As the price of cotton has slipped below the Minimum Support Price (MSP) set by the government of India, the Cotton Corporation of India (CCI) has procured historic amounts of cotton from Indore, Madhya Pradesh. The prices of cotton were 5 to 20 per cent below the MSP, which is a discouraging factor for cotton suppliers—the farmers. Therefore, the current situation of mass acquisition of cotton is something that was necessary.

The story behind the large buyout:

The government of India has established MSP for all agricultural produce in the country. The MSP serves as a price floor set by the government for individual crops, aiming to protect farmers from uncertainties. There are 23 crops included under the MSP.

In India, cotton is sold in the spot market, and its price depends on demand and supply factors. Cotton, which is the backbone of the textile industry, is traded in India through major markets including CCI, the Agricultural Produce Market Committees (APMCs) or mandis, and private markets run by private traders and companies.

Market uncertainties in the US and the UK have resulted in an overall reduction in demand for cotton, leading to prices falling below the MSP. This is where the CCI intervened. The organisation, established by the ministry of textiles and the government of India, has intervened in the cotton spot market since December, purchasing historic amounts of cotton to align prices with the MSP. Since last year, due to decreased demand, farmers who are not exporting but need immediate cash have either been selling below the government-set price floor or selling to organisations like the CCI at the MSP.

New year, same story

In December, for example, due to the lack of demand for cotton, CCI purchased around 2.5 lakh bales from farmers at the MSP and spent 900 crore on the purchase of cotton last year. This year, the nodal agency has also purchased cotton from Madhya Pradesh at the MSP. According to CCI, as of January 2024, it had procured 2,029,848 bales of cotton at MSP. Adding the recent procurement of cotton from Madhya Pradesh brings the latest procurement figures of cotton to approximately 2,134,895 bales. With the supply of cotton being the highest since November, dampened global demand has resulted in cotton trading below the MSP.

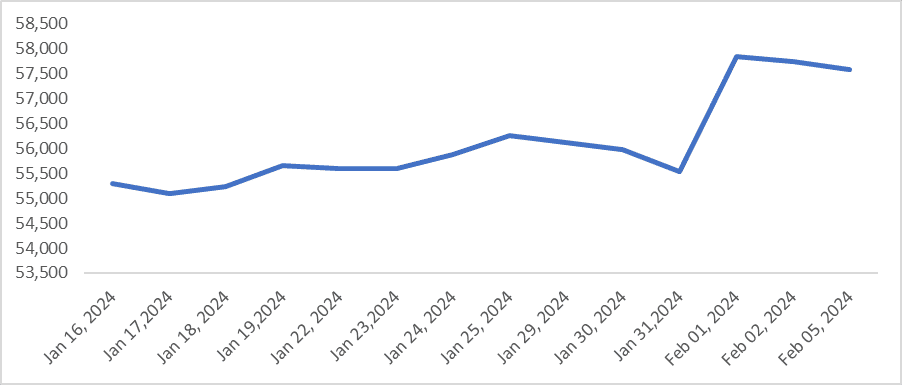

Figure 1: Price of Cotton Futures in India:

