With the onset of probable tariffs under Trump on major Southeast Asian economies, key players in textile and apparel exports—particularly high-end apparel manufacturers—might look into sourcing needs from Eurasian countries. As Latin American (LATAM) and countries like Vietnam face transhipment charges due to their dependence on China for raw materials, and with Bangladesh’s political instability and comparatively higher tariffs imposed on India and Pakistan in the initial announcement, Turkiye emerges as a probable destination for sourcing apparel.

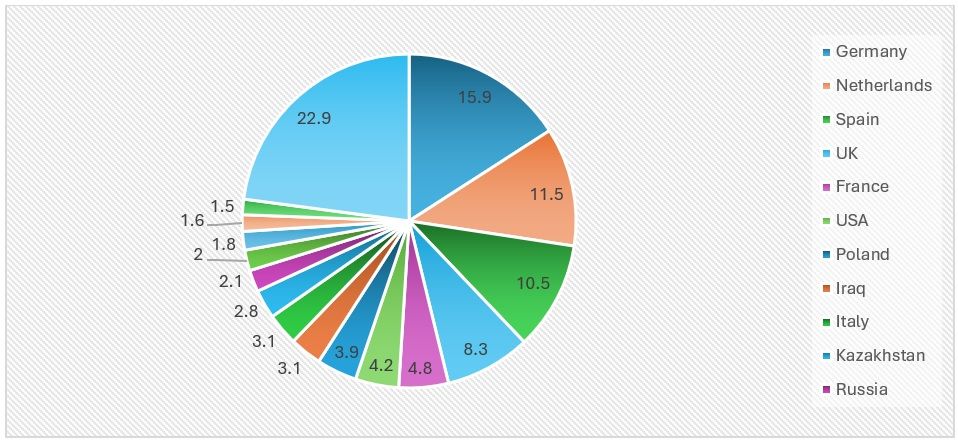

Figure 1: Turkiye’s top 10 apparel importers in CY 2024 (in %)

Source: TexPro

Turkiye has been able to effectively diversify its apparel export market, with a strong concentration in European countries due to advantageous factors such as zero per cent tariffs and geographic proximity. However, the US also features in the top ten list of apparel-importing countries, with Iraq and Kazakhstan representing the MENA region and Central Asia, respectively.

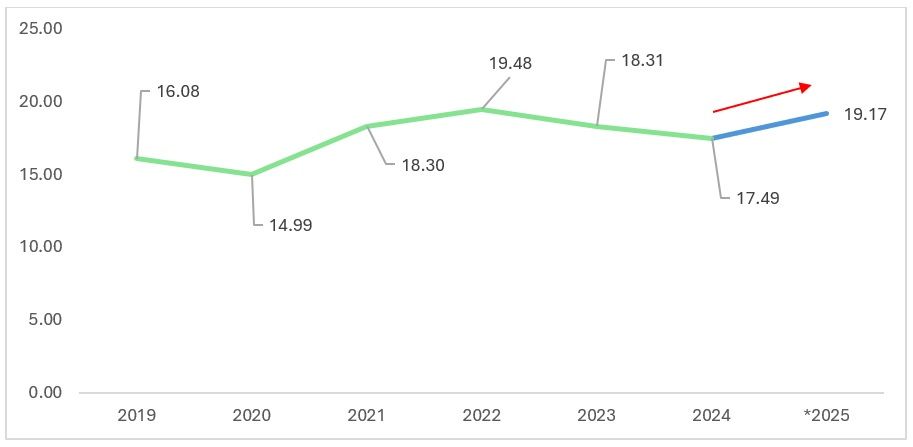

Figure 2: Turkiye’s apparel exports over the years (in $ bn)

Source: TexPro

Türkiye’s apparel exports have shown a generally upward trend from 2019 to 2025, rising from $16.08 billion in 2019 to a projected $19.17 billion in 2025. Despite a dip in 2020 due to the pandemic, exports rebounded strongly in 2021 and peaked in 2022 at $19.48 billion. Although there was a slight decline in 2023 and 2024, the 2025 forecast suggests renewed growth—likely driven by continued nearshoring demand, Turkiye’s competitive advantages in logistics and sustainable production, and improved global trade dynamics.

