The World Trade Organisation, established in 1995, serves as the global trade watchdog, responsible for maintaining the integrity of international trade and ensuring that trade-promoting policies do not disrupt the market. Since its inception, agriculture has remained a persistent challenge for the organisation, given the global divide between developing and developed countries.

The C4 nations are significant producers of cotton, with countries like Benin making notable strides in cotton production and exports. Despite the region's emergence as a leading exporter of cotton, the impact of US subsidies continues to exacerbate the challenges faced by the C4 collective.

Crux of the issue

The crux lies in the classification by the WTO of various measures announced by the country as support for agricultural production, under three categories—the amber box, the green box, and the blue box measures. While amber box measures are assumed to distort trade, green box and blue box measures are believed to have minimal impact on international market prices and trade.

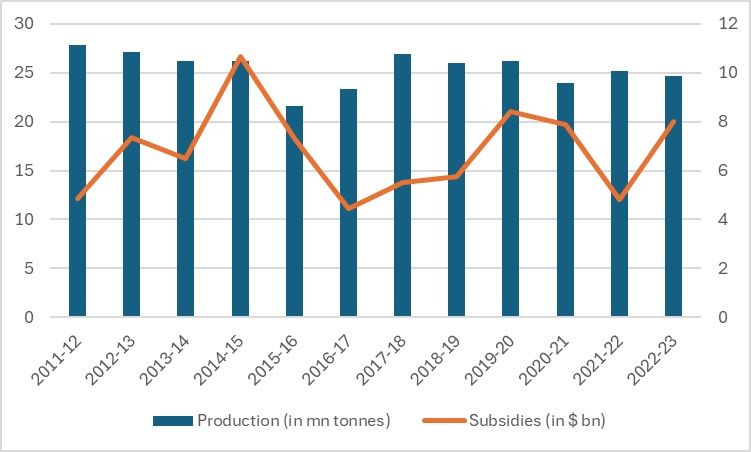

Figure 1: Global cotton production (in mn tonnes) and government support (in $ bn)

Source: ICAC

The cotton subsidies have been increasing again recently as all countries are attempting to support the sector and make themselves more independent from international market pressures. Both less developed and developing nations have been using them at a regularised pace. However, the ease with which developed nations have been utilising the amber box measures has left less developed countries scrambling, as the produce of these nations appears comparatively expensive. The logic behind this is simple: the more subsidies given to domestic producers, the lower the cost burden on them. According to the World Bank, developing and less developed countries are highly vulnerable to trade-distorting subsidies and their effects. Subsidies are used to ensure that the sector develops and promotes research and development if required. However, they do end up distorting the international market and prices, putting less developed and developing countries at a disadvantage.

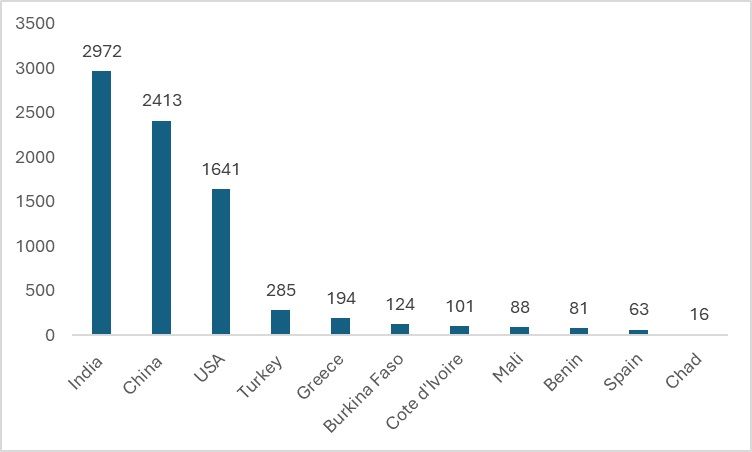

Compared to other nations, the support of C4 nations to the sector is minimal, thus putting their cotton exports at a disadvantage. The highest support comes from India, followed by China and the US. Countries like India provide more support in terms of fertiliser subsidies.

Figure 2: Government support to the cotton sector by country (2022) (in $ mn)

