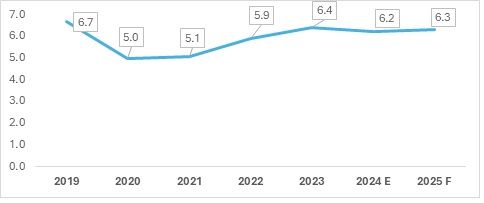

Exhibit 1: Global skirt imports for CY 2023 (in $ bn)

Source: TexPro, F2F Analysis

*Values for CY 2024 and CY 2025 are estimated and forecast respectively

Skirts are one of the few apparel subcategories that have shown growth of 8.47 per cent in CY 2022 compared to CY 2021. Women’s apparel has always played a prominent role in building a country’s export ecosystem with respect to garments. The skirts sector did show a decline during the pandemic period but has been one of the few sub-sectors within apparel to show consistent growth like its pre-pandemic levels.

Estimates for CY 2024 show a slight decline in the sector due to geopolitical tensions and a general economic downturn in several major economies. However, an uptick is expected in CY 2025, given improvements in several industries that make use of women’s apparel, such as skirts, for their workers.

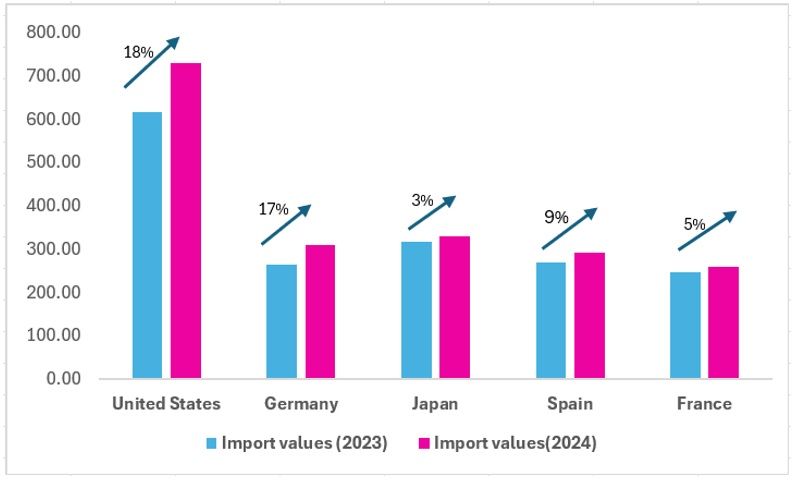

Exhibit 2: Import values and growth rate of top 5 importing countries in January-July for CY 2023 and CY 2024 (in $ mn)

Source: TexPro, F2F Analysis

Skirts as an apparel item are not only relegated to daily wear but are often seen as part of uniforms, whether in school clothing, industries such as aviation for their cabin crew/flight attendants, sports events with cheerleaders, and sometimes even healthcare professionals or military personnel for formal events.

The import values for skirts from various countries in the calendar years 2023 and 2024 reflect notable growth trends. The US leads with a substantial increase from $616.05 million in 2023 to $728.51 million in 2024, achieving an impressive growth rate of 18 per cent, indicating strong demand and purchasing power in the premium segment. Germany follows with a significant rise from $263.74 million to $308.27 million, marking 17 per cent growth, which suggests a robust market for quality apparel. Japan’s growth is modest at 3 per cent, moving from $317.81 million to $328.65 million, indicating a more saturated market with slower expansion. Spain shows a healthy 9 per cent increase, from $269.00 million to $291.97 million, suggesting a steady demand for skirts, particularly in budget-friendly segments. France, with the smallest growth at 5 per cent, increases from $246.83 million to $258.02 million, reflecting a stable but slower market for luxury fashion.

Overall, the data indicates that the US and Germany are emerging as the most dynamic markets for skirt imports, while Spain maintains steady growth and Japan and France show signs of market saturation.

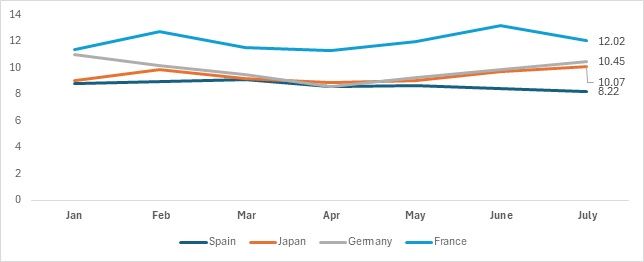

Exhibit 3: Unit rates of top importing countries in the EU for skirt imports in January-July in CY 2024 (in $/unit)

Source: TexPro, F2F Analysis

The import unit values for skirts from January to July 2024 reveal which countries provide the most benefit to exporters. Spain, with values ranging from $8.22 to $9.08, offers a low-cost market, making it an attractive destination for exporters looking to enter budget-friendly segments. Japan presents a slightly higher range, from $8.85 to $10.07, indicating a potentially lucrative market driven by consumer interest in fashion, which could yield good returns for exporters.