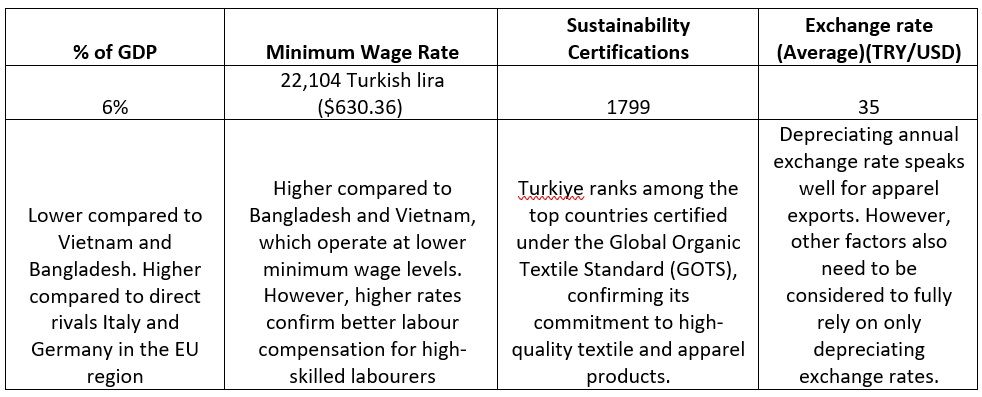

Table 1: Turkiye’s economic snapshot

Turkiye’s focus has primarily been on sustainable and high-quality apparel products, given the dominance of European countries among its importers. Turkiye has acknowledged the difficulty in competing with cost-effective countries such as China, Vietnam, and Bangladesh, and instead concentrates on producing basic apparel using cleaner technology.

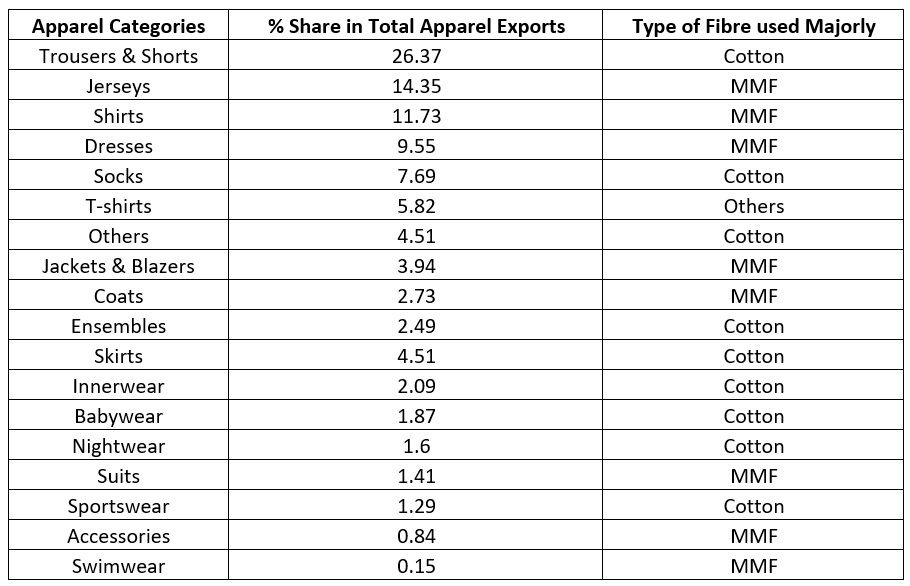

Table 2: Turkiye’s apparel composition

Source: TexPro

Turkiye’s apparel export portfolio is well-diversified across product categories, with trousers and shorts (26.37 per cent), jerseys (14.35 per cent), and shirts (11.73 per cent) leading the mix. A closer look at fibre usage reveals a near balance between cotton and man-made fibres (MMF), highlighting Turkiye’s versatility in catering to different market needs. High-volume categories like trousers, socks, and innerwear rely heavily on cotton, leveraging Turkiye’s strong domestic cotton production, including organic varieties.