Source: ICAC

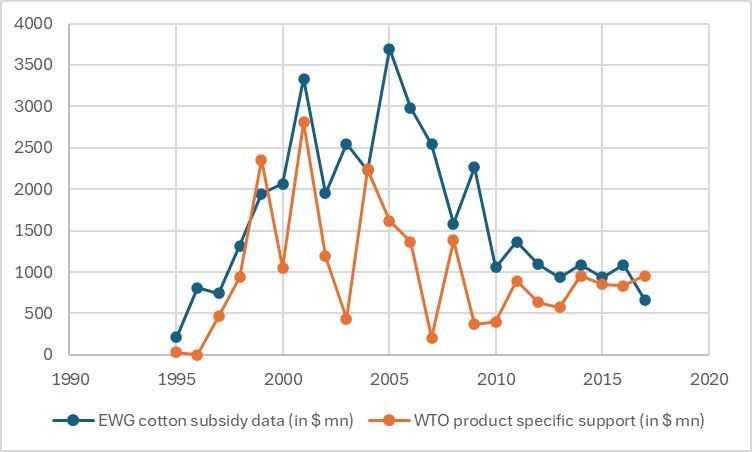

The US has a range of subsidies applicable to the cotton sector and the output for the same, as indicated by the EWG cotton subsidy data and the WTO product-specific support. Even though the US was one of the 34 countries that pledged to reduce the measures classified under the Amber box measures, cotton subsidies remain significant, comprising almost 8 per cent and 11 per cent of the total value of the product. This level is not desired, as the de minimis level encourages keeping subsidies below 10 per cent of the total value of the product. However, the US has maintained these levels above 10 per cent. Similar trade-disrupting measures have also been adopted by the EU and other countries, harming the C4 countries. Figure 3 illustrates the fluctuating level of subsidies provided by the US to cotton producers. Although the EWG is reducing, WTO product-specific support is increasing every year, thus neutralising the effect of lowering subsidies.

Figure 3: US cotton subsidies (in $ mn)

Source: World Trade Organization

Why are subsidies harmful?

It's a basic market pricing mechanism. Any producer will add the cost of production to the pricing of the commodity concerned. However, adding subsidies reduces costs significantly. Therefore, countries promoting production at home support the stakeholders involved with subsidies. Subsidies can have a devastating effect on other less developed and developing countries as well. One of the most harmful effects of subsidies on these countries is in terms of income inequality, apart from the potential loss in trade. A considerable proportion of the population in developing and less developed countries depends on agriculture, and subsidies can dent the income of these people. Therefore, it is important for countries to either stop the subsidies or implement counter-subsidies. Consequently, many developing countries are attempting to do so but face tight scrutiny from WTO regulations; countries like India, for example, face scrutiny if they subsidise cotton or any agricultural output.

For C4 countries, cotton accounts for more than 50 per cent of total export earnings, and 40 to 45 per cent of the population is involved in the sector. Therefore, subsidies from developed nations are a burning issue for them. The US accounts for 28 per cent of total world cotton exports and has so far provided around $40 billion in subsidies to the cotton sector between 1995 and 2020. These subsidies, which affect both domestic and international prices, impact livelihoods in C4 countries. Consequently, they have been demanding reparations as well.

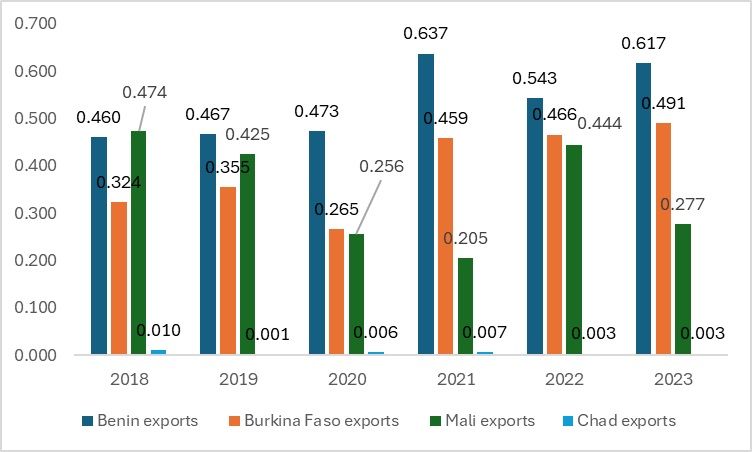

Exports of the C4

Among the C4 countries, Benin, Mali, and Burkina Faso are among the highest cotton producers in the continent of Africa. However, cotton exports are experiencing a major downturn or fluctuation. Cotton production in these nations is facing downturns due to climate change, and subsidies are adding to the difficulties of these nations that heavily rely on cotton exports. For example, Benin exports cotton to countries like Bangladesh, China, Egypt, and Vietnam. Mali exports cotton to China, India, Indonesia, and Thailand. Burkina Faso exports cotton to nations like Switzerland, the United States, China, and Pakistan.

It is evident that nations are now heavily reliant on developing and exporting final products to other countries. African countries, in general, heavily export raw materials to both developing and developed nations. Consequently, any minor fluctuations in the cost of raw materials affect exports and the entire economy of these nations.

Figure 4: Cotton exports from C4 countries (in $ bn)

Source: ITC Trade Map

Alternative to raw material exports

An alternative for these nations is to develop the textile value chain and further export final products to the US under the African Growth and Opportunity Act (AGOA), as they have duty-free market access to the US. However, out of the C4 countries, only Benin and Chad are eligible for the AGOA policy. For nations to export under the act, they need to have a fully developed value chain.

For example, Benin has been aggressively investing in creating its textile value chain to produce final textile products like T-shirts since 2022. In Mali and Burkina Faso, various organisations have taken initiatives to build and promote a value chain. All these nations have immense capacities for developing their textile value chains.

While building alternatives may not solve the main issue of unfair subsidies by developed nations, which distort trade and prices in the international market, presenting constructive alternatives can help C4 nations diversify their economies and reduce dependence on cotton and raw material exports.

The issue of unfair subsidies has plagued the WTO since the Uruguay Round and calls against such subsidies and provisions will likely increase in the future as more countries become aware of their conditions and the role of international economy and policies. Among all issues, agriculture-related tariffs and subsidies have been the elephant in the room for the organisation, and it is high time that the organisation pays attention to them.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!