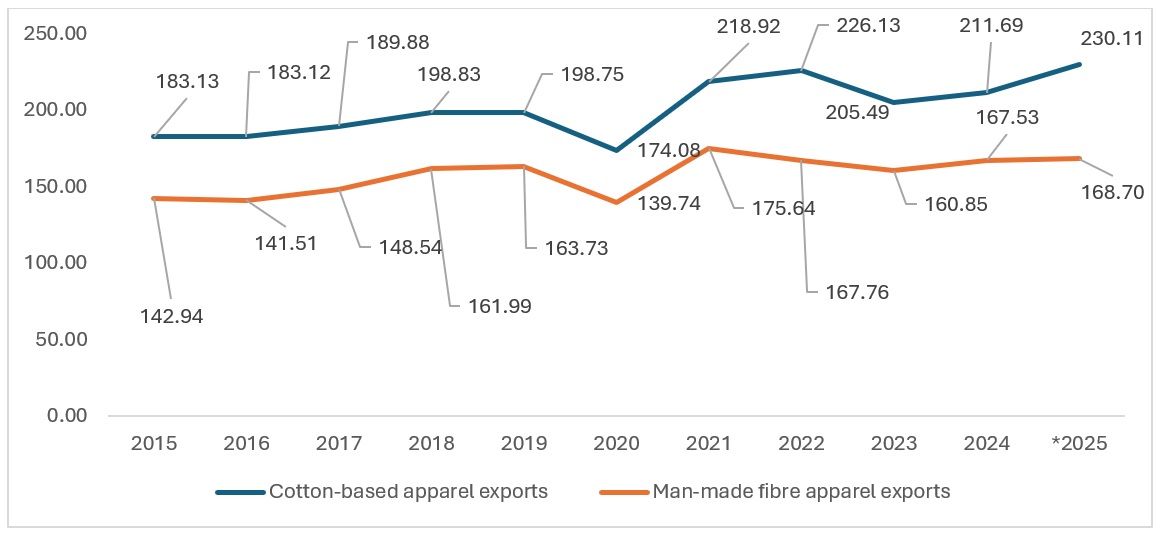

Exhibit 1: Cotton-based vs man-made fibre apparel exports (in $ bn)

Source: TexPro, F2F Analysis

Between 2015 and the projected figures for 2025, cotton-based apparel exports have risen from $183.13 billion to an estimated $230.11 billion. MMF apparel exports also grew, from $142.94 billion in 2015 to a projected $168.70 billion in 2025, though at a more moderate rate.

In 2020, both segments experienced significant declines due to the COVID-19 pandemic, which caused factory closures, supply chain disruptions, and reduced consumer spending. Cotton apparel exports fell from $198.75 billion in 2019 to $174.08 billion in 2020, while MMF exports dropped from $163.73 billion to $139.74 billion, marking the lowest point of the decade for both segments.

Despite this setback, both categories rebounded strongly as global markets reopened. Cotton apparel, in particular, witnessed accelerated growth, likely fuelled by a growing consumer shift towards natural, breathable, and ethically sourced materials. This resurgence is especially evident in the latest projections: between 2024 and 2025, cotton apparel exports are expected to grow by 8.69 per cent, significantly outpacing MMF apparel’s modest 0.70 per cent increase. This divergence may reflect both the rising global preference for sustainable fibres and the potential increase in cotton prices driving export values upward.