Meanwhile, (Man-Made Fibre) MMF dominates in fashion-forward or performance-driven segments such as jerseys, shirts, dresses, jackets, and suits. This balanced fibre composition enables Turkiye to serve both sustainability-conscious buyers focused on natural fibres and brands prioritising technical performance, cost-efficiency, and design flexibility associated with MMF. Such adaptability strengthens Turkiye’s position as a well-rounded sourcing hub capable of meeting diverse global apparel demands.

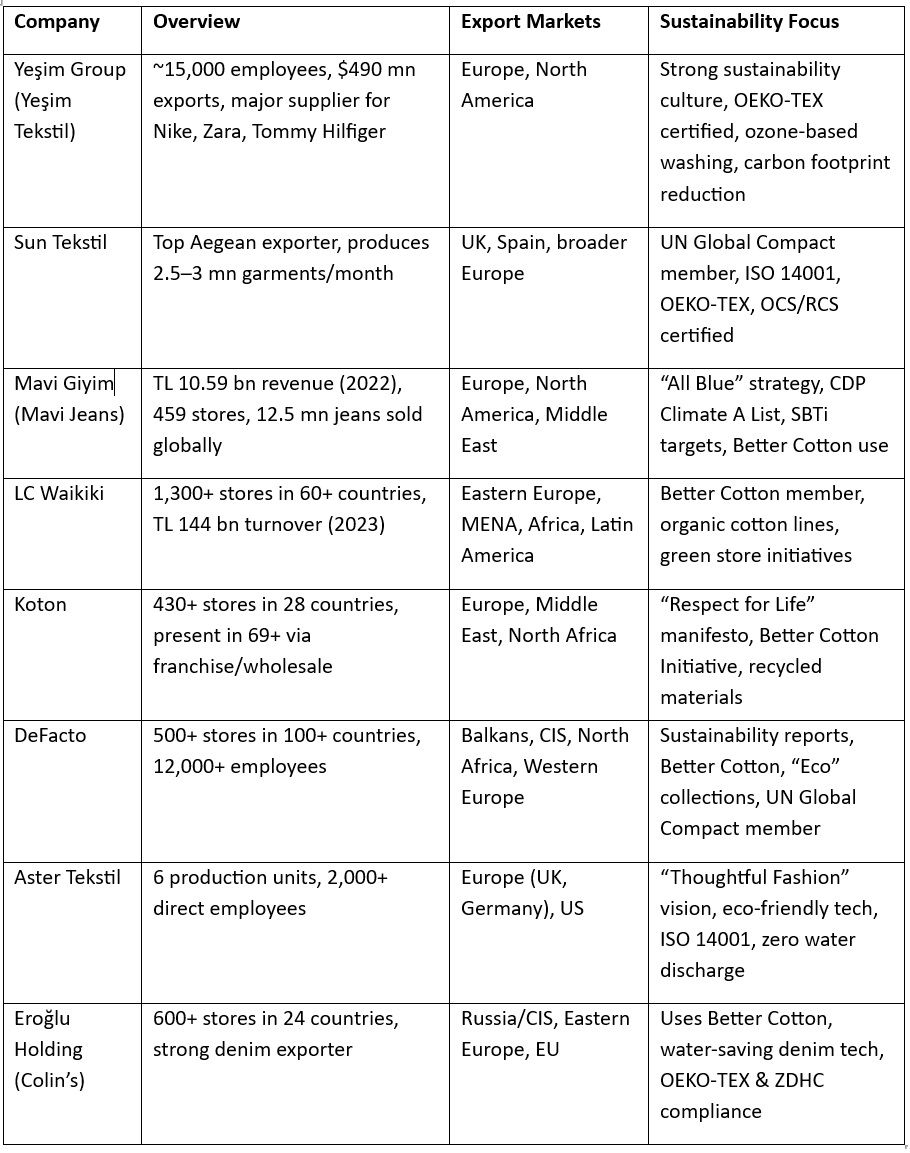

Table 3: Leading Turkish apparel brands exporting to the world

Source: Official company websites

The table above highlights some of the leading Turkish brands that serve as key suppliers to major global economies, particularly those prioritising the sustainability of imported apparel. Several defining characteristics of sustainable Turkish apparel brands include:

Better Cotton Initiative certification - BCI certification indicates that a company engages with cotton that is sustainably and ethically produced, ensuring minimal environmental impact and safeguarding the well-being of cotton producers. This certification also enhances documentation standards, making certified companies more reliable for import purposes.

OEKO-TEX - This certification represents textile safety against harmful substances. With the EU’s safety standards being one of the main reasons for the rejection of apparel products—especially in categories such as babywear—Turkiye’s OEKO-TEX certifications help maintain the standards that the EU has established.

Presence in Europe, Balkans and Africa - Turkiye’s major brands have a strong presence not only in Western Europe but also in Eastern Europe and Russia. Africa and Latin America, which are untapped markets, also feature as major importers for Turkish apparel brands. However, Turkish brands have not been widely explored in the Asian continent due to stiff competition.

Major fashion brands such as Zara, H&M, Nike, Adidas, Mango, and Levi's source apparel from Turkiye due to the country’s unique combination of strategic location, manufacturing expertise, and supply chain agility. Turkiye’s proximity to European markets enables faster lead times, allowing brands to respond swiftly to fashion trends and consumer demand—crucial in fast fashion and seasonal retail cycles. Its well-developed textile sector excels in key categories like denim, cotton knits, and performance fabrics, supported by a skilled workforce and advanced production capabilities.