Germany's values, fluctuating between $8.59 and $10.97, suggest a stable and mature market that values quality, making it a strong candidate for exporters targeting mid to high-end segments. France, with prices from $11.26 to $13.18, represents a high-value market focused on luxury and high fashion, offering significant opportunities for exporters of premium skirts.

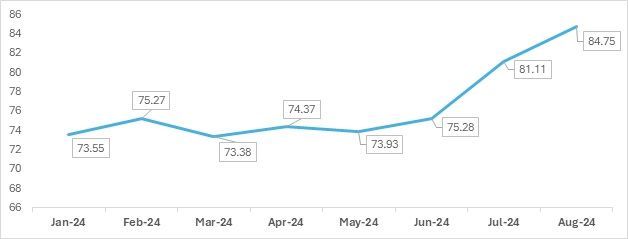

Exhibit 4: Unit values for skirt imports into the US from January-August 2024 (in $/DOz)

Source: TexPro, F2F Analysis

US values show an interesting trend with respect to skirt imports based on unit prices per dozen. The trend has been on an upswing since June 2024. This positive trajectory continued, with import prices reaching their peak in August 2024, indicating a sustained demand for skirts. Exporters can profit significantly from bulk orders to the US, given the steady demand coupled with stable and consistently rising prices.

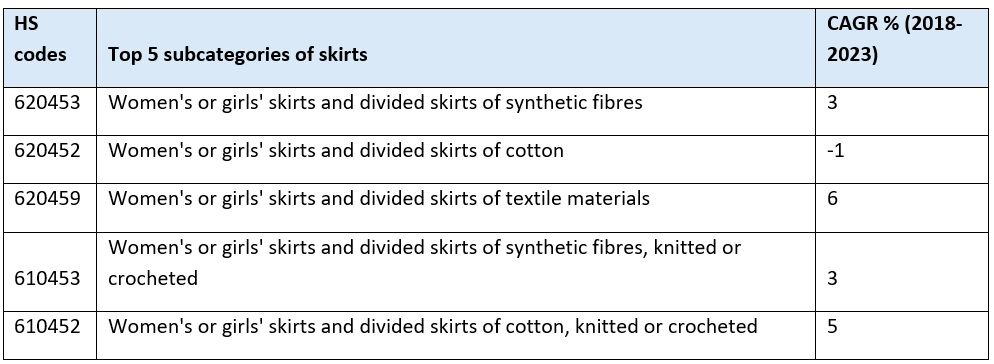

Table 1: Top 5 subcategory of skirts with CAGR (in %)

Source: TexPro, F2F Analysis

Skirts made from synthetic materials stand out in terms of global demand. Synthetic materials are widely used in uniforms due to their durability and features such as being wrinkle-resistant and having a longer lifespan. This makes them a popular choice for uniforms in various industries. Using the ITC Trademap, F2F has been able to conclude that skirts are one of the few sub-categories within the apparels sector that have shown considerable growth in CY 2023 compared to CY 2022, a major year for Global textile exports. CY 2023 shows skirt export levels returning to their pre-pandemic status, indicating that skirt exports were particularly affected by pandemic restrictions and have now revived under improved conditions. According to F2F analysis, with a little more than two quarters completed in CY 2024, despite geopolitical tensions and inflation in major consumer countries, skirts have demonstrated significant growth and are expected to continue doing so in the remaining two quarters of CY 2024.