Source: Investing India

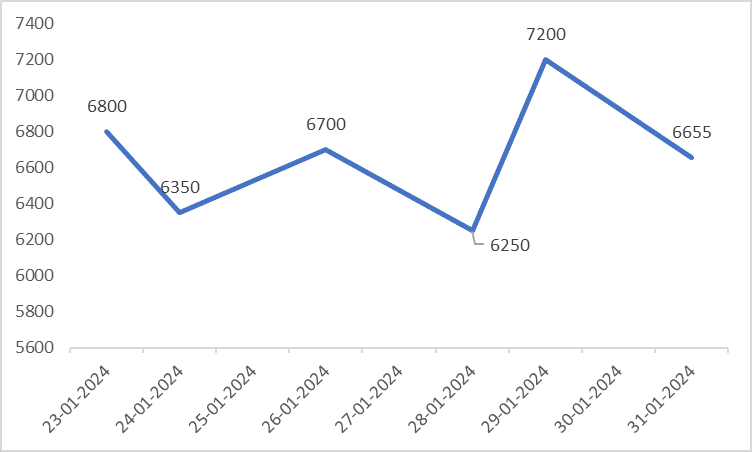

The action taken by CCI has led to the stabilisation of prices in the market. As of February 5, 2024, the price of cotton per bale is also decreasing, indicating that globally, there is still a cloud of uncertainty looming over the market. Bales refer to cotton after ginning. The average cotton prices, as checked on February 4, 2024, stood at a minimum of 6,542.5/quintal, with the lowest price at 6,000 per quintal and the maximum at 7,020 per quintal. When observed, the prices are relatively low compared to the MSP but are close to it. Most surprisingly, the price of export-quality cotton like Shankar is trading below the MSP at an average price of ₹6,463 per quintal. These prices are from the mandi market or the APMC.

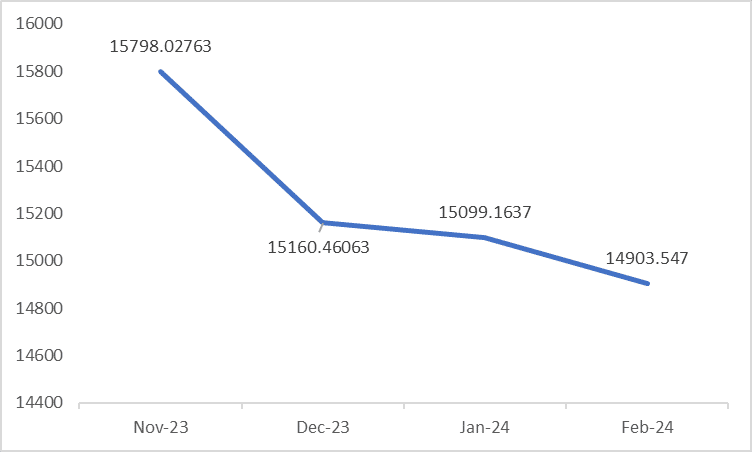

Figure 2: Prices (per bale) of Madhya Pradesh cotton (of Indian Cotton Association)

Source: TexPro

Figure 3: Mandi prices of cotton in Madhya Pradesh (per quintal)

Source: Kisan Deals

Impact of CCI buyout

The prices of cotton fell in October due to the increase in cotton supply and the decline in global demand amid rising uncertainty stemming from ongoing conflicts. When supply exceeds demand, prices typically fall below existing levels, as was the case from October 2023 onwards, prompting CCI to purchase cotton from the market at the MSP.

Government bodies play a crucial role in regulating commodity prices. If prices rise to a point where consumers cannot afford them or fall to a level where producers cannot sell profitably, the government and its agencies intervene to stabilise prices. This is precisely what CCI has been doing up to the year 2023. By purchasing cotton from the open market, such as the mandi, for example, when there is a supply shortage, it helps exert upward pressure on prices to reach the required level. The same effect can be seen in the current CCI purchase of cotton, as illustrated in Figure 2. Although prices have not returned to the initial level of 6,800/quintal and above, they are now hovering near the MSP.

A mixed bag of global scenarios:

Although the global scenario is a little unstable due to the wars and the constant threat of a potential geo-political war, consumer confidence is slowly increasing which also indicates good news for the supply chain. Globally, the price of all the raw materials is stabilizing and projections of robust economic growth for all the developing economies like India, a positive outlook for Europe and the US will bring some good days for the struggling textile industry.

The outlook for cotton is mixed. With the weather change continuing to affect the output in the year. The prices are slowly stabilising, which will benefit the sector. However, the shift towards synthetic and man-made fibres will continue to affect the cotton sector. Plus, the shift within the sector is also evident. With the world shifting towards organic cotton, the production of cotton itself is to be diversified in the coming years. In India there are a lot of farmers whose livelihood is dependent on cotton; therefore, the interventions by such organisations will continue to happen in the future if the price of white gold falls below the minimum markup.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!