Price Dynamics

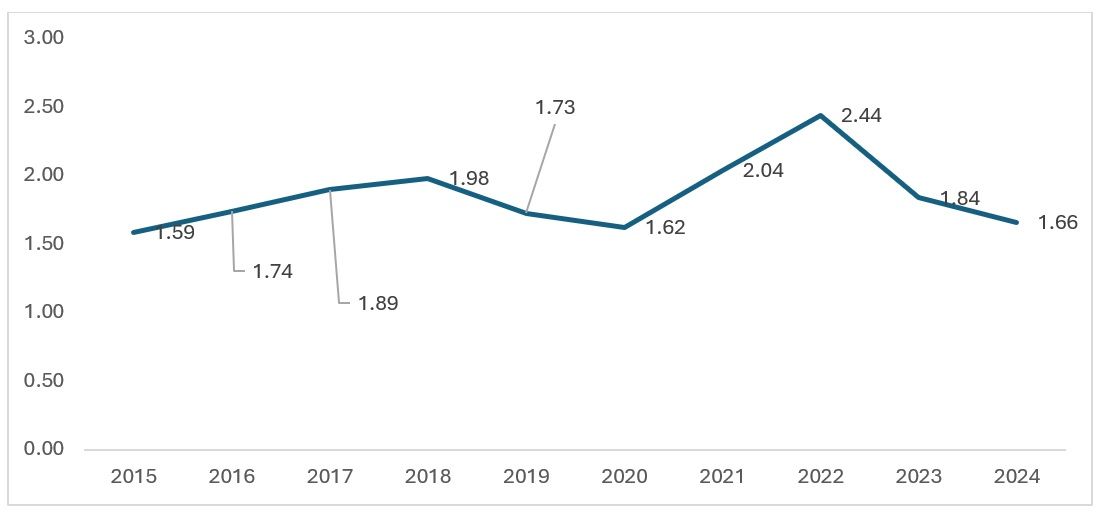

Exhibit 2: Cotton index over the years (in $/kg)

Source: World Bank Commodities Database

Although cotton can be purchased at a fixed price through hedging, cotton prices often reflect the rise or fall in global cotton apparel exports. A notable year for both was 2020, the peak of the COVID-19 pandemic. Both the World Bank’s Cotton Index and cotton apparel exports showed similar trends, indicating that rising cotton prices typically lead to higher consumer prices and a subsequent decline in demand. This suggests that apparel demand remains relatively constant regardless of price; however, elevated intermediate costs, combined with geopolitical risks, can increase the per-ton cost of apparel.

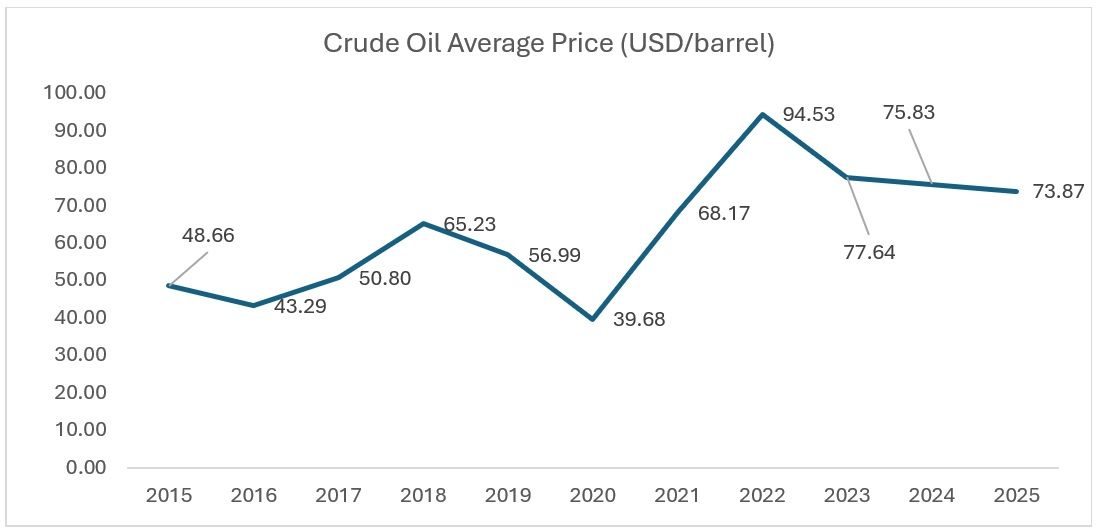

Exhibit 3: Crude oil price trends for man-made fibre-based apparel

Source: US Energy Information Administration

Crude oil prices significantly influence the cost of man-made fibre (MMF) textiles, as key raw materials like polyester are derived from petroleum-based products such as purified terephthalic acid (PTA) and mono-ethylene glycol (MEG). When crude oil prices rise, the production costs of these synthetic fibres increase, leading to higher prices for MMF textiles.