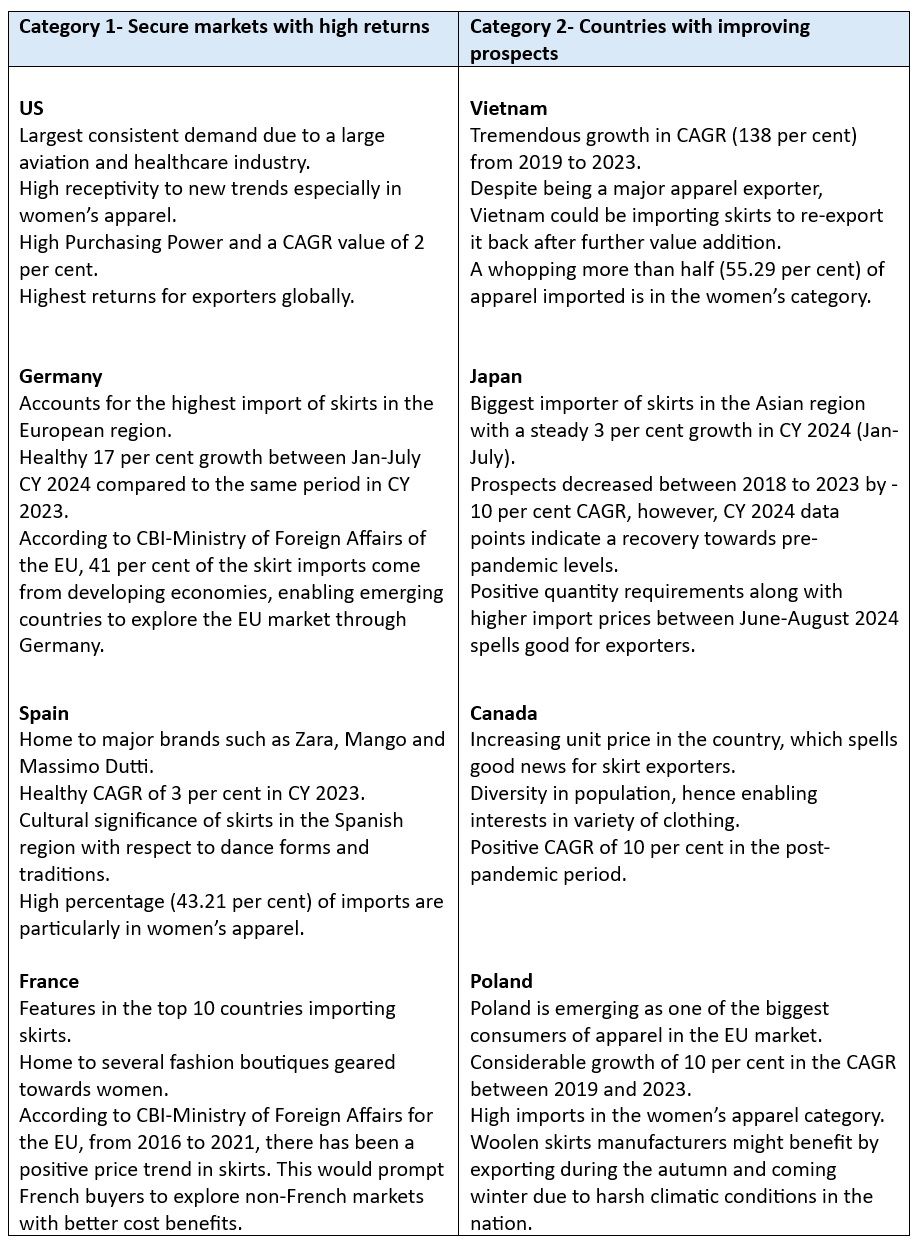

Fibre2Fashion Analysis on markets with potential for skirt exporters

The table below provides insights into which major importing countries have the potential to be significant consumers of skirts in the women's category. The countries are divided into two categories: those that have shown consistent interest in importing skirts and those with high potential for increased skirt imports.

Table 2: Markets with good import potential for skirts exporters

Source: F2F Analysis

Exporters in developing countries can particularly benefit from exporting skirts to the countries listed above. Apparel items like T-shirts and skirts can be produced with minimal machinery. Basic skirts are relatively simple to manufacture due to their straightforward designs, such as A-line or pencil shapes, which require minimal cutting and sewing techniques. They often use a single type of fabric, reducing the need for complex patterns or embellishments. This simplicity makes them easy to produce and versatile for various outfits. However, due to the demand for synthetic fibres and fabrics in skirts, countries like China and Vietnam have effectively captured the market. The EU, as the second-largest market, has leveraged intra-EU trade with high-end skirt-producing markets such as Spain, Italy, and Germany.

Potential markets that could increase their share in synthetic skirt exports include India and Türkiye. Türkiye’s proximity to the EU has proven beneficial for its synthetic skirt exports, although it has not surpassed EU member countries. India’s main challenge lies in its garment manufacturing capabilities, particularly its limited domestic production of synthetic fabrics and its dependence on external markets for inputs related to finished goods. However, a policy-driven approach could help India contribute more significantly to synthetic skirt exports, especially to the US market.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!