Additionally, Turkiye’s alignment with EU trade regulations (through the Customs Union), relatively strong labour and environmental standards, and growing emphasis on sustainability make it an attractive alternative to Asian manufacturing hubs. This regional sourcing not only reduces transport times and carbon footprints but also helps brands diversify supply chains, manage geopolitical risks, and maintain quality control more effectively.

Conclusion

With the onset of Trump’s tariff—an additional base rate of 10 per cent on the majority of countries—Turkiye’s apparel is set to be a bit pricier. However, Trump’s initial tariff rates on the country hint at a lower rate for Turkiye, effectively eroding the effects of having higher-priced apparel products compared to China, Vietnam, and Bangladesh. Unless cost-effective apparel-exporting countries renegotiate their tariff rates, Turkiye has the chance to hit the bullseye by providing the US market with high-quality goods at a lower price.

Turkiye is increasingly emerging as a strategic textile sourcing hub due to a combination of global trade realignments and its inherent strengths. The US–China trade war and EU sanctions on unethical labour practices in China have pushed Western buyers to diversify their sourcing, with Turkiye benefitting from this shift thanks to its stable, tariff-free access to the EU via a longstanding Customs Union, as well as an expanding network of free trade agreements.

Its geographical proximity to Europe offers short lead times and lower shipping costs, making it ideal for fast fashion and just-in-time inventory strategies. While Turkiye’s labour costs are higher than those in South Asia, its skilled workforce, high productivity, and currency depreciation have helped maintain cost competitiveness. Turkiye stands out for its emphasis on sustainable and ethical production, with significant investments in eco-friendly practices and high-quality organic cotton. Post-COVID, Turkiye has become a top beneficiary of the nearshoring trend, as fashion companies seek more resilient, regionally integrated supply chains. Together, these factors make Turkiye a compelling choice for apparel sourcing in the current global landscape.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!