The annual average price of crude oil mirrors the trends observed in both cotton and cotton-based apparel, although crude oil exhibited more volatility in CY 2016, which is also reflected in the slight decline of MMF-based apparel.

Country-Level Trade Insights

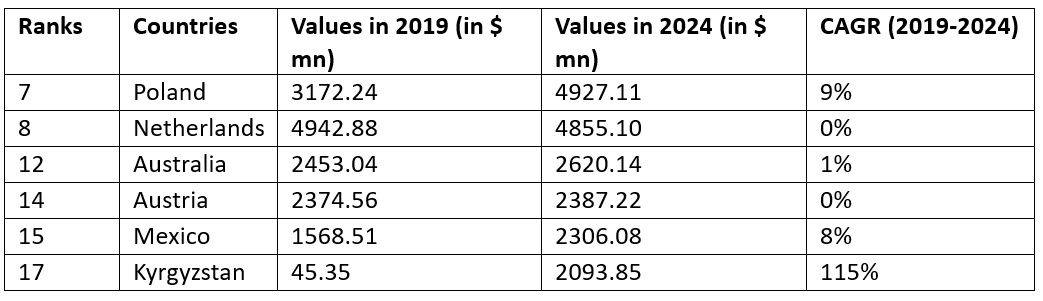

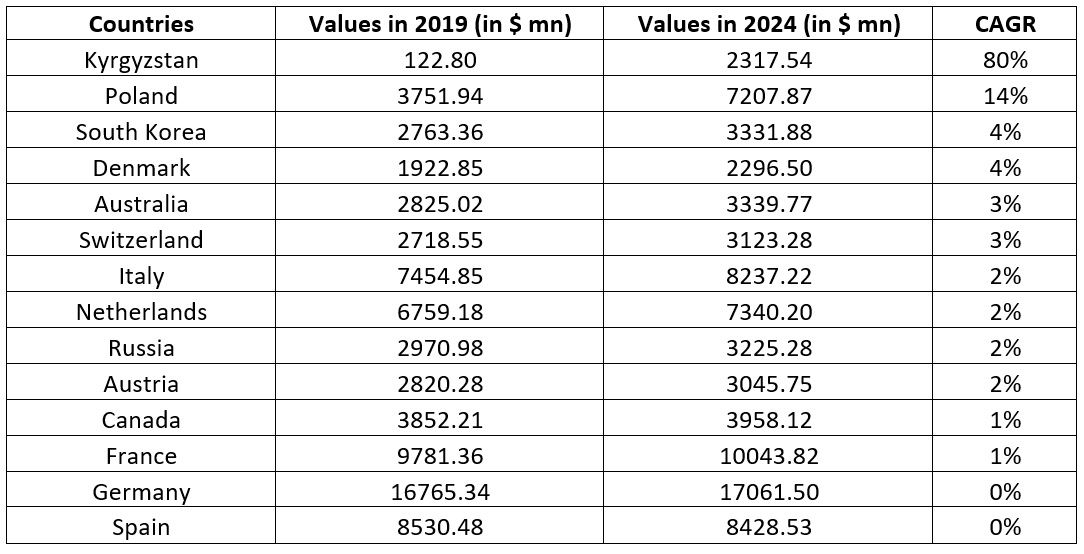

Table 1: Top importers of MMF apparel (growth from 2019 to 2024)

Source: TexPro, F2F Analysis

Among the top 20 importers of man-made fibre (MMF) apparel, Kyrgyzstan leads with a remarkable surge of over 115 per cent in imports. This sharp increase is likely driven not by domestic demand alone, but by the country’s role as a strategic re-export hub, particularly for Chinese goods destined for markets such as Russia, Kazakhstan, and Uzbekistan. China’s dominance in regional MMF exports, along with established logistics networks through Kazakhstan, further supports this trend.

Poland continues to be both a significant importer and exporter of MMF apparel, recording a solid annual growth rate of 9 per cent. As one of the six largest apparel importers in Europe, Poland plays a critical role in the continent’s trade landscape, accounting for nearly 73 per cent of the apparel market. Its geographic proximity to Eastern Europe enhances its position as a distribution hub, with demand expected to rise further due to its logistical efficiency and expanding intra-European trade.

Mexico has also experienced steady growth in consumer spending and MMF apparel imports. However, newly imposed tariffs in early 2025—covering approximately 138 tariff lines—are expected to slow imports this year, potentially reshaping sourcing strategies for exporters targeting Latin America.

Meanwhile, the Netherlands and Australia are expected to remain stable and attractive markets, backed by consistently high GDPs and strong economic fundamentals. Both countries rank among the top 10 globally in terms of GDP growth, offering exporters relatively predictable and secure trade environments.

At the top of the global rankings, the United States, Germany, Japan, France, and the United Kingdom continue to be the five largest importers of MMF apparel. However, their import volumes may face downward pressure in 2025 due to ongoing economic headwinds, including inflationary pressures, shifting consumer spending patterns, and geopolitical tensions such as trade wars.

Table 2: Top importers of cotton apparel (growth from 2019 to 2024)

Source: TexPro, F2F Analysis

Cotton vs MMF Apparel: Regional Dynamics and Outlook

Kyrgyzstan and Poland once again emerge as key players in the global apparel trade, driven by high overall import demand. Notably, Kyrgyzstan shows significantly stronger growth in the man-made fibre (MMF) apparel segment, indicating a strategic focus on lower-cost ($/ton) synthetic garments. This preference may be influenced by the country’s hot summer climate, where lightweight synthetic fabrics offer practical advantages. While cotton apparel also registers demand in Kyrgyzstan, it remains relatively modest compared to MMF.

Poland, on the other hand, continues to demonstrate balanced demand across both cotton and MMF categories, supported by its central location in Europe and its role as a regional distribution hub.

Several other top 20 importing nations also present strong potential for cotton apparel exports. South Korea stands out with sustained high demand, underpinned by a well-developed consumer market and geographic proximity to major cotton apparel exporters like China, Vietnam, Bangladesh, and India. In Europe, countries such as Denmark, Italy, Switzerland, and the Netherlands offer stable, high-value markets. However, as EU members, they place increasing emphasis on sustainability, transparency, and ethical sourcing, making compliance with environmental and labour standards essential for exporters targeting these regions.

Russia, despite registering a positive compound annual growth rate (CAGR) in cotton apparel imports, faces continued geopolitical tensions and trade restrictions, which could hinder future growth and market access.

Looking ahead, the global apparel trade must strike a careful balance between cost-efficiency, sustainability, and evolving consumer preferences. Cotton-based apparel continues to grow steadily, buoyed by rising awareness around ethical and eco-friendly sourcing, particularly in developed markets. However, its progress is constrained by price volatility and environmental challenges such as water usage and climate sensitivity.

In contrast, MMF apparel remains dominant in fast fashion and emerging markets, thanks to its affordability, resilience, and adaptability to rapid style cycles—attributes that are especially appealing in markets like Kyrgyzstan and Poland.

To navigate the future, industry stakeholders must invest in sustainable fibre innovation—both natural and synthetic—while diversifying sourcing strategies to mitigate risks from geopolitical instability and supply chain disruptions. The ability to meet both economic and ethical demands will define the next chapter of global apparel trade